The overall picture for emerging markets debt (EMD) remains clouded by uncertainty around COVID-19, yet we remain constructive on the outlook for the asset class and anticipate strong performance going into year-end.

The bad news stems from COVID-19, including its impact on near-term growth and the potential for further lockdowns, particularly in the United States.

On the other hand, the likely U.S. election outcome, positive news about COVID-19 vaccines, monetary policy accommodation, improved technical conditions, and attractive valuations all point to further compression of EMD risk premia.

U.S. Elections: Gridlock Is Good

EMD rallied strongly on the back of rising prospects for a Biden administration and a Republican Senate. On one hand, investors believe that a more predictable and less protectionist U.S. White House will be more supportive of global trade and the global economy. On the other hand, a split government would limit the scope of fiscal stimulus, which could put significant upward pressure on U.S. rates and the U.S. dollar.

In the absence of a large fiscal stimulus package, and amid uncertainty around the evolution of the COVID-19 crisis, the U.S. Federal Reserve (Fed) should continue providing extraordinary monetary stimulus. In this environment, we expect U.S. rates to remain close to historically low levels and financial conditions to remain well supported.

COVID-19 Vaccine Inspires Hope

The recent announcement that a leading COVID-19 vaccine was found to be more than 90% effective in preventing the disease among trial volunteers raised hope that a preventative could be available soon (and supported the possibility that other vaccines currently in development could be similarly effective).

While the path from testing to regulatory approval to mass inoculation is still highly uncertain, the news creates hope for a faster economic recovery in 2021.

In the near term however, a sharp increase in the number of COVID-19 cases in Europe and the United States should lead to new containment measures, thereby limiting the scope for material economic improvement.

However, in light of still-significant near-term growth risks, extraordinary monetary accommodation should remain firmly in place on both sides of the Atlantic, supporting very favorable global liquidity conditions.

In emerging markets, where COVID-19 numbers seem to be moving in the opposite direction of those in developed economies, fundamental deterioration has stabilized on the back of improved expectations for stronger economic activity in 2021. The recovery will likely be led by Asia, where containment measures have proved successful in controlling the pandemic.

That said, with fiscal deficits averaging 8.5% of gross domestic product (GDP) in 2020 and the total public-debt-to-GDP approaching 60% on average, there is very little room for fiscal response in most places. Therefore, we view the fundamental outlook with a degree of caution.

Technical Conditions Should Drive Performance

However, technical conditions should remain the main driver of performance going into year-end. While market volatility remains somewhat elevated and bid-ask spreads are still relatively wide, technical conditions have improved as flows into EMD portfolios have continued to rise over the past months.

Investor flows into the asset class should comfortably offset a seasonal pickup in net issuance of new debt, especially in the context of very ample liquidity conditions and attractive EMD valuations.

Valuations Remain Attractive

EMD valuations remain attractive in spite of the recent rally. EMD sovereign spreads are trading above long-term averages and compare very favorably to credit spreads in developed markets.

We particularly see value in the EMD sovereign high-yield space, where spreads are trading 515 basis points (bps) above EMD sovereign investment-grade spreads—levels not seen since the global financial crisis.

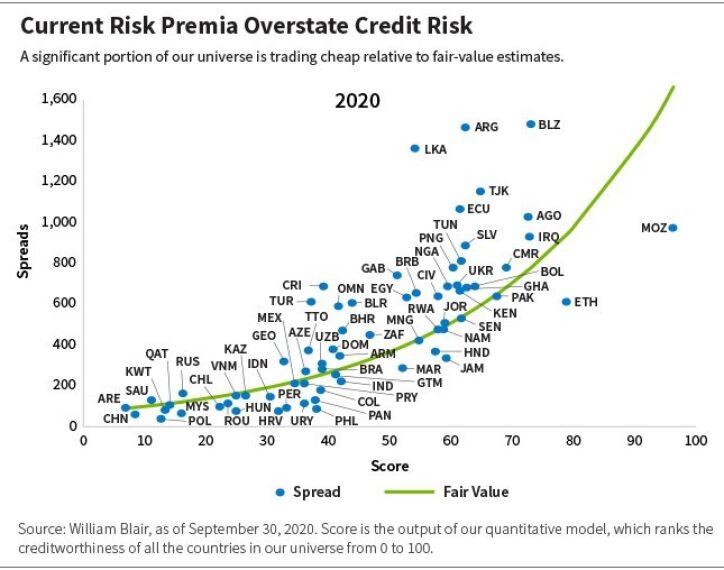

Our proprietary sovereign risk model indicates that the vast majority of the investable universe currently trades above fair-value levels, as the chart below illustrates.

In a world with close to $17 trillion of government bonds trading with negative interest rates and approximately $3.7 trillion invested in near-zero-yielding money market funds, higher EMD yields should continue attracting sizable flows into the asset class.

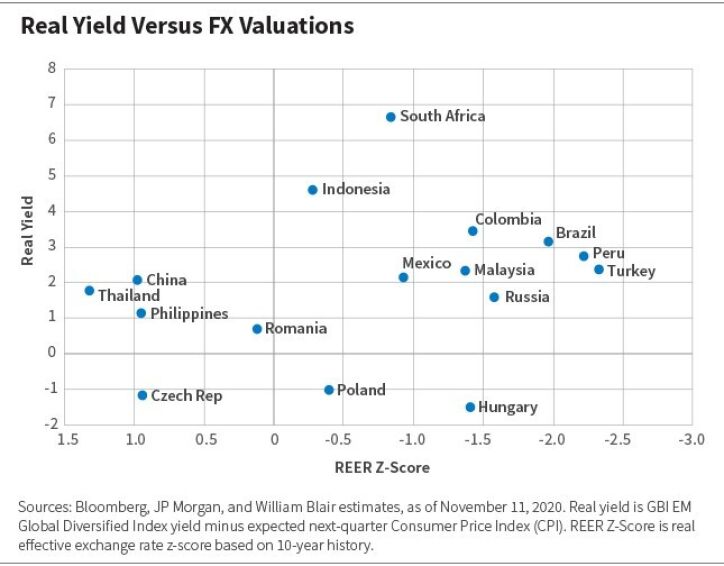

We also expect emerging markets currencies to continue trending higher, albeit unevenly across the globe. Currencies in Asia and higher-yielding currencies in Africa, Eastern Europe, and Latin America are seeing a pickup in investor appetite on the improving growth outlook, higher real interest rates, and cheap foreign exchange (FX) valuations, as the chart below illustrates.

Reduced inflationary pressure and lower credit risk is also driving positive performance in local rates, where a number of curves offer attractive levels of term premium compared to their developed market counterparts.

Hard Currency Positioning

In the EMD hard currency space, we remain overweight the high-beta universe as we position for additional compression of the high-yield/investment-grade spread differential.

We still favor countries with strong buffers and the ability to respond to economic downturns. However, we are cognizant of opportunities in countries that have been severely impacted by COVID-19 but have strong potential to recover as we exit out of the crisis, particularly tourism-dependent economies.

We also favor countries with easier access to financing, especially those with strong relationships with multilateral and bilateral lenders.

Lastly, we see opportunities in the distressed debt space, where existing bond prices do not reflect realistic assumptions for recovery values.

We also see attractive opportunities in the emerging markets corporate credit space—in particular corporates where spreads are compressing relative to their sovereigns.

Local Currency Positioning

Positioning in EMD local currency markets has favored positions in Asia and frontier Africa and underweighted Eastern Europe.

Bonds in the latter have outperformed significantly owing to tight correlations with developed Europe, and now offer little value, whether in terms of real interest rates or term premium.

Frontier Africa, on the other hand, is benefiting from a much improved outlook for external financing while also proving much more resilient than expected to the effects of COVID-19.

We also prefer rates and local market credit risk exposures in Latin America, particularly in the larger and more liquid Brazilian and Mexican curves, while being more cautious on FX. The region has been hit particularly hard by the global pandemic and the coming months will prove critical for firming up our macro expectations for the next few years.

Marcelo Assalin, CFA, is a portfolio manager on and head of William Blair’s Emerging Markets Debt team.

Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. Rising interest rates generally cause bond prices to fall. Sovereign debt securities are subject to the risk that an entity may delay or refuse to pay interest or principal on its sovereign debt because of cash flow problems, insufficient foreign reserves, or political or other considerations. High-yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Diversification does not ensure against loss. Any investment or strategy mentioned herein may not be suitable for every investor. Past performance is not indicative of future results.