For some time now I have been discussing a few key areas in which the healthcare landscape could change, including gene therapy and liquid biopsy. Then COVID-19 struck, and we saw the landscape change, with growth accelerating in many other areas.

Hospitals are increasing ICU capacity to address pandemic preparedness, for example, and tech giants are getting even more involved in healthcare.

Let’s look at a few key areas, with our estimations of current sales, total addressable market (TAM), and the potential growth opportunity.

Internet Healthcare

Internet healthcare can mean many things: online consultations, online pharmacies, electronic medical records, even using big data to improve medical diagnosis and reduce medical error.

In our opinion, telehealth will remain the leading segment of the internet healthcare market as the market shifts away from in-person medical visits.

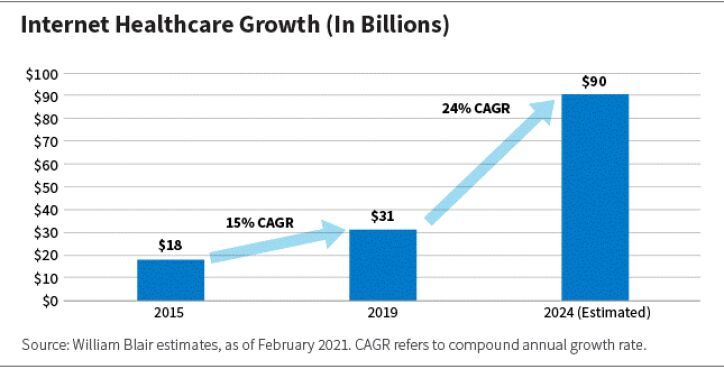

Internet healthcare had a compound annual growth rate of 15% from 2015 to 2019, and we estimate that it is currently a $31 billion market. The COVID-19 pandemic has demonstrably accelerated this market, and we project a 24% annual growth rate for the next five years. We also believe that growth is sustainable, and that stands out because this market is in its infancy.

In our opinion, telehealth—when a patient interacts with a medical professional online—will remain the leading segment of the internet healthcare market as the market shifts away from in-person medical visits.

There is also significant potential in China, given that internet healthcare there is uniquely positioned to relieve some of the key bottlenecks in the healthcare system. Unlike many healthcare systems in developed nations such as the United States—where most routine care and diagnosis is performed in a well-established primary care setting—most routine care in China is performed at the hospital. The result of this—at least before the coronavirus pandemic—is overcrowded hospital lobbies and a high level of inefficiency in the delivery of medical care. The growing use of telehealth for diagnosis, together with online pharmacies, drastically alters this dynamic.

Over the past couple of years, we also began to see policies that could drive this market globally. For instance, regulatory changes in Germany have opened access to online prescription drugs. While these policy changes are in their early stages, we believe they will create opportunities.

Hospital Infrastructure

Hospital infrastructure involves the expenditures necessary to make hospitals meet consumer demand. These expenditures are shifting from traditional capex to medical equipment (such as personal protective equipment, or PPE) and ICUs that can meet surge capacity.

Hospital infrastructure, based on our estimates, had a compound annual growth rate of 6% from 2015 to 2019, and we estimate that it is currently a $120 billion market. But growth will likely accelerate post-COVID as healthcare systems are forced to revisit their pandemic preparedness, giving it an estimated TAM of $220 billion.

There are many questions that remain to be answered. How will the delivery of patient care change, especially as hospitals change? What is the right level of ICU bed capacity to address future surges (and can it become more flexible)? How will inventory levels rise for critical medicines, medical devices, and PPE? What are the implications of de-globalization for national stockpiles and supply chains? How will government oversight and funding change? Will increased spending post-COVID look more like a supercycle of a structural shift?

The answers to these questions—whatever they are—will undoubtedly change the market, and we believe many of these changes will likely be permanent. In the first half of 2020, one medical equipment manufacturer estimated that over the medium term ICU capacity globally needs to double. Another hospital CEO said the increased need for beds and stretchers “may not be something that’s just pull forward; it may be additional demand.”

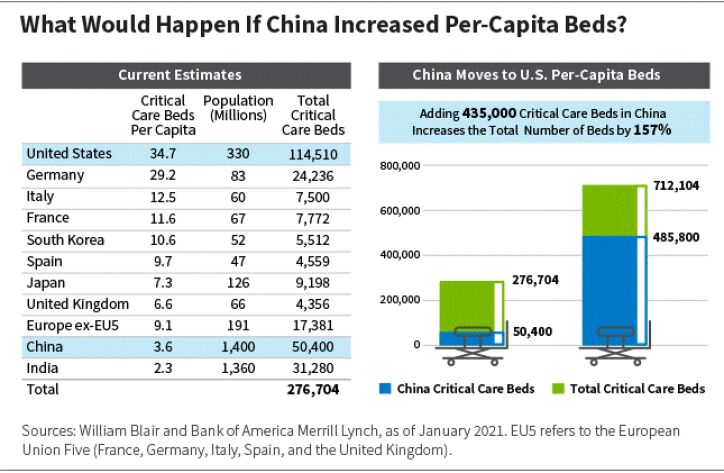

Just how much demand? To answer that question, I asked what would happen if China increases ICU bed capacity to the level of the United States, which leads the world in beds per million people? And what would happen if Europe increases ICU bed capacity to the level of Germany, which is second in the world?

In China, that would involve a 150% increase in total ICU beds, from 276,000 to more than 700,000 beds as shown in the chart below. Additionally, in Europe, it would be a 30% bump up. Together, that would triple the market for ICU beds. It’s reasonable to assume revenues of companies in the market would also increase.

Tech Giants Moving Into Healthcare

Historically, tech giants have not been healthcare companies. But are they? David Feinberg, head of Google Health, believes so. “I believe Google is already a health company,” he said. “It’s been in the company’s DNA from the start.”

According to Apple CEO Tim Cook, “I believe, if you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s great contribution to mankind?’ it will be about health.”

Tech giants such as Google, Apple, Amazon, and Microsoft are moving into healthcare for two main reasons. First, the healthcare market offers these tech giants an enormous TAM to help grow their already massive revenue bases. Second, these companies have advantages in terms of their technology, user bases, and cash to deploy to help tackle some of the biggest problems in healthcare, such as the explosion in healthcare data and how it can be used to improve health outcomes and manage the growing complexity of administrative infrastructure and reducing inefficiency and waste.

The revenue opportunity for these tech giants is potentially massive. Our team estimated that by 2030, it’s possible that these companies could have revenue pools in healthcare that approach or exceed their overall revenue bases today. To be sure, this would represent more of a lower-probability bull case than a higher-probability base case, but one thing is more certain: these companies are going for it. According to Apple CEO Tim Cook, “I believe, if you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s great contribution to mankind?’ it will be about health.”

So what are these companies doing in healthcare? Amazon, for example, has been making some inroads into healthcare by buying a company called PillPack to pursue the online pharmacy market, and collaborating with JPMorgan and Berkshire Hathaway in services via a joint venture (JV) called Haven. Although the JV was recently disbanded, I don’t believe this diminishes Amazon’s intentions to pursue a move into healthcare as various other initiatives such as Amazon Care remain in place.

If anything, I believe Haven is a good example of how tech companies are willing to try multiple initiatives to solve a problem, knowing full well that many fail. For all the success that tech giants have had, a “healthy dose” of acceptance of failure will likely be required to crack the proverbial healthcare nut.

Other Opportunities

If you’d like to learn more about liquid biopsy and gene therapy, which I mentioned at the outset of this post, please see “EditGenetics: Improving Lives,” which is part of our Convergence series examining five themes shaping the future of investing.

Thomas A. Sternberg, CFA, Partner

Global Research Analyst

William Blair Investment Management

Global research analysts Camilla Oxhamre-Cruse, Ph.D., Richard Reznick, Ph.D., and Emily Moore contributed to this post.