As the emerging markets hard currency universe has evolved from an asset class predominantly composed of sovereign debt to a more diversified one including sovereigns, quasi-sovereigns, and corporate debt, opportunities to create better risk-adjusted portfolios using corporate debt have emerged.

Adding Corporates to Portfolios: A Systematic, Risk-Managed Approach

The hard currency emerging markets debt (EMD) universe is currently valued at more than $3 trillion, with each sub-asset class—sovereigns, quasi-sovereigns, and corporate debt—accounting for approximately one-third of the total.

Quasi-sovereign and corporate credit issuers usually trade at an additional spread to their country of risk. While corporate credit can have quite different risks than sovereign credit, we believe a systematic and bottom-up approach is useful in extracting the spread-over-sovereign (SoS) premium while managing excess idiosyncratic corporate credit risk.

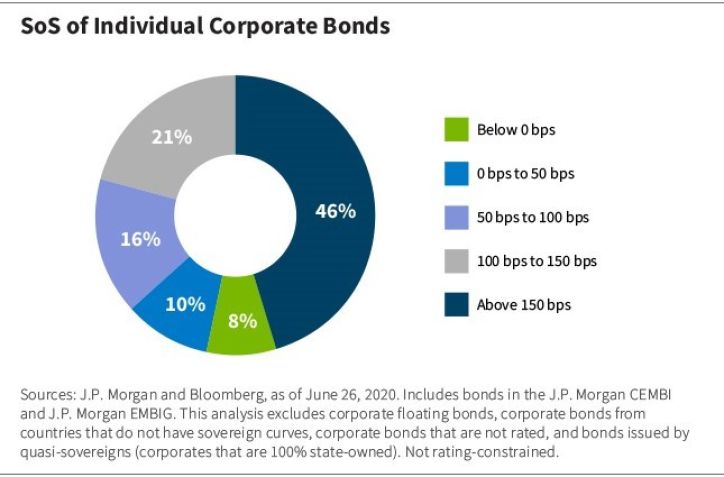

Most emerging markets (EM) corporate issues trade at a higher spread than their respective sovereigns, reflecting an additional premium for risk. According to our analysis, based on the bonds that compose the J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad and J.P. Morgan Emerging Markets Bond Index Global (EMBIG), about two-thirds of corporate bonds offer at least 100 basis points (bps) in additional spreads to their comparable sovereign bonds, as the chart below illustrates.

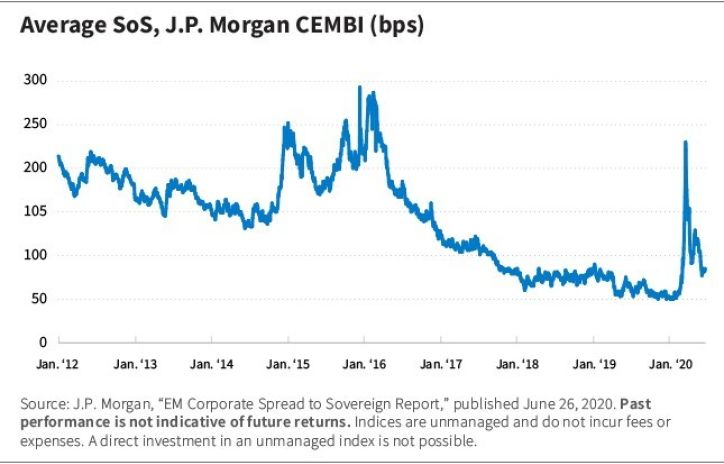

Similarly, J.P. Morgan analysis shows that corporate bonds in the J.P. Morgan CEMBI offer, on average, an 83-bps pickup relative to their sovereign bonds as of June 26, 2020, as the chart below illustrates.

Lastly, when looking at some of the largest countries in the J.P. Morgan CEMBI Broad, such as Brazil, Colombia, Indonesia, China, Russia, and Peru, the spread of the corporate index over the sovereign index (the J.P. Morgan EMBI) ranges from 75 to 430 bps as of June 25, 2020.

