When assessing opportunities in emerging markets (EM) debt, we consider both top-down and bottom-up perspectives—and recently, this led us to view two high-yielding Gulf Cooperation Council (GCC) countries as potentially interesting opportunities.

Top-down global macro conditions appear positive for risk assets, fundamental and sustainability drivers have been improving markedly, and technical conditions remain supportive at the margin. Moreover, we believe valuations are not fully pricing in these improvements.

A Holistic Perspective

When analyzing the sovereign debt of any country, we believe it is important to (a) have strong insight into the fundamental drivers of each market and (b) ensure that investment decisions are made within the context of a robust framework. That leads us to analyze instruments and positioning within each market using both top-down and bottom-up perspectives.

Top-Down: Determines Outlook and Shapes Risk Appetite

The top-down component of our process is designed to assess global macroeconomic conditions and trends to ensure that we position our portfolio to potentially benefit from the investment landscape for EM debt.

Our monthly assessment of the top-down macroeconomic environment produces a global macro score. This score influences the amount of near-term risk we will take. In the first quarter of 2021, our positive global macro score pointed us to a high-beta tilt.

As high-yielding energy exporters with a high beta to global growth through their growing tourism industries, Oman and Bahrain present compelling opportunities.

Equally important, however, are the drivers of this score, which help us determine the nature of the risks we are comfortable taking. In the first quarter of 2021, those drivers were recovering global growth, abundant liquidity conditions, a positive outlook for commodity prices, and attractive valuations (particularly in high-yield debt).

That led us to look at non-investment-grade GCC countries. As high-yielding energy exporters with a high beta to global growth through their growing tourism industries, Oman and Bahrain present compelling opportunities—because they are the type of markets we believe have the potential to outperform in current conditions.

Bottom-Up: Optimizes the Use of Our Risk Budget

However, we are only comfortable allocating capital to a market that is also compelling from a bottom-up perspective—and to assess each investment case, we conduct forward-looking sovereign credit analysis of each market.

Our bottom-up research—which we believe is a core strength—often involves regular visits to each market we cover and the leverage of strong networks we have established there. There are two components to the subsequent analysis.

Both Oman and Bahrain appear inexpensive relative to other high-beta oil exporters outside the region.

First, to obtain a comprehensive picture of each sovereign market, we determine the drivers of the country’s sovereign spread based on economic growth and resilience, public finance health, external balances and buffers, and environmental, social, and governance (ESG) factors.

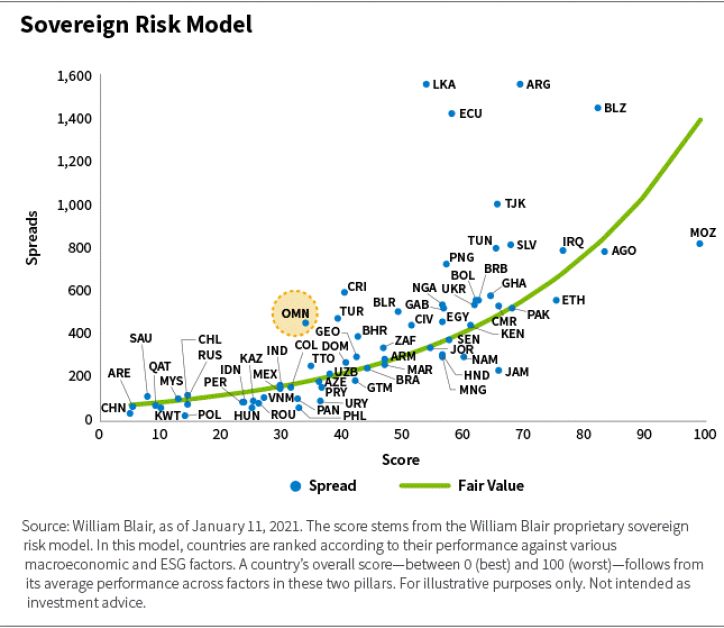

We then feed these forecasts into our proprietary sovereign risk model, which quantitatively determines how attractive each market is relative to both its peers and its history. This determines a fair value for each market, and forms the starting point in establishing whether a market should be an overweight, underweight, or neutral position in our portfolios.

Second, because different factors have different impacts on future spreads at different times, we also evaluate each market qualitatively to assess factors that cannot accurately be captured in the sovereign risk model. This either validates the output of our sovereign risk model or alerts us to reassess the output.

Broadly speaking, high-yielding GCC countries have scored well both quantitatively and qualitatively, but let’s look at what is driving the inputs into our decision in more detail.

Fundamentals: Credible Fiscal Reform in Oman

When viewed through a fundamental lens, Oman scores high relative to other high-yielding opportunities for a number of reasons.

Oman’s debt has grown rapidly as a result of fiscal looseness exacerbated by the COVID-19 crisis. However, authorities, under a new sultan, have established what we believe is a credible plan to address this deterioration. Unlike his predecessor, the new sultan seems to understand the challenges and is willing to address them in a meaningful way. Specifically, he has signed off on a fiscal consolidation path.

Although implementation risks remain, the International Monetary Fund (IMF) recently concluded a staff visit to Oman, and its subsequent report echoes our positive stance. The IMF’s analysis cited Oman’s ambitious medium-term adjustment plan and broad public-sector reforms, including measures to increase revenues (via a value-added tax), increase taxes for high earners, and expand the excise tax base. Oman’s plan also addresses expenditures by containing civil service wages, targeting energy subsidies in a more focused manner, and streamlining capital expenditures.

Additionally, there will be consolidation of Oman’s sovereign wealth fund and reform of its state-owned enterprises, which have drained the country’s budget.

