China A-shares—the domestically listed equities of mainland Chinese companies—have been extremely resilient during the current crisis, outperforming other emerging market (EM) and developed market stocks. We attribute their strong performance in part to a number of interrelated factors and sustainable trends that support our positive outlook for the asset class and our preferences within it.

Extreme Performance

The MSCI China A Index is up roughly 24% in U.S. dollar terms year-to-date as of September 15, 2020. In contrast, MSCI’s broader EM and global indexes are only up about 2% to 4%, and the S&P 500 Index is up 7%, showing just how well China A-shares have performed since the pandemic broke out.

This A-share outperformance—along with the strong absolute and relative performance of Chinese stocks in general—led to a dramatic increase in China’s weight in the MSCI Emerging Markets Index.

China now represents about 40% of the index, up about 650 basis points from its pre-crisis weighting. Many market watchers had expected to see such an increase occurring over the next 5 to 10 years. Instead, it occurred over the course of a few months this year.

Factors supporting the outperformance of China A-shares include the steady Chinese currency, the domestic-driven economy, the local-investor-centric equity markets, and several positive near-term developments and long-term structural trends.

Factors supporting the outperformance of China A-shares include the steady Chinese currency, the domestic-driven economy, the local-investor-centric equity markets, and several positive near-term developments and long-term structural trends, many of which support a favorable growth outlook for China.

Supportive Stimulus

Positive developments behind A-shares’ strong showing this year include supportive fiscal and monetary policies. The government has announced an unprecedented fiscal deficit target of 8.5% of the country’s gross domestic product (GDP) for 2020, or an annual increase of 3.6 trillion renminbi, to support and stimulate economic growth post COVID-19.

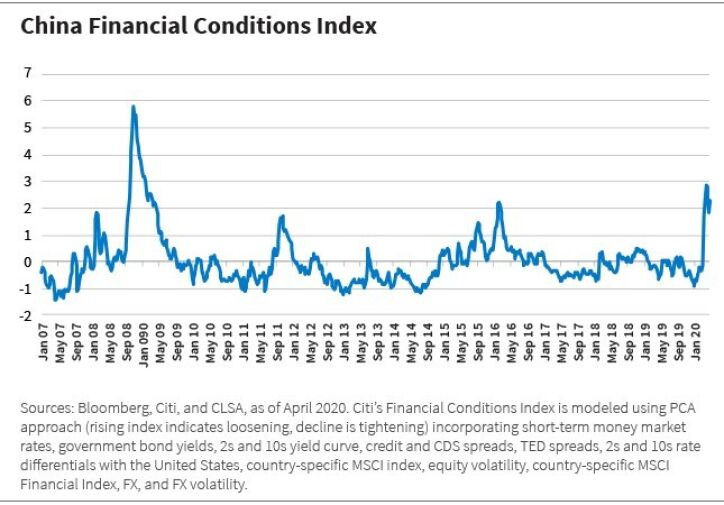

It also selectively relaxes monetary policies to ensure necessary liquidity and credit for the recovery and growth. These measures have loosened local financial conditions more than we saw during the 2015 economic slowdown or the 2013 “taper tantrum.” See the chart below.

A Shifting Economy

Another supportive and sustainable trend is China’s shift toward consumption-led growth from investment- and export-led growth. The COVID-19 crisis has helped accelerate this trend, which was already underway pre-pandemic as China sought to make its economy more reliant on domestic consumption.

The Chinese government’s stimulus in response to the pandemic shock has mostly targeted boosting local consumption. This follows China’s focus in recent years on stimulus efforts such as tax cuts, aimed at putting money in consumers’ pockets.

These more-recent efforts represent a change from previous ones aimed at stimulating the fixed-asset investment part of the economy, via infrastructure spending, to drive demand for commodities.

As a result, China’s economic growth is now less dependent on investments and exports than it was in the past and more reliant on domestic consumption. We see this structural shift persisting, leading to ongoing improvement in the quality and sustainability of China’s economic growth.

Resilient Earnings Growth

The China A-share market is supported by strong fundamentals. Its earnings growth over the past five years has outpaced that of Chinese H-shares (the shares of companies incorporated in mainland China that are traded on the Hong Kong Stock Exchange), emerging markets, and developed markets excluding the United States.

In fact, the China A-share market is the only equity market globally to expect positive earnings growth in 2020, according to Bloomberg estimates.

A more favorable structural growth outlook for the Chinese economy overall should translate into higher-quality, more sustainable earnings growth for domestic companies.

We expect this resilient earnings growth will persist. A more favorable structural growth outlook for the Chinese economy overall should translate into higher-quality, more sustainable earnings growth for domestic companies.

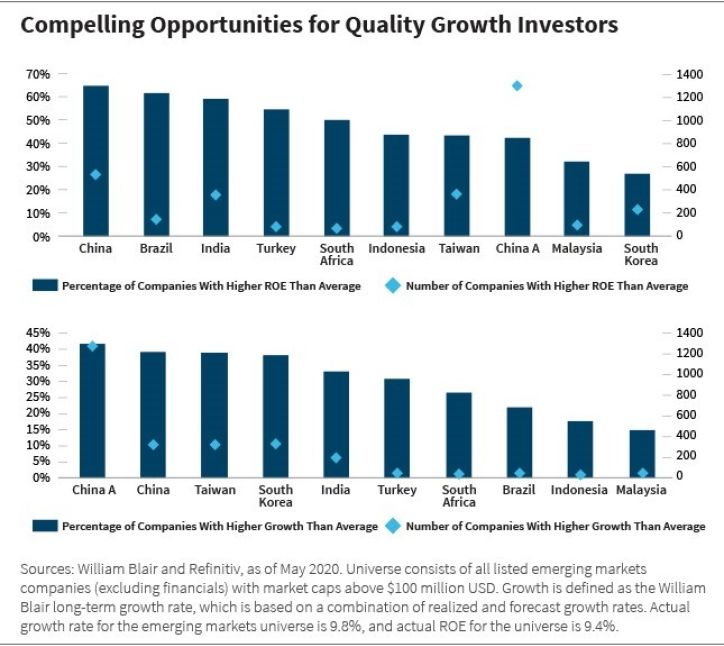

According to our analysis, the A-share market currently has more than 1,200 companies exhibiting earnings growth greater than the EM average, the highest in our EM universe.

Exposure to Structural Growth Sectors

The A-share market also has substantial and unique exposure to key growing industries within the Chinese economy, including information technology, consumer staples, and healthcare—another trend we see persisting.

The Pandemic Response

The Chinese government has done a relatively good job of containing COVID-19, in our view, with the domestic economic and social activities now mostly resumed and recovered to the normal levels.

To be sure, the recovery in China has been gradual and uneven—a roadmap of what recoveries in other regions may look like too. Local production is now fully back, and operating capacity has rebounded for many sectors of the economy, with the exception of entertainment, dining out, and tourism.

Selectivity Is Key

In our view, investing in the China A-shares market is essential for global investors seeking to capture China’s growth potential. Yet, we believe stock selection is key here too. We use the same criteria when evaluating A-share opportunities as we do when analyzing stocks in other regions.

We look for characteristics such as solid management, strong returns, attractive earnings growth, and good ESG factors.

We seek to find high-quality and differentiated companies in growing industries. We look for characteristics such as solid management, strong returns, attractive earnings growth, and good environmental, social, and governance (ESG) factors, which signify companies likely to remain or become market leaders.

We especially see attractive opportunities today in selected consumer, healthcare, and technology-related A-share companies who source a majority of their profits and revenues from the domestic market.

The MSCI China A Index captures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges. Index performance is for illustrative purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Vivian Lin Thurston, CFA, partner, is a portfolio manager and research analyst on William Blair’s Global Equity team.