A Long Runway for Growth

The total addressable market (TAM) in the sportswear space is estimated at $472 billion globally.

While apparel and footwear is a low-growth category overall, we have seen sportswear take increasing share over time. Sportswear increased from about 18% of the apparel category in 2007 to almost 26% in 2019.

In fact, sportswear has shown a 6.5% compound annual growth rate (CAGR) over the past five years, one-and-a-half times that of the apparel market.

We believe this trend will continue, driven in part by a growing middle class around the world. Per capita sportswear spending in emerging markets, particularly China, is one-tenth that of the United States, and has plenty of room to grow.

Economic Cycles: Mostly Background Noise

The sector's behavior in response to economic cycles has been mixed. While there is an impact from the economic backdrop, there are many times that results have been detached from the economic cycle.

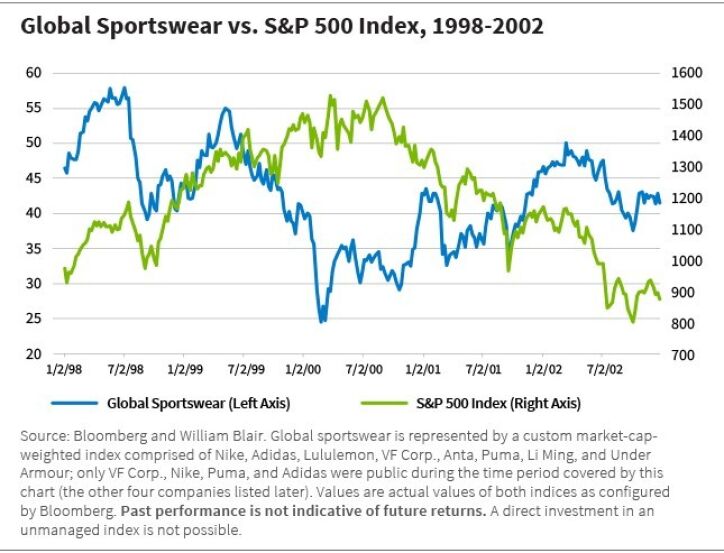

For example, sportswear growth peaked in 1995 and decelerated through 1999, leading the stocks to underperform the broader market. After bottoming in 1999, sportswear started a five-year growth acceleration, leading to strong stock performance.

This is exactly the opposite of what the broader market was doing: The market peaked in 2000, and growth slowed as the U.S. economy went into a recession in March 2001.

As the chart below shows, the S&P 500 Index peaked at roughly the same time sportswear bottomed, presenting a prominent case for how sportswear performance has detached from the economic backdrop at times.

This was also apparent after the September 11 attacks, where we saw sportswear quickly recover despite continued weakness in the broader market.

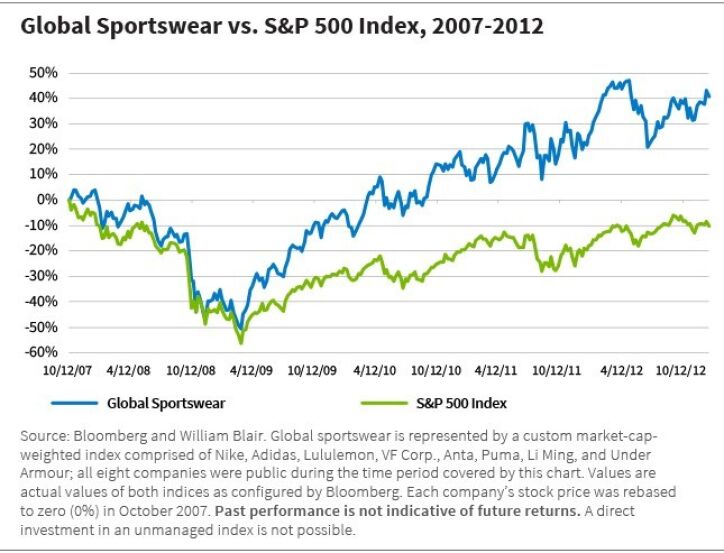

We saw more economic sensitivity during the global financial crisis (GFC). Both the S&P 500 Index and sportswear companies peaked around the same time, within two to three months of each other.

However, sportswear fundamentals were fairly resilient. Revenues across the group declined 3% in 2009 and earnings before interest and taxes (EBIT) were down 35%, but there was a strong rebound in 2010. While sportswear fundamentals recovered within five to seven quarters, sportswear stocks surpassed prior peaks within a year of bottoming—much faster than the market, due to clear visibility and robust growth.

The key takeaway: economic cycles matter, but they have not been as impactful as we might think they would be. We are seeing a number of sportswear companies perform outside of the economic cycle.

Product Cycles: Critical in the Near and Medium Term

To understand the sportswear space, one must appreciate product cycles. While sportswear companies are not high-fashion companies, there is a fashion element to their success, and they need to remain on trend.

