Investors are preoccupied with inflation for good reason: It affects interest rates, public-equity valuations, private-equity access to capital and, ultimately, stock-price multiples.

The recent policy change announced by U.S. Fed Chairman Jerome H. Powell to allow inflation to run at an average rate of 2% over time, rather than setting that figure as a strict threshold, will fuel the debate about central-bank policy, inflation, and growth.

Yet confusion about inflation assumptions and forecasts could lead investors astray. In this post, I hope to clarify the definition of inflation and the factors that influence it, then explain why both aggregate demand growth and inflation may be higher over the next decade than in the 2010s, with major implications for asset allocation.

- First, let’s agree about the definition of inflation.

When we measure inflation, we are really looking at changes in prices. Inflation is a broad-based and sustained increase in prices year-over-year. It occurs when demand—whether from the private sector or from the government—grows consistently in excess of supply.

Two variables determine aggregate demand growth: 1) income growth and 2) distribution of income. When widely distributed, income growth generates demand, but increasing income concentration suppresses growth in aggregate demand. Higher-income households have higher savings rates than lower-income households, so as income is transferred from the bottom and middle of the distribution to the top, less of it is spent.

Inflation is not manufactured by central banks, driven by one-time price changes due to tariff increases, or measured by shifts in relative prices.

Supply can lag demand for many reasons, including restrictive labor laws or a lack of qualified workers, expensive or unavailable land, or high-priced utilities.

Overall, a multitude of complex, dynamic, and simultaneous interactions determine the balance of growth and inflation, including forces that affect regulation, tax policies, labor, education, transportation, energy, demographics, and technology.

Meanwhile, inflation is not manufactured by central banks, driven by one-time price changes due to tariff increases, or measured by shifts in relative prices. I explain why in the white paper, which you can read in full below.

- The money supply is surging because consumers cannot spend.

With very few exceptions, governments are not debasing money, and it is unlikely that inflation expectations are about to change dramatically, even following the shift in Fed policy, which largely formalizes its recent decisions rather than setting a surprising new course.

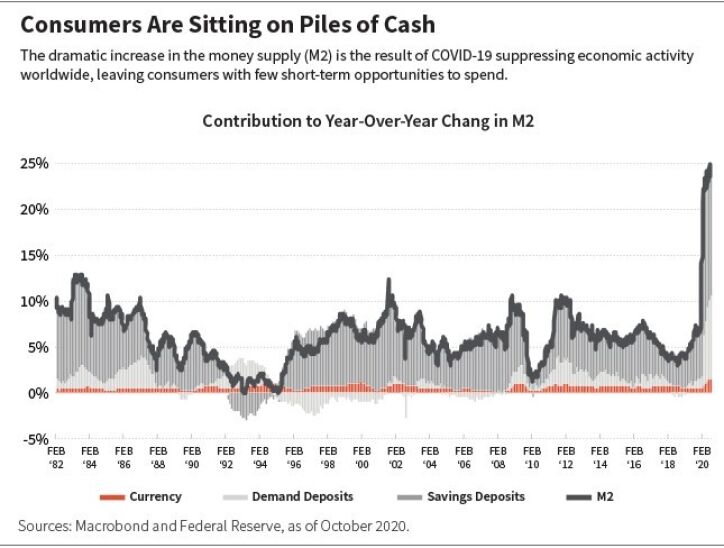

Then why are there concerns about the money supply? As a reminder, we measure the money supply by looking at M2, which consists of M1—currency in circulation and checking accounts—plus savings accounts. There is a sharp increase in the money supply because people literally have not been able to spend since late March. The large checking and savings account balances they are accumulating show up as a surge in M2.

In fact, U.S. retail deposits have increased by 7% of annual disposable household income in just two months, reflecting that spending flows are roughly 30% below income. As the economy reopens, consumers will likely spend these balances, and the growth in M2 should taper

In my view, it is not worth worrying about hyperinflation.

In my view, it is not worth worrying about hyperinflation. The fiat money system—in which currency is backed by faith in the issuing government, not by gold or some other physical asset—is based on trust. When a government is unable to raise funds and resorts to “creating” money to finance its policies, it breaks that trust. This decision has been the path to every hyperinflation episode in history.

In today’s world of abundant data, it is virtually impossible for a government of a developed-market economy to take this path toward hyperinflation. The U.S. Fed reports all data on the money supply every week. Any move to dramatically expand it beyond the telegraphed policies would be immediately recognized.

Why are measures of inflation expectations increasing? Indices published by the University of Michigan and others show rising consumer-inflation expectations 1. But these expectations are highly influenced by food prices, which have increased because of higher demand at grocery stores, and higher production and transportation costs due to COVID-19.

Inflation expectations are an extrapolation of recent experience—not a reliable indicator of what inflation will be in 5, 10 or 30 years. Financial instruments such as inflation futures, swaps, or Treasury Inflation Protected Securities (TIPS) are useful in telling policymakers what markets think about future inflation today. However, they are almost uniformly wrong in predicting actual inflation in the future.

- Government responses to inflation fears have suppressed demand growth for decades.

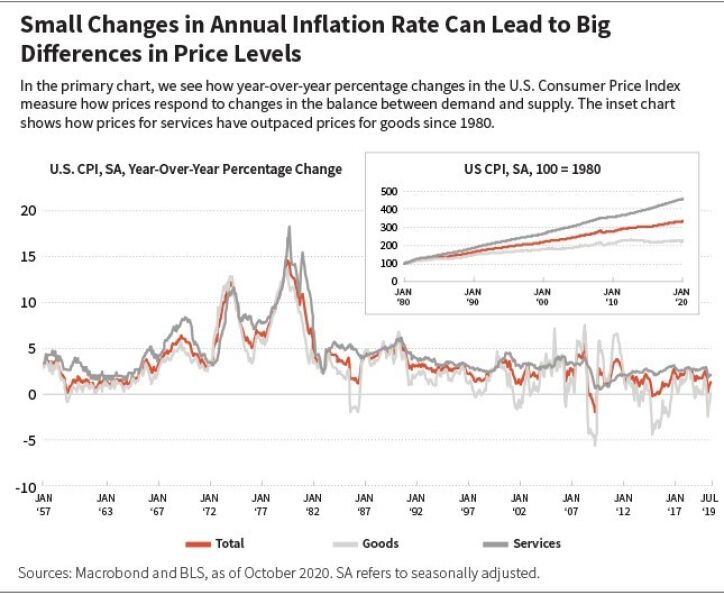

Inflation is highly redistributive: Even small changes in year-over-year prices add up to a noticeable loss in purchasing power. When consumers recognize this loss, they tend to withdraw support from the political structure, so governments are naturally preoccupied with limiting inflation.

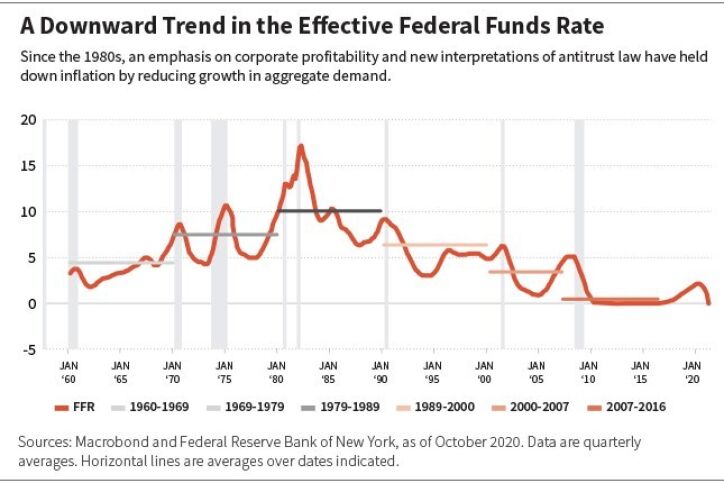

But efforts to control inflation affect growth, and political responses to the stagflation of the 1970s created or exacerbated the economic imbalances of today. The so-called neoliberal orthodoxy of the 1980s attempted to reverse a dramatic decline in corporate profitability. Governments cut corporate taxes and shifted the burden onto employees and households. Corporate taxes as a share of total federal tax revenue collapsed in the United States, from an average of 21% in the 1960s to about 10% since the 1980s. Politicians shunned fiscal policy as counterproductive.

Meanwhile, U.S. courts and government agencies reinterpreted competition or antitrust laws to prioritize lower consumer prices in the very near term. So long as a company could demonstrate that buying a competitor allowed it to reduce prices, mergers and buyouts would be approved.

The emphasis on corporate profitability and the new interpretation of antitrust law unleashed massive consolidation. Today, many industries are deemed oligopolies or monopolies. Corporate concentration has suppressed wages for high-tech workers 2and increased shortages of qualified nurses3. It has increased prices, depressed aggregate demand growth, and concentrated income and political power.

- Inflation is unlikely to accelerate after the COVID recession ends.

In the next 6 to 18 months, cyclical forces will likely hold down inflation. Most supply has not been destroyed, but mothballed, so it can be mobilized quickly to meet recovering demand.

Other factors, such as impaired balance sheets, higher unemployment, and wage and hiring freezes, are likely to repress income and, therefore, demand growth. We are unlikely to see demand growth persistently outpacing supply, leading to broad-based and sustainable price increases that indicate accelerating inflation. Inflation should stay muted, similar to other recent recoveries.

What could change the inflation outlook over the next three to five years? One-time checks to workers idled by COVID-19 are not enough to spur inflation. If the bottom 60% of the population received substantial, sustained wage and salary increases, and there were significant supply constraints, we could see persistent excess demand leading to inflation.

Constructive and consistent fiscal policy can encourage healthy supply expansion.

Yet sustained supply constraints are unlikely in a market economy, where supply responds to demand. Constructive and consistent fiscal policy can encourage healthy supply expansion. Fiscal policy can promote costly investments, such as building new airports and developing foundational technologies, that economies need, but private markets rarely finance.

In recent decades, the misguided focus on fiscal austerity has reduced such investments, undermining aggregate demand growth in many developed-market economies. It also placed an undue burden of economic policy adjustments on monetary policy, which is an inappropriate tool to address such issues.

Fiscal policy is shaping up to play a more prominent role in the current recovery—see the German4 and French5 stimulus packages, as well as the recent pan-European deal6. So far, the policies aim at reducing the corporate tax burden and incentivizing a shift in demand toward electric vehicles. Investment in select industries, while welcome, is too limited to drive inflation.

Three more trends could impact inflation. First, deglobalization or localization would leave everyone poorer by reducing aggregate income and demand, as well as corporate margins. Second, aging populations have been disinflationary in the past because older adults tended to consume less. Third, technological gains will likely continue to be disinflationary.

- Investment opportunities likely will look different in the 2020s.

We envision the decade ahead marked by rebounding supply to match the resurgence in demand that will likely follow COVID-19. With strong fiscal support, austerity should no longer handcuff growth, and investments by the private sector and governments can spur a healthy recovery.

It is likely that economic growth will be broader than during the recovery of the 2010s. If so, and if inflation remains in the 2% to 3% annualized range, investors in public equities will likely have more opportunities for profitable growth than in recent years. The stocks of rapidly growing companies may lose some of their scarcity premium, and companies with improving earnings may become relatively more attractive.

Despite the recent furor around central-bank policies, their decisions are not causing inflation. Economic recovery after COVID-19 has the potential to benefit a wide swath of consumers and companies, with inflation likely to remain in a low and sustainable range.

Olga Bitel, partner, is a global strategist on William Blair’s Global Equity team.

1 Inflation Expectations Are Wrong, Which Is Good.” The Wall Street Journal. July 14, 2020.

2 “Apple, Google Agree to Pay Over $300 Million to Settle Conspiracy Lawsuit.” Yahoo! Finance. April 24, 2014.

3 “Patient Deaths Tied to Lack of Nurses.” The New York Times. August 8, 2002.

4 “Germany Is Finally Ready to Spend.” Foreign Policy (FP). June 22, 2020.

5 “France Primes Fresh Stimulus to Boost Jobs, Cut Taxes on Firms.” Bloomberg. July 13, 2020.

6 “E.U. Adopts Groundbreaking Stimulus to Fight Coronavirus Recession.” The New York Times. July 20, 2020.