These reforms are largely driven by the country’s circumstances. Three-quarters of Oman’s debt stock comes from external borrowing, so foreign sentiment is more important to Oman than it is to other countries in the region. In our opinion, this suggests that the most recent S&P downgrade of Oman remains a floor to Oman’s credit rating.

Fundamentals: Fiscal Credibility Less Clear in Bahrain

Bahrain will likely be running a fiscal deficit for the near term. Although it adopted a fiscal plan, that plan has fallen off track, and there appears to be no concept of how to get back to balance.

As a result, regional support is essential. Bahrain is still receiving the benefits of grants and 0% loans from the region, and intends to return to fiscal balance by 2022. However, due to the COVID-19 virus and fiscal looseness, Bahrain appears far from achieving that goal.

It may even need an additional bailout from the region. A new plan has been drawn up to facilitate post-economic recovery in Bahrain, which would allow the government to withdraw $450 million from the Future Generations Fund.

This will help plug the fiscal deficit somewhat, but any support is likely to come with increased requirements for more fiscal reform, since Bahrain hasn’t done much in that regard since its 2018 bailout.

We are also encouraged by Bahrain’s swift vaccine deployment; it should help offset the negative impact of COVID-19 on the economy and speed the return of tourism.

Sustainability: ESG Improvement Trajectory Continues

In recent years there has been an increased focus on the application of environmental, social, and governance (ESG) factors to EM debt investing, but this is not new to us. The analysis of ESG factors has been integrated into the fundamental component of our investment process for many years because we believe analyzing ESG factors is critical to properly assessing risks and risk premia in EM debt.

We are encouraged by recent improvement in ESG scores in the region.

We are encouraged by recent improvement in Oman’s ESG scores, which reflect progress relative to peers on the rule of law, control of corruption, and government effectiveness. Oman also scores well in nutrition and basic medical care, water, sanitation, and shelter.

However, the country lags its regional peers in regard to personal rights, inclusiveness, and environmental performance, and we would like to see further improvements there.

In Bahrain there has been some progress too. For example, we were encouraged to read that as of 2022 all energy used at the Formula 1 grand prix in Bahrain will come from sustainable energy sources. In 2020 Bahrain also issued ESG reporting guidelines for companies listed on its domestic stock exchange.

ESG factors—like fundamentals—tend to move slower than technical and valuation factors, so changes to our scores in these areas are less frequent. As a result, a high-beta credit’s positive score in these categories is likely to drive a core structural overweight.

Technicals: Issuance Largely Finished and Positioning Light

When looking at technical factors, we assess current positioning, the likelihood and size of potential new issuance, and the ownership structure of each market.

Both Oman and Bahrain returned to the capital markets in the first quarter of 2021, issuing $3.25 billion and $2 billion, respectively, across three maturities. The new issues were well received by investors, and in both cases spreads are currently trading close to tights since issuance.

Although Oman may decide to issue again in relatively small size later in 2021, this is likely to be more tactical in nature because the country recently secured a $2.2 billion loan from a consortium of international banks, adding to market confidence in its ability to self-finance.

In the case of Bahrain, we expect up to $2 billion in additional issuance in 2021, some of which may come in the form of sukuk, an Islamic financial certificate, similar to a bond in Western finance. This is likely to be easily absorbed by the market.

Although market positioning in Oman has increased in recent months to reflect the improvement in fundamentals, we do not believe the market is heavily overweight, and there is likely room for investors to add further on market weakness. By contrast, positioning in Bahrain is the lightest in the region, with investors taking a large underweight exposure on the back of the high and rising debt stock. The relatively light positioning should also help shield Omani and Bahrain credit from any outflows, should they materialize.

Valuations: Less Attractive at the Margin

We look at valuations through a number of different lenses when assessing the merits of each market, analyzing how attractive spread levels look against relevant key global macro drivers, such as oil prices.

In the case of energy-exporting markets, such as Oman and Bahrain, it is important to assess current spread levels against both current oil prices and our future expectations for oil prices. Because these are high-beta markets, it is also important to assess valuations against our assessment of global risk sentiment. We currently believe in both cases that conditions are supportive and can facilitate further spread compression relative to peers.

We also assess valuations relative to other regional peers (markets with a similar beta) and a country’s own historical spread level.

Here, the valuation argument is less compelling for Oman. Oman now trades through Bahrain, which has not been as aggressive in its fiscal consolidation path. Oman has also tightened significantly against higher-rated regional credits, such as Saudi Arabia and Qatar, whereas Bahrain has room for further spread tightening. However, both countries appear inexpensive relative to other high-beta oil exporters outside the region, such as Nigeria.

Conclusion: Overweight

In sum, top-down global macro conditions appear supportive of risk assets. Having also assessed the case for high-yielding GCC markets by looking at fundamentals, sustainability, technicals, and valuations, we concluded that both Oman and Bahrain merit consideration as overweight positions in our portfolios. That said, our conviction level has fallen recently based on a weakened valuation score.

Determining Optimal Positioning

Our proprietary spread-over-sovereign (SOS) model is largely designed to analyze opportunities in corporate bonds in investment-grade countries. Because both Oman and Bahrain are high-yield sovereign credits, it would be unusual for us to assess the relative merits of corporate credits within this market when deciding how to position optimally.

As a result, we focus on the sovereign curve, positioning the size of the trade on this curve based on our conviction—which is determined by the top-down global macro score, the output from our proprietary sovereign risk model, and the qualitative assessment of fundamentals, sustainability, technicals, and valuations.

We also factor in the overall risk characteristics of our portfolio, considering the liquidity, diversification, and overall beta relative to the benchmark to determine the optimal risk-adjusted use of capital.

Daniel Wood is a portfolio manager on William Blair’s Emerging Markets Debt Team.