We are in what we like to call the Mother of All Recoveries (MOFAR), but we don’t think it will expire in months or quarters: We believe it is a multiyear phenomenon that has the potential to slowly morph into something more sustainable (and it is not fully priced into assets). In some ways, this drama can be divided into five acts, much like a Shakespearean play (minus the catastrophe at the end). Let’s open the curtain.

Act 1: Growth

We believe the MOFAR could involve exceptionally strong gross domestic product (GDP) growth in 2021 and 2022—something on the order of 5% to 6% in the United States. We haven’t seen such growth rates since the early 1980s.

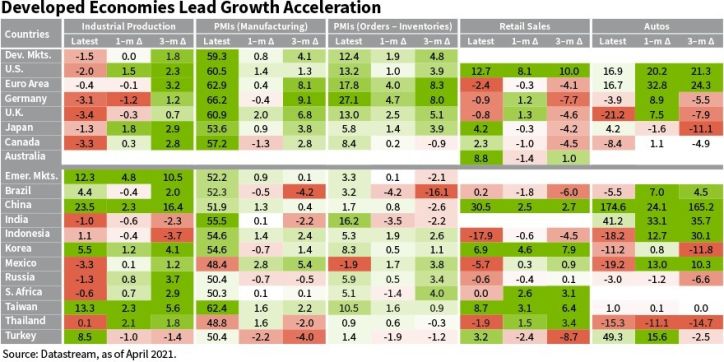

Why are we so confident in the economic recovery? We like to look at the world using a macroeconomic scorecard, a sample of which is shown below. As you can see, the top third shows developed markets, while the bottom two-thirds shows large emerging markets. For all markets, we show production data (the first three columns), retail sales, and new auto registrations.

The Mother of All Recoveries (MOFAR) is not a U.S. story; it’s a developed-market story.

What immediately jumps out to us is the predominance of dark green in the upper left quadrant. This indicates that economic growth has been off the charts, and it’s accelerating monthly. Ultimately, that should translate into much higher year-over-year numbers. So we’re likely moving from double-digit industrial production declines in the first half of 2020 to strong year-over-year growth starting in the second quarter of 2021.

We believe this is not a U.S. story; it’s a developed-market story. There are two reasons. First, emerging markets have been slower to vaccinate than developed markets. Second, consumer spending has been constrained in many emerging markets, which didn’t receive the same fiscal support as the United States and Europe.

Moreover, emerging markets’ ability to restart is limited by currencies that are tied to the dollar. During the pandemic only five countries issued debt in their domestic currencies.

Even within developed markets, however, there is some variation. In Europe, for example, retail sales have suffered from further lockdowns. But we think this situation is temporary. Vaccination efforts in Europe are about six weeks behind those in the United States. By the end of May, anyone in the United States who wants a vaccination should be able to get one; we expect that to be the case in July for Europe.

Inflation is not likely to start galloping into the double digits or even high single digits. I expect it to be closer to 3%.

One note about China: In our view, what happens in the three big global demand centers—the United States, Europe, and China—tends to drive what happens in the global economy.

While manufacturing growth is strong in the United States and Europe, it is decelerating in China. But this is to be expected, given that the United States and Europe suffered from longer shutdowns than China. China expanded strongly as the U.S. and European economies languished. China should continue to be a fast grower, but the wedge between China’s growth and that of the United States and Europe should shrink to an all-time low.

It is also worth noting that the recovery will likely be uneven. Consider weekly credit card data for three types of purchases: durable goods, nondurable goods, and services. By and large, consumption of durable goods has returned to or surpassed pre-crisis levels, and in some categories is 20% or 30% higher than it was at the beginning of 2020. But services consumption is still down between 20% and 40%. Nondurable goods consumption is somewhere in between.

Act 2: Inflation

The second act of the MOFAR story is inflation. We expect it to move up from very depressed levels, especially relative to 2020. But it is not likely to start galloping into the double digits or even high single digits. I expect it to be closer to 3%.

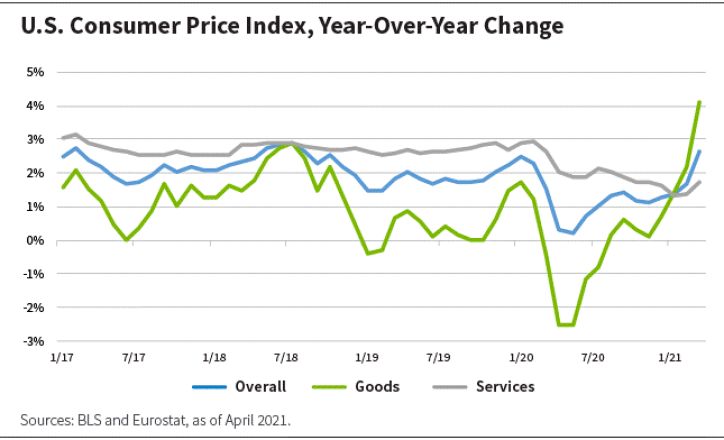

But let’s ground this expectation in a few facts. The chart below shows the inflation rate in the United States—total, services, and goods. (The trajectory is similar in Europe, but the numbers are lower.)

Overall inflation is typically driven, by and large, by services. This isn’t surprising since the bulk of consumption consists of recurrent services. During the pandemic, however, we’ve seen a reversal, with inflation driven by goods inflation.

Why is that? Globalization typically depresses the prices of goods, but COVID-19 changed that. Fewer people were able to work in production and distribution facilities. Supplies were constrained. As a result, supply chains lengthened. That contributed to a sharp rise in goods prices.

We think this reversal is temporary. The U.S. economy reopened around this time last year, and in the subsequent (third) quarter, we saw a sharp reversal in goods inflation. At the same time, during the depths of the pandemic services inflation was as low as 1.4% year-over-year (less than half of the 3% annual rate that we’ve seen over the past few decades), and we expect that to reverse once high-contact services open in earnest and combine with strong income growth and tremendous pent-up demand.

So, prices will likely be higher when the pandemic ends, and inflation is once again driven by services, and that’s normal. We’re more concerned about inflation decelerating. No central banker wants to engineer deflation, which is essentially what led to the Great Depression. We hope inflation will stay in the 2.5% to 3% range.

As a final note about inflation, much as been said about commodity prices, which have seen a strong rebound. Certainly, looking at the Bloomberg Commodity Index, the rise in prices is meaningful from the lows we saw in March of 2020. But in year-over-year terms, I do not think there is much to worry about. Commodity prices would need to rise by triple digits to show up meaningfully in aggregate consumer price index (CPI) numbers. The 1% to 5% increases we’re seeing now will not have that kind of an impact.

Act 3: Interest Rates

What does that mean for interest rates?

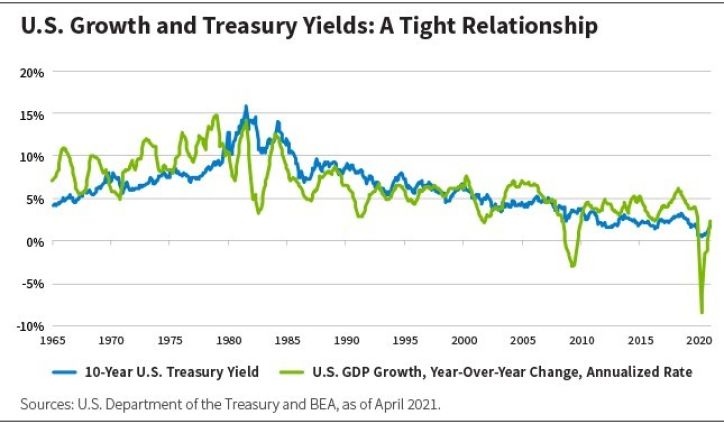

The benchmark U.S. rate (the 10-year U.S. Treasury yield) was below 1% as we headed into 2021. It rose as high as 1.7%, and is now hovering below 1.6%, but I wouldn’t be surprised to see it in the 2% to 2.5% range by the second half of 2021.

I believe rates can reach levels above 2% in the near term because U.S. Treasury yields are largely a function of the three- to five-year moving average of U.S. economic growth. That relationship has been relatively tight for a very long time, and I don’t expect it to change, as shown in the chart below

No systematically important central bank likely is interested in withdrawing liquidity at this point. There are still tremendous amounts of economic slack in both economies, so interest rates and liquidity conditions should remain low for the foreseeable future. Monetary policy authorities are not likely about to disrupt this recovery.

Act 4: Earnings Growth

So far, rising interest rates have been all about repricing growth expectations. Stronger economic growth should mean stronger corporate earnings growth.

As interest rates have risen, we’ve seen spreads between the 10-year U.S. Treasury (a proxy for the risk-free rate) and corporate bonds compress from what were already record-low spreads in October and November of 2020.

It does not appear, however, that higher interest rates have been fully priced in to earnings. During the height of the pandemic, growth was very depressed. This is starting to shift, but a year later it is not quite where it was in 2017 and 2018. So, for many companies, earnings growth is about the same as it was then.

If a company can’t grow its earnings in this environment, it probably can’t grow its earnings at all.

If economic growth increases such that it is ultimately two to three times higher than current levels, the earnings growth of listed companies needs to be at least that much higher, if not more. We consistently observe growth in the listed space well in excess of the overall economy. It is not uncommon for listed companies to see earnings growth in the high double digits.

That means we could see earnings growth revised upward significantly starting in the second quarter. The numbers are already creeping up, but have much further to go, in my opinion.

This focus on earnings growth is where we, as fundamental analysts, have a significant role to play. We believe if a company can’t grow its earnings in this environment, it probably can’t grow its earnings at all. This is very consistent with our cyclical framework.

Act 5: Pressure on Multiples

To close our play, we believe that everything we have discussed will likely work in tandem to put further pressure on multiples.

As we move from recovery to expansion in the economic cycle, earnings growth should become market focused. Companies that can deliver strong earnings growth, and companies that deliver stronger earnings growth than the market currently expects, are likely to perform better, in my opinion.

But under the surface there will be pressure on multiples. We’ve already begun to experience this in fits and starts. There are two sources. The first source is rising interest rates, which lead to discounted cash flows being discounted by larger factors. The second source is the fact that within-market rotation, pressure on relevant multiples also likely to come to the fore.

In regard to the latter point, the scarcity value premium portion of multiples for very fast growers and last year’s COVID beneficiaries is likely to be repriced downward as growth broadens and other companies participate via stronger earnings growth. We’ve begun to see some evidence of that already, but we don’t think it’s finished.

This is very relevant for us, given where we as fundamental analysts operate—in the quality growth spectrum.

No Stopping the MOFAR?

Lastly, one would be wise to ask: Is there anything that could stop this MOFAR?

On the economic front, we believe there is little. But COVID-19, and its derivatives, are a different story. The recession was a medical recession, so the risks are skewed to the medical side. Will vaccines be as efficacious and safe as the current science suggests?

Starting in late July, we should get a sense of the long-term effects of vaccines because stage three of the trials started in late July 2020. My colleague Camilla Oxhamre Cruse, an immunologist by training, thinks the risks of the vaccines are low, but the mRNA platform is new.

Any longer-term ramifications of the technology could potentially slow down our reopening efforts. But this is very much a tail risk, so the probability of it happening is small in our view.

Olga Bitel, partner, is a global strategist on William Blair’s Global Equity team.