We believe it can be dangerous to be overly reliant on thematics when positioning portfolios. Yet as growth investors, we are always looking for companies that are tied to supportive long-term structural drivers.

Identifying these drivers is an important step toward pinpointing the undervalued companies with superior quality and growth characteristics—and we see a number of these investable themes today in emerging markets.

Theme 1: Technology

One investable theme in emerging markets is technology. E-commerce, 5G telecom, online education, distributed computing, and telemedicine have long outperformed more traditional, “old economy” industries, regardless of valuation differentials favoring the latter.

In our view, the competitive positions of companies in these sectors are strengthening amid the downturn as pandemic-related stay-at-home measures have accelerated the move to a digital society. What had been a gradual 20-year shift to online life quickly gained speed, with healthcare, shopping, education, and work going digital almost overnight.

We believe technology will likely lead the way out of this downturn.

We see technology-related opportunities in China, Taiwan, and South Korea.

We find many of these technology-related opportunities in Asia, including China.

The Chinese government’s efforts to accelerate the cloud and 5G domestically are contributing to this as the government rolls out stimulus measures with a dual purpose: to stimulate the economy and make China hyper-competitive from a 5G perspective. A desire in China to have more local technology software and hardware suppliers is also supportive of this trend, as is a growing and broader set of technology customers within China.

At the same time that we are embracing technology, we are being diligent in reassessing cyclically oriented companies within our quality growth universe that have been heavily penalized this year. These include travel-related companies as well as selected financials. We have cut financials back in our portfolios, as they face the headwinds of record low interest rates and potential credit-quality issues.

Theme 2: Healthcare

A second investable theme we are positive on is healthcare. We see opportunities across the healthcare spectrum—from healthcare services to healthcare equipment—as spending there is only poised to grow, in our view.

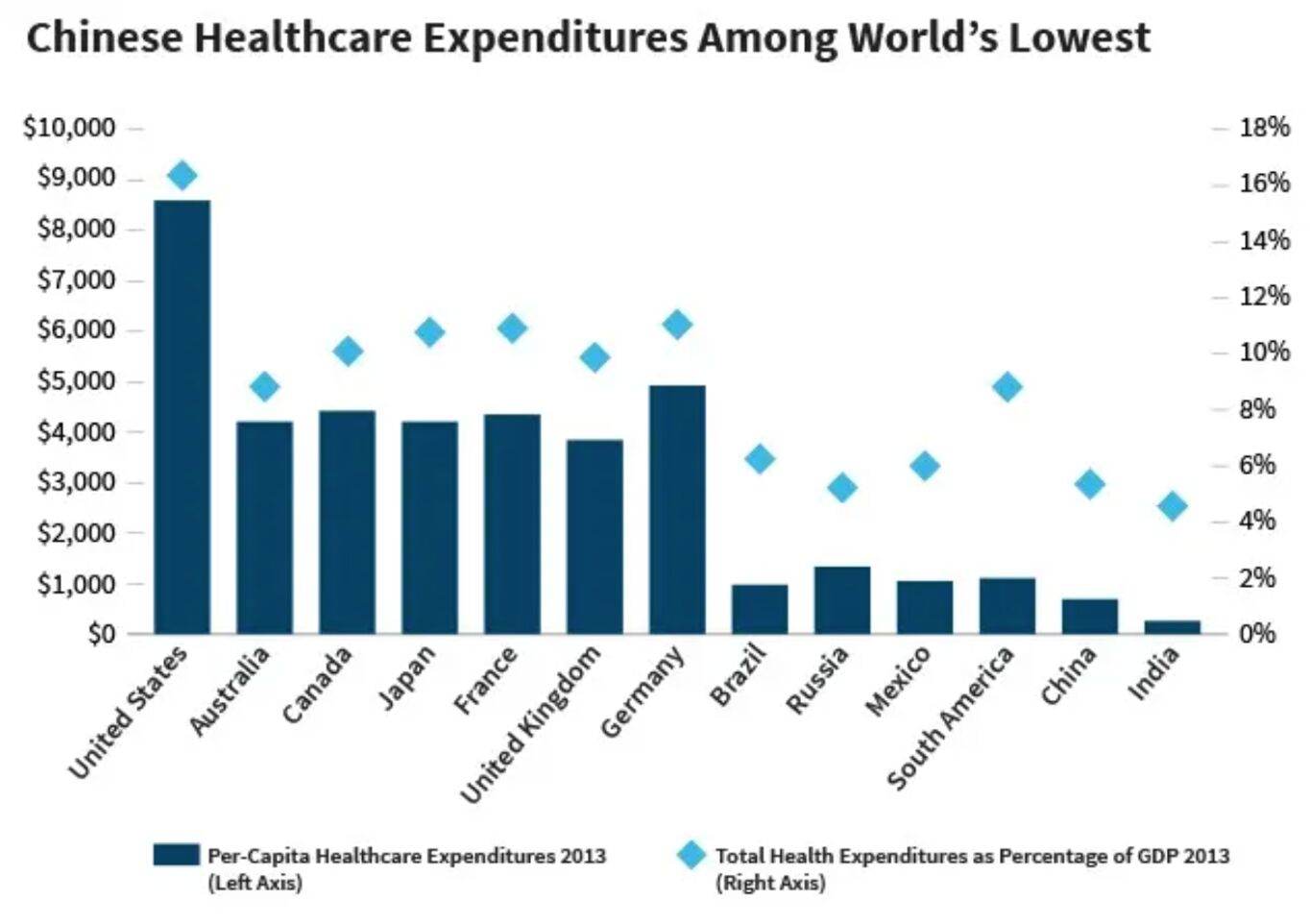

Healthcare remains a largely underdeveloped industry many emerging markets. Healthcare expenditures in China, for example, are among the lowest in the world per capita and as a percentage of gross domestic product (GDP). Yet the prevalence of chronic disease in China has risen significantly over the last two decades, setting the local healthcare industry up for consumer-driven growth.

In addition, the COVID-19 pandemic is likely to increase demand for quality healthcare. And the health-related nature of the current crisis should spur investments in healthcare as well, especially in the pharmaceutical industry.

Theme 3: China

While controversial right now for a number of reasons, we cannot ignore that China’s performance this year has been impressively resilient. This has been supported by China’s containing of the virus, sizable Chinese government stimulus measures aimed at offsetting the detrimental effects of COVID-19, and the gradual reopening of the local economy.

We expect China to announce more easing efforts, further supporting the local economy and market. The domestic economy continues to recover, with China the first country to come out of the crisis, and some of its sectors still poised to rebound.

We find many structural growth themes are flourishing in China.

The COVID-19 crisis has also helped accelerate China’s shift toward consumption-led growth from investment- and export-led growth, with recent government stimulus mostly targeted at boosting domestic consumption.

Geopolitical tensions with the United States are supporting the shift as well, spurring China to become more reliant on its domestic economy and less reliant on trade.

We see this structural shift persisting, leading to ongoing improvement in the quality, consistency, and sustainability of China’s economic growth.

Selectivity Is Key

Our focus in emerging markets amid the downturn is on quality companies that are tied to structurally advantaged themes such as these—and also are attractively valued.

We expect those with strong balance sheets and cash reserves to invest will be able to strengthen their competitiveness in this environment and come out ahead.

We have been increasing our exposure to these themes in the current market environment, adding allocations to related companies where we now find intrinsic value to be attractive.

Todd McClone, CFA, partner, is a portfolio manager on William Blair’s Global Equity team.

Vivian Lin Thurston, CFA, partner, is a portfolio manager and research analyst on William Blair’s Global Equity team.

Weitere beliebte Meldungen: