Global equity markets broadly moved higher in September but there was little change to the market narrative that dominated much of the quarter: trade war uncertainty globally and Brexit negotiations domestically. With a further $200bn of tariffs imposed on Chinese goods by US President Trump, there was little chance of respite for investors.

Whilst China retaliated with $60bn of its own tariffs, there were some signs the tensions are affecting the Chinese economy with the flash China manufacturing PMI reporting new export business falling at the quickest rate since early 2016. There was continued spill-over into the eurozone where the flash manufacturing PMI fell to a 24-month low as export orders stagnated for the first time in over five years. Concerns of a slowing Europe were exacerbated further by Italy’s new populist government proposing (and subsequently approving) a threefold increase in their budget deficit target to 2.4% of GDP for the next three years. This unnerved the European Commission and investors alike, as Italy, Europe’s third largest economy, is already Europe’s second most indebted nation (after Greece). German bond yields reversed some of their gains having reached a four-month high earlier in the month.

US manufacturing continued to fare much better, with the flash PMI reaching a four-month high. However, there was a notable slowdown in the services PMI to an 18-month low, albeit stronger new business growth suggested underlying resilience. Both sectors registered the sharpest price rises in their nine-year survey histories. Citing continued strength in the labour market and rising economic activity, the Federal Reserve voted unanimously to raise rates to 2.00 - 2.25%, as expected, making it the eighth raise since late 2015 and taking the effective rate to a 10-year high. The yield on the US generic 10-year Treasury closed the month at 3.06% - the first time the month close figure has breached 3.00% since December 2013.

In the UK resilient economic data continued to be marred by the sabre rattling of Brexit negotiations. The IHS Markit Household Finance index remained close to survey highs, whilst the UK services PMI reached its second-highest level since February. At 54.3 the services PMI marked another consecutive month of expansion in the unbroken series since August 2016, represented a reading above the average for this period (54.0), and was second only to Germany out of all the G20 countries. Despite this, headlines focused on the accompanying drop in business optimism to a five-month low, attributed to political uncertainty and the unpredictable impact of Brexit. Uncertainty was stoked further by the European leaders summit in Salzburg. The summit ended with Donald Tusk, the European Council president, rejecting Theresa May’s Chequers plan and the French president Emmanuel Macron branding the UK’s Brexiteers as “liars”. With the EU summit on 18-19 October being seen by many as the most likely opportunity for a final agreement to be reached and a further emergency summit planned for November in case of continued deadlock, there is every chance that the longstanding market narrative of negotiation uncertainty is in its final months. Whilst we are in no position to determine what form a future relationship between the eurozone and UK will take it is interesting to observe what the market’s expectations are for UK stocks ahead of an outcome:

- Relative price-to-book of UK stocks vs US stocks are at a discount not seen in over 40 years

- Relative price-to-book of UK stocks vs European stocks are at a discount not seen in 19 years

- The yield gap between UK equities and government bonds are at a level only seen in World War I and World War II in the last 100 years

- UK equities as a share of the MSCI All Country World index is at its lowest level in 42 years

Strategy update

The Fund outperformed in September, returning 0.34% against a showing of 0.07% by its benchmark, the FTSE All-Share Total Return Index (12pm adjusted). This was not enough to offset the Fund’s weak performance in July, meaning the Fund underperformed in Q3 in returning -1.85% against the index return of -1.17%. Much of this underperformance can be attributed to the Fund’s underweight position in healthcare, which was one of only two sectors to significantly outperform in the quarter (the other was oil & gas where the Fund is broadly neutral). However, it is disappointing that despite a number of positive updates there were no noteworthy portfolio stock performances in a period that has been undoubtedly sluggish for UK equities. Despite this lacklustre backdrop there have been a number of highly active decisions made within the portfolio, including the exiting of two investments, reallocation of capital to newer holdings and increases made to longer standing positions where there have been some undue share price weaknesses.

Ascential has been a position in the Fund for two years, contributing 62bps of performance, with the shares up 65% since first ownership. During this time management successfully recycled cash and assets away from the company’s traditional media businesses into faster-growing digital and e-commerce data-led businesses. Whilst this has undoubtedly led to the creation of a faster growing unique asset which is unequivocally linked to the structural growth associated with digital marketplaces (e.g. Amazon, Alibaba, Tmall), it has also led to a dilution in earnings as low earnings multiple businesses have been exchanged for high multiple businesses. This is not a concern in itself as higher growth businesses will always demand higher valuations but, accompanied with the share price move, the shares are now at a significant valuation premium to other media assets within the portfolio.

Compared to Ascential’s EV/EBITDA of 15.4x on consensus numbers, Daily Mail & General Trust (DMGT) trades at 10.3x, has c.15% of its market cap in cash, providing it with optionality, and a number of its digital assets are currently under earning (see ‘Under the Bonnet’, June 2018). Consensus is currently forecasting Ascential’s EBITDA to be 26% higher in 2020 than in 2018, whilst the same number for DMGT is just 1.6%. This leaves scope for significant upside to forecasts from new management’s turnaround strategy at DMGT – signs of which are already beginning to show – and arguably with lower execution risk as earnings growth can be derived from idiosyncratic management actions rather than market growth factors. The Fund will continue to monitor Ascential as the assets and market position remain of interest but current valuation leaves too little scope for a misstep. This was recently illustrated by the negative share price reaction to a marked slowdown in revenue growth at MediaLink, an acquisition which this Fund has always questioned given the price it was acquired at and the non-data-led business model.

We wrote back in April (‘Under the Bonnet’, April 2018) that the Fund’s position in De La Rue was under review following the failure to re-win the contract with Her Majesty’s Passport Office (HMPO) to design and produce the UK passport. The Fund has held De La Rue for nearly three years, and whilst the new management team have made significant progress in repairing the balance sheet and reducing the capital intensity of the business, the ability to generate growth via its new growth platforms has been muted. The loss of the passport contract means that one of these growth platforms is now potentially subscale, whilst also leaving a significant profit headwind which needs to be bridged by the remaining two growth platforms. This is no easy task and, combined with the distraction of a new activist investor and an increasing market narrative about a cashless society, the Fund believes that investors’ capital is best allocated elsewhere at this time. De La Rue added a total of 62bps to the Fund’s relative performance over its holding period.

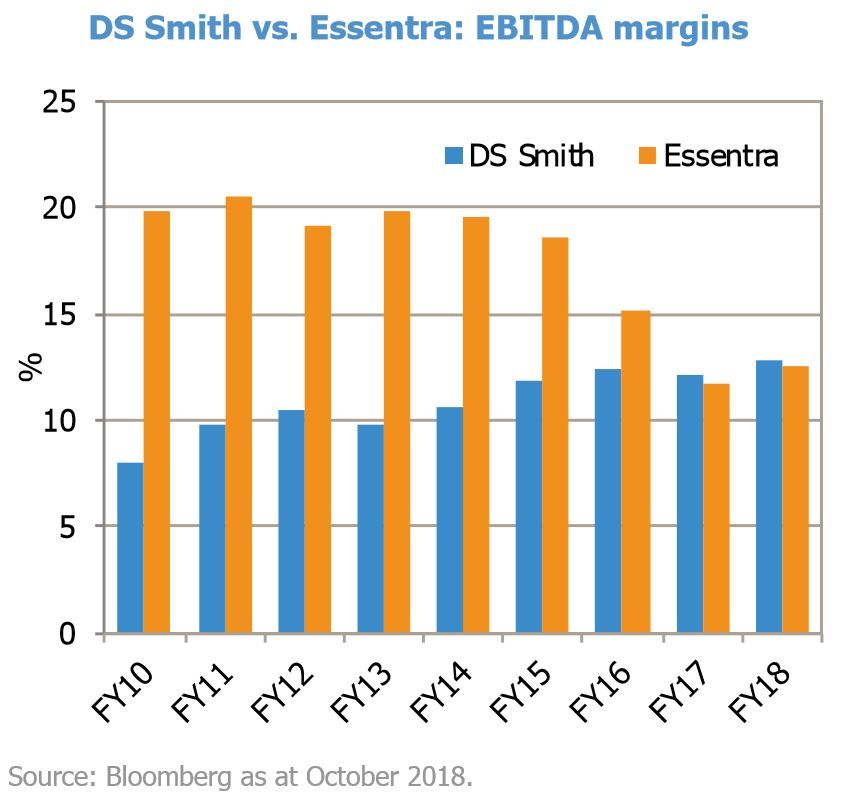

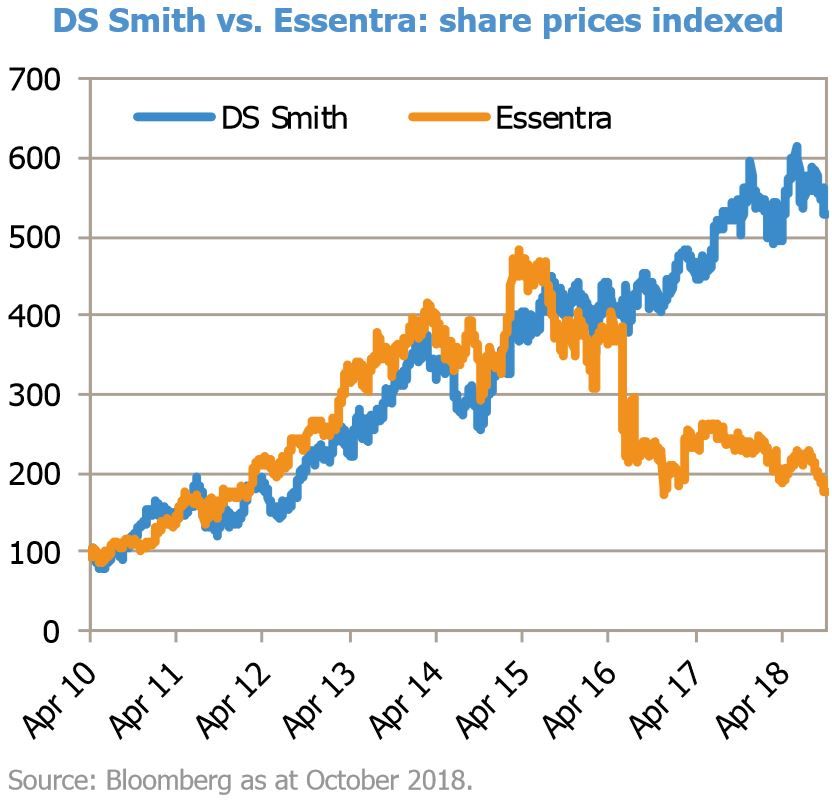

Within industrials some capital was reallocated from DS Smith to Essentra. Whilst both businesses look broadly similar on EV/EBITDA metrics, Essentra’s total earnings include next to no contribution from its Packaging division which, despite accounting for 33% of group revenues, only broke even at the operating profit level at the recently reported interims as new management’s turnaround strategy begins to take hold. Group EBITDA margins at Essentra have fallen from c.19% to c.12% (see chart) ever since the acquisition of the specialist packaging division of Clondalkin in 2015. In today’s money, Clondalkin was acquired for the equivalent of one-third of Essentra’s current market cap and yet total group EBITDA is yet to reach the level it was prior to this acquisition. It is no wonder that shares have fallen 55% in relative terms since then and taken the CEO with it. Under the new CEO, Paul Forman, there are clear signs that the business has stabilised, with Packaging’s revenue like-for-likes (LfLs) set to be positive in the second half of this year for the first time in two-and-a-half years. This is an important first step in unlocking the latent earnings upside in this division as, with volumes returning, margins will recover thereby taking group EBITDA margins higher.

Essentra’s packaging division is one of only two multicontinental suppliers of secondary packaging to the global health and personal care sector and, alongside its filter division, means that near 60% of group revenues are non-cyclical in nature. This compares to DS Smith where EBITDA margins are already at all times highs and revenues are cyclical in nature. Additionally, DS Smith’s acquisition of Europac, its largest yet, will stretch the balance sheet to 2.5x net debt/EBITDA compared to Essentra’s 1.7x. Whilst DS Smith is likely to be able to reduce this leverage to 2.0x, it will not be without the sale of its high returning plastics division, which will potentially be dilutive to group returns. Despite the recent signs of progress, shares in Essentra have continued to underperform against the FTSE All-Share Total Return index and DS Smith, providing the Fund with opportunities to rebalance the holdings. The underperformance of Essentra’s shares has clearly also been puzzling the CEO, Paul Forman, who personally bought an additional £262k in shares over the last quarter.

One of the most recent additions to the portfolio, retirement housebuilder McCarthy & Stone, got off to a pleasing start. Last month’s FY18 trading update was, importantly, not accompanied with a profit warning following three in the last two years and also showed the group ending with net cash and renewed sales momentum. The Fund has watched this stock and engaged with its management ever since the first profit warning. However, it was not until the third warning, which was accompanied with a change in CEO (enacted by the new chairman who also chairs Essentra) and a complete change in strategy, that the Fund began building its position. Shares at the time offered an attractive margin of safety as they were trading at a 30% discount to tangible net book value and new management’s strategy – re-iterated at a strategy day on 25 September – moved the company away from a mindset of growth to one of delivering value from the existing assets through using new innovative build and ownerships models to broaden the appeal of the product and drive higher ROCE and margins. The Fund had long viewed previous management’s ambitious growth targets as unrealistic and dilutive to returns. It remains early days for this investment, with risks still remaining around the forthcoming ruling by the