Mid of March the Central Bank of Brazil kicked off a rate-tightening cycle following a sharp rise in inflation in recent months, making it the second major emerging market (EM) to raise interest rates since the start of the COVID-19 pandemic. What happened—and is it is sign of things to come across EMs?

Turkey was the first major EM to raise rates, in September 2020. The move—the first of its kind since 2018—occurred after a series of other measures fell short of stabilizing the lira. It not only surprised economists; it was also dramatic, increasing the country’s benchmark one-week repo rate from 8.25% to 10.25%.

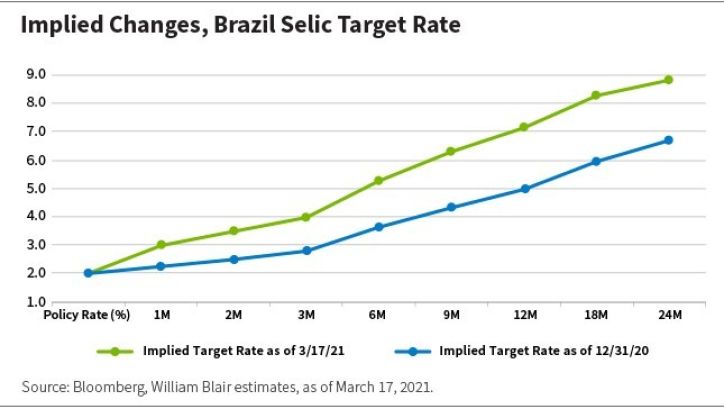

We believe the Brazilian bond market has overpriced policy tightening over the next 12 to 18 months.

The Central Bank of Brazil is likely to adopt a much more gradual approach to tightening than Turkey did. We expect the benchmark Selic policy rate (the central bank’s overnight rate) to trail Brazil’s consumer price index (CPI) for much of this year and keep real interest rates in negative territory until next year.

Policymakers in Brazil face a difficult situation in the short term. A weak Brazilian real (BRL), combined with higher global commodity prices, has pushed the tradable segment of CPI into the double digits and dragged the full CPI above the Central Bank of Brazil’s target band (1.75% to 4.75%). With the economy still struggling with the effects of the pandemic, higher nominal rates are needed to support the currency rather than slow demand—hence the need for a cautious approach.

For local investors, the bond market has already reacted strongly to these trends, and we believe it has overpriced policy tightening over the next 12 to 18 months. Brazil stands out among its peer group in this regard and offers attractive yield premium in the belly of the curve.

Real rates will likely remain quite low for some time given the protracted post-COVID recovery and available spare capacity in the economy.

The Central Bank of Brazil hiked 75 basis points (bps) at last week’s meeting to take the Selic rate to 2.75%. We expect it will follow with additional hikes at each of its remaining meetings this year, with the exception of December, taking the Selic to 5% by year-end. This would be in line with the 5.0% year-end consensus expectation published in the Central Bank of Brazil’s latest focus survey.

We are slightly more bearish on the trajectory of inflation in Brazil, expecting it to come in at 5% at year-end (versus 4.71% consensus), which would give us a real rate of 0%. The rationale is that higher U.S. rates will likely put additional pressure on the BRL, which in turn will have a less positive impact on inflation tradables than the market is anticipating.

So, real rates will likely remain quite low for some time given the protracted post-COVID recovery and available spare capacity in the economy.

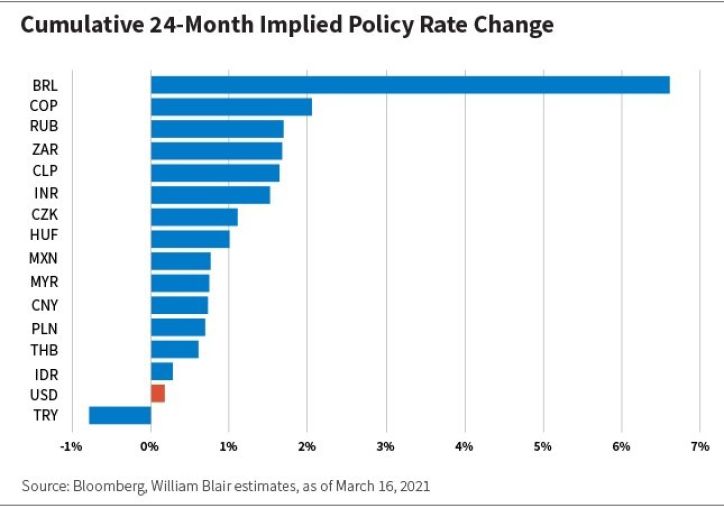

While Brazil is among the first major EMs to tighten, we certainly do not believe it will be the last.

Contrary to consensus expectations, however, the market is pricing in more than 500 bps of hikes through the first quarter of next year and nearly 700 bps in total over the next two years. We think this is far too aggressive, and the curve will flatten as the Central Bank of Brazil firms up expectations and gets the tightening cycle underway.

While Brazil is among the first major EMs to tighten, we certainly do not believe it will be the last. The chart below shows implied policy rate changes over the next two years.

But as EMs bounce back from pandemic lows to above-potential growth rates—at least in the short term—we expect surging demand, lingering supply shocks, and commodity prices to drive inflation higher. But next year and beyond, growth levels should normalize and fiscal consolidation should keep longer-term inflation expectations in check.

Lewis Jones, CFA, FRM, is a portfolio manager on William Blair’s Emerging Markets Debt Team.