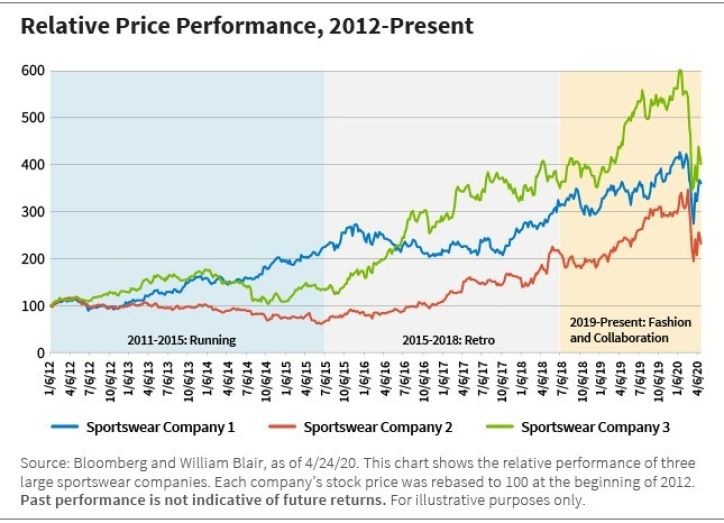

The chart below illustrates how three key sportswear companies performed in past product cycles.

A running-related product cycle started in the mid-2000s. It was interrupted somewhat by the GFC, but then came back with a vengeance. This is when we saw the Nike Free and Vibram Five Fingers products take off.

Sportswear Company 1 in the chart above was well positioned for this cycle; Sportswear Company 3 was not. As a result, Sportswear Company 1 outperformed Sportswear Company 3 significantly from 2012 to 2015.

Then, from 2015 to 2018, retro sportswear came into fashion. Sportswear Company 1 continued to push the running platform while Sportswear Company 3 was on trend for retro. Guess which outperformed?

We are now in a new product cycle that we call high fashion and collaborations. Brands are collaborating with different designers and luxury houses (Kanye West, Selena Gomez, Beyoncé, Dior, and Off-White to name just a few), and new product releases are coming out monthly if not weekly. Most leading brands are participating successfully in this trend.

There are two key takeaways. First, the category has a degree of fashion risk (such as the move away from technical performance and athletic functionality), although it is less pronounced than in luxury or casual wear.

Second, once we identify companies that we believe have strong brand equity and solid management teams, we need to make sure we are patient, because even the best will potentially miss a trend and have a period of underperformance relative to peers.

Differentiated players throughout the supply chain can capture substantial value.

Investment Opportunities

Looking at the sportswear ecosystem from textile manufacturers to retailers, differentiated players throughout the supply chain can capture substantial value (although brands are certainly in the driver's seat).

Over time we have seen brands rationalize their supply chains, allocating more orders to what we would call key manufacturing partners. We view key suppliers as strategic partners and more akin to internal manufacturing than external. A single supplier, for example, manufactures about one-sixth of Nike's shoes globally.

We also see this happening on the distribution side. Brands are culling undifferentiated wholesalers and diverting more in-demand products to strategic retail partners. We view these retail partners as part of a brand's direct-to-consumer efforts more than wholesale.

The return on invested capital (ROIC) for these strategic partners is typically fairly robust and at times has exceeded the brands' ROIC, indicating that there is substantial value creation throughout the entire value chain.

On that note, we see a long runway for brands to shift sales from the wholesale channel (70% of Nike's and Adidas's business) to the direct-to-consumer (DTC) channel, which includes their own retail footprints and e-commerce operations.

We believe the big brands have the potential to reach about 50% DTC penetration in the next 10 years, and perhaps even higher over the long term. Some estimates place DTC at 70% of the sales mix.

While brands do not provide the profitability difference between the two channels, we estimate that DTC generates double the revenue and EBIT dollars of wholesale, underscoring just how accretive the mix shift from wholesale to DTC is.

Sportswear in the Wake of COVID-19

We have long identified health and wellness as a structural theme driven by consumers being increasingly concerned by the connection between their lifestyle (physical activity and food consumption) and their overall health.

COVID-19 and the potential health risks have intensified the desire to eat better, live better, and feel better. We believe sportswear is well positioned to benefit from this as consumers express this desire through active lifestyles.

While we believe the long-term view for sportswear remains positive, COVID-19 has presented an unprecedented situation resulting in a coordinated global retail shutdown. The ensuing consumer weakness (such as unemployment), combined with a broader apparel and footwear inventory glut, will likely hurt discretionary spending overall.

This will undoubtedly depress near-term sales and margins as sportswear companies adjust to overall market conditions.

Despite these challenges, sportswear appears to be a resilient category in the midst of COVID-19, and not just because the pandemic appears to have intensified consumers' desire to focus on their health and wellness.

Sportswear companies, over the past few years, have woven digital engagement into their DNA. Their ability to speak directly to an audience without a physical footprint, amplify their messaging, and drive engagement has allowed them to drastically accelerate online sales during the lockdown.

Multiple brands, for example, have reported triple-digit e-commerce growth in China throughout the lockdown, helping them offset lost brick-and-mortar retail sales.

While the pace of the recovery varies by brand and region, we are encouraged by what we are seeing and anticipate that sportswear sales will be one of the fastest discretionary categories to recover, as we have seen in prior downturns. As retail conditions normalize globally, so will sportswear sales.

After all, the category has a long track record of value creation over the past 30 years. We have every reason to believe this will continue over the long term.

Kwesi Smith, CFA, is a research analyst on William Blair's Global Equity team.

Past performance is not indicative of future returns. Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. References to specific securities and their issuers are for illustrative purposes only. William Blair may or may not own any securities of the issuers referenced and, if such securities are owned, no representation is being made that such securities will continue to be held. It should not be assumed that any investment in the securities referenced was or will be profitable. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.

Weitere beliebte Meldungen: