To appreciate the investment opportunities in this space, it is important to understand the business models involved and how money flows through the system every time consumers swipe a credit card, tap a smartphone at a store, or enter their payment information online.

Three Distinct Segments—But Not Siloes

As we explained in a previous post, the global payments ecosystem consists of three primary segments.

Merchant acquirers are the entities that enable merchants to accept credit cards and other forms of digital payments.

Issuers are the banks that issue credit and debit cards and the issuer processors that are either internal functions within banks or are banks' external partners.

Networks are the “pipes” or “rails” through which all transactions flow, connecting merchants and issuers.

While it is useful to think about these three components separately, they are far from being siloed. Many payments companies operate in more than one segment, and there has been a significant blurring of lines in recent years.

Payments companies are looking for economies of scale as well as economies of data that can result from having access to data about transactions and consumers generated from more than one segment of the payments chain.

Simple Money Flow Example

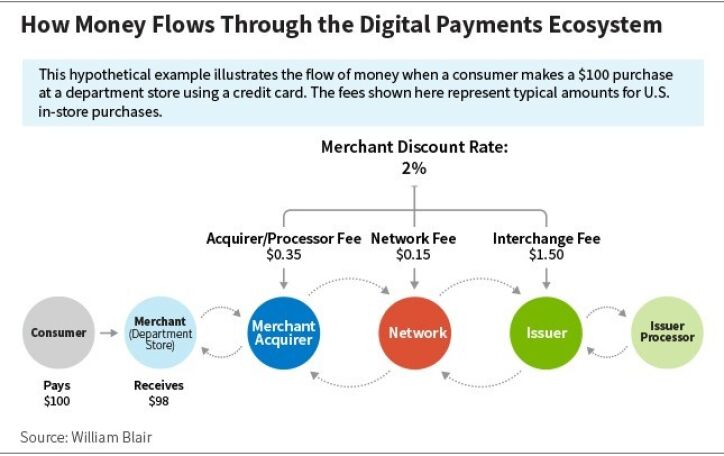

To understand how a transaction flows through the payments system, it is helpful to look at a simplified example, illustrated in the chart below.

- A consumer uses her credit card at a store to make a purchase.

- The merchant acquirer's software and hardware allow the purchase to be initially accepted.

- The merchant acquirer sends the transaction to the network, which authorizes the transaction and sends it to the issuer.

- The issuer—either through an internal system or via a third-party processor—verifies that the consumer has sufficient credit available.

- A message is sent back through the network to the merchant acquirer authorizing the transaction, and the consumer's purchase is completed.

Two of the most important concepts in understanding payments business models are the merchant discount rate (MDR) and the take rate.

MDR refers to the difference between what the consumer spends and what the merchant ultimately receives, net of the payments providers' fees.

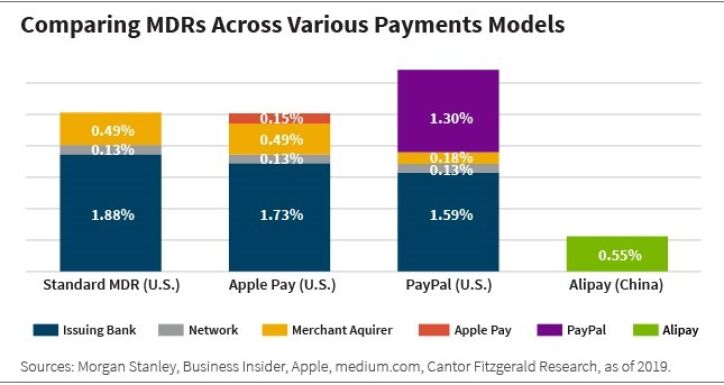

Take rate refers to how the total MDR is divided among the various entities involved in the transaction. The chart below illustrates how MDRs vary significantly, using four common payment methods.

Comparing the MDR for a standard transaction in the United States using a credit card to the MDR for an Apple Pay transaction, note that the merchant acquirer and network take rates are the same; Apple Pay's 15 basis points (bps) reduces the issuer's take rate.

With PayPal, the MDR is significantly higher, but merchants that accept PayPal (often smaller vendors) recognize the value PayPal provides in the form of increased acceptance rates and the trust that PayPal has built with consumers.

The MDR structure for payments made in China using Alipay is drastically different. Alipay has a significantly lower MDR structure because it bypasses the other players in the ecosystem and because local regulations limit MDRs.

Up Next

With that as context, in our next three posts, we will offer some insight into the opportunities and risks each segment faces, starting with merchant acquirers.

Digital Payments Series

Part 1: Why We Find Digital Payments Compelling

Part 2: 5 Factors Driving Digital Payments Growth

Part 3: Disruption and Growth in Digital Payments

Part 5: More Competition for Merchant Acquirers

Part 6: Digital Payments Issuers Face Regulatory Risk

Part 7: Networks: The Rails That Connect Digital Payments

Global Research Analysts Drew Buckley, CFA, and Kwesi Smith, CFA, contributed to this blog post.

Daniel Hill, CFA, is a research analyst on William Blair's Global Equity team.