At the same time, the credit quality of many EM corporate issuers can be significantly intertwined with the macroeconomic conditions and policy agenda of their respective countries, either because the issuers belong to highly regulated and/or domestically driven sectors, such as utilities, financials, and infrastructure, or because they are partly owned by their sovereigns.

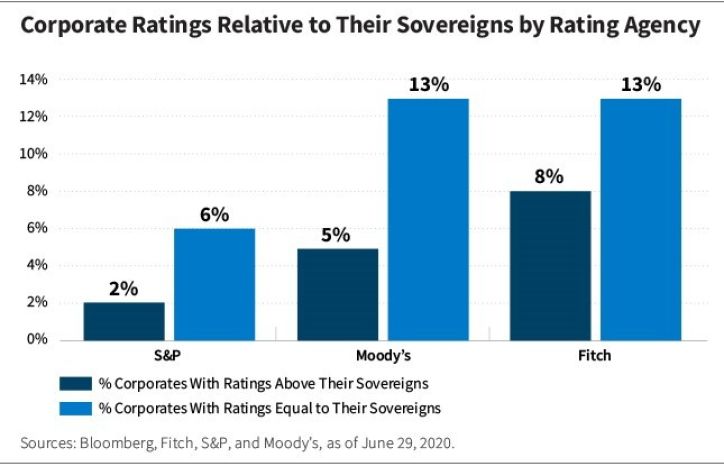

These relationships affect corporates' credit ratings. The majority of corporate issuers are rated below their country of risk. While the stand-alone credit quality of many corporate issuers merits a lower rating than the country of risk, there are also a large number of issuers whose ratings are capped by their sovereign's rating even though their intrinsic credit quality suggests a higher rating.

Alternatively, corporate issuers with government ownership and strategic importance to a country can benefit from rating uplifts due to an expected high likelihood of sovereign support should the issuer require it.

Even though ratings vary by rating agency, our analysis suggest only 2% to 8% of issuers in the J.P. Morgan CEMBI are rated above their respective sovereign, while an additional 6% to 13% have the same rating as their country of risk, as shown below.

Alternatively, there are also companies whose credit trajectories are, to some extent, negatively correlated with their sovereigns, such as commodity exporters. These issuers are more exposed to the global dynamics of their industries than to domestic conditions. If a country's fundamental deterioration leads to a currency depreciation, these issuers could benefit through hard-currency-denominated sales and local currency cost structures. In those cases, adding portfolio exposure to these corporates could create benefits within the country allocation.

Adding corporate exposure to a sovereign portfolio offers the clear advantage of the spread pickup over a sovereign's curve, but it also exposes the portfolio to a range of new risk factors.

Adding corporate exposure to a sovereign portfolio offers the clear advantage of the spread pickup over a sovereign's curve, but it also exposes the portfolio to a range of new risk factors outside the scope of sovereign risks.

Sovereign debt risk factors include fiscal conditions, debt sustainability, capital flows, political risk, and reform momentum (or lack thereof).

Corporate credit risk includes, in addition to the sovereign risk component itself, risks associated with the company's financial fundamentals, sector, liquidity, and quality of management, as well as risks related to environmental, social, and governance (ESG) factors and regulatory risks.

To properly address this broad range of risks, we analyze corporate issuers using a multi-risk-factor framework, including financial, business profile, management and strategy, debt structure, ESG, and sovereign risk.

Our Approach

We aim to capture the excess spread corporates offer over their sovereigns while avoiding exposing the portfolio to excess idiosyncratic corporate credit risk. To achieve this objective, we adopt a bottom-up approach to security selection.

We select the majority of the corporate securities for our sovereign portfolios through our SoS framework, which combines a valuation screen, fundamental analysis, and risk-management framework.

We maintain limited exposure to corporates in countries with high-risk profiles (high-beta countries) because the high level of sovereign risk in those countries can have unpredictable negative effects on the credit profiles and ability of companies to service their debt. These risks can materialize through regulatory changes, such as higher taxes and price controls; legal action, such as property expropriation; and intervention in financial markets, such as the imposition of capital controls.

Nevertheless, we have observed many cases of corporates in high-beta countries outperforming their respective sovereigns due to their strong credit profiles and transparent access to U.S. dollars. In those cases, relative valuation can be another reason to avoid exposure to corporates in high-beta countries. Some of these companies trade at a tighter spread than their sovereigns. This is the case in many sovereigns that trade at distressed levels, such as Argentina, Nigeria, and Zambia.

The most recent output of our framework selected 54 bonds from 43 different issuers in 17 countries, offering an average spread over sovereign of 189 bps.

In terms of regional breakdown, Asia represented 43% of recommendations, Latin America 39%, and Central and Eastern Europe, Middle East, and Africa (CEEMEA) 19%. Because the CEEMEA region has a higher share of high-beta countries than Asia and Latin America do, it usually represents a smaller share of the model's recommendations. China, Brazil, and Indonesia accounted for most of the recommendations (24%, 19%, and 11%, respectively); the high representation of China and Brazil is not surprising since those are the largest countries in the CEMBI Broad.

In terms of sectors, financials clearly dominated, accounting for 43% of the recommendations, including securities in the UAE, Brazil, China, Indonesia, Philippines, Qatar, and Poland. Bonds in the utilities, oil and gas, and industrials sectors made up 15%, 13%, and 11%, respectively, of the total recommendations.

By adding corporates to our sovereign portfolios, we aim to capture the excess premium over the sovereign created by market dislocations.

Takeaways

To avoid exposing portfolios to excessive idiosyncratic corporate risk, we believe it is important to add this exposure through a systematic, risk-managed approach. Our security-selection process seeks to take advantage of attractive spread pickup while mitigating risks by combining a valuation screening within predefined risk parameters with our bottom-up credit analysis.

While historical default rates for EM corporates have been modest (averaging 2.8% over the past 10 years ending in 2019), we acknowledge the off-benchmark nature of exposures, which warrants a cautious and quality-focused methodology. By adding spread while avoiding issuers on a deteriorating credit trend, we believe we can improve the risk/return profile of our portfolios.

We believe exposure to corporates in sovereign portfolios is an important source of alpha. By adding corporates to our sovereign portfolios, we aim to capture the excess premium over the sovereign created by market dislocations.

This can occur for two reasons: first, because of the linkage of some corporates to their respective sovereigns' trajectories while providing additional yield, and second, because a corporate's price performance is not always fully correlated to a deterioration of a sovereign's fundamentals and corporates can act as a diversifier.

A more in-depth discussion is available in our white paper.

Luis Olguin, CFA, and Mariana Villalba, CFA, are portfolio managers on the Emerging Markets Debt team.

Past performance is not indicative of future returns. Investing involves risks, including the possible loss of principal. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. Rising interest rates generally cause bond prices to fall. Sovereign debt securities are subject to the risk that an entity may delay or refuse to pay interest or principal on its sovereign debt because of cash flow problems, insufficient foreign reserves, or political or other considerations. High-yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result. Diversification does not ensure against loss. Framework output is provided for illustrative purposes only and is subject to change without notice.

The J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) is a market-capitalization-weighted index consisting of U.S.-dollar-denominated corporate bonds issued by emerging markets entities. The J.P. Morgan CEMBI Broad is one of four sub-indices of the CEMBI family; it includes bonds with an outstanding amount of $300mm and above and has no diversification weighting scheme. The J.P. Morgan Emerging Markets Bond Index Global (EMBIG) tracks total returns for traded external debt instruments in the emerging markets. (Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2020, JPMorgan Chase & Co. All rights reserved.) Beta is a quantitative measure of the volatility of a portfolio relative to the overall market, represented by a comparable benchmark.

Weitere beliebte Meldungen: