With reinvigorated optimism around a COVID-19 vaccine, many investors have rotated away from growth stocks and into value stocks—and a readily available vaccine could alter the ingredients that precipitated the outperformance of growth versus value over the past several years.

Reasons for Optimism

The dramatic rise in coronavirus cases, hospitalizations, and deaths as we head into winter is frightening. Given the current trajectory of cases, some areas of the country are closing schools and employing more restrictive measures in an effort to stem further spread of the virus.

While these restrictions could limit overall economic activity, we do not anticipate a lockdown scenario similar to what we experienced earlier this year.

Plus, there’s encouraging news on the vaccine front: multiple pharmaceutical companies have released promising vaccine results. While this is clearly positive, before we determine when the vaccines will be readily available (and when we may return to some semblance of normalcy), we will need to see more data regarding efficacy and better clarify manufacturing and distribution logistics.

A more inclusive economic environment—one in which more companies are delivering solid revenue and earnings growth—typically provides a better backdrop for value stocks to outperform.

COVID-19 Vaccine Drives Growth-Value Rotation

We believe a readily available vaccine is likely to alter the ingredients that precipitated growth’s outperformance of value over the past several years, including declining and persistently low interest rates, benign inflation, and moderate economic growth.

Specifically, the widespread rollout of a vaccine should allow for a return to normalcy and provide for a more conducive economic environment.

Generally speaking, when growth is scarce, investors often pay up for the limited growth they can find. However, as growth broadens, investors become more price-sensitive and seek out the least expensive growth available.

Therefore, a more inclusive economic environment—one in which more companies are delivering solid revenue and earnings growth—typically provides a better backdrop for value stocks to outperform.

This better backdrop is likely to be highlighted by higher interest rates and inflation and broader and higher economic growth, providing a more fertile environment for value stocks in general.

It’s not surprising, then, that reinvigorated optimism for a near-term vaccine has led investors to start rotating away from growth stocks and into value stocks since early November.

We believe this may be a precursor to a more sustained rotation into value stocks and may lead to a period of prolonged outperformance of value stocks going forward.

After all, the valuation differential between growth and value stocks is extreme, and the widespread availability of a vaccine could provide a backdrop that allows this valuation gap to narrow.

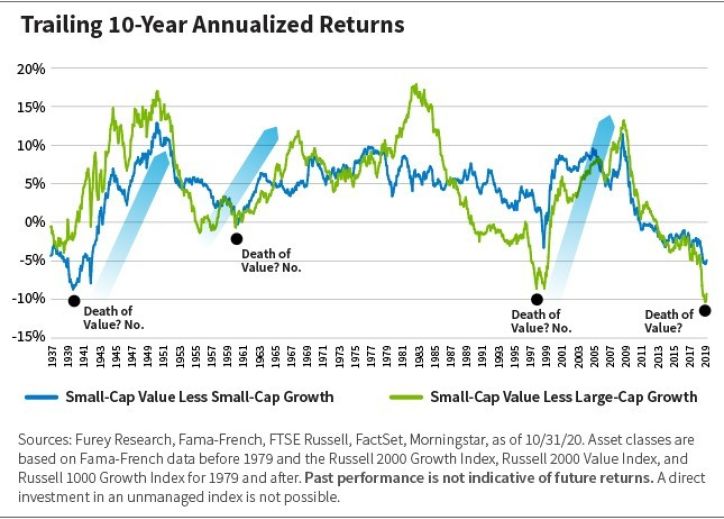

While it has been challenging to be a value investor over the past 10 or more years, history has proved time and time again that it is dangerous to declare that value is dead.

Value Stocks Appear Inexpensive

We looked at valuations earlier in 2020, noting that value stocks are attractive based on a number of valuation metrics.

While this has changed since early November as value has begun outperforming growth, we still view value stocks as extremely inexpensive.

Value Isn’t Dead

Moreover, although current market trends have been in place for some time and seem unstoppable, the mindset that this is inevitable is often the case at market inflection points.

As the well-known investor Howard Stanley Marks once said: “Rule Number 1: Most things will prove to be cyclical. Rule Number 2: Some of the most exceptional opportunities for gains and loss come when other people forget Rule Number 1.”

As long-term investors, we believe that nothing lasts forever. Markets are cyclical. While it has been challenging to be a value investor over the past 10 or more years, history has proved time and time again that it is dangerous to declare that value is dead.

Is the Tide Turning?

The strong efficacy data from recent vaccine trials, renewed optimism for a near-term vaccine, and hopes for a return to normalcy fueled the recent outperformance of value over growth.

Although the transition to value will undoubtedly experience fits and starts, we believe sustained progress toward controlling the virus could be the catalyst for a further rotation into value stocks and lead to a period of prolonged outperformance of value stocks going forward.

Matthew Neska, CFA, is the Portfolio Specialist for the firm’s U.S. value equity strategies.

The Russell 1000 Index measures the performance of the 1000 largest companies in the Russell 3000 Index, which represents approximately 90% of the total market capitalization of the U.S. market. The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000 index, which represents approximately 8% of the total market capitalization of the Russell 3000 index. The Russell 3000 Index measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. Value indices measure companies with lower price-to-book ratios and forecasted growth values; growth indices measure companies with higher price-to-book ratios and forecasted growth values. Index performance is provided for illustrative purposes only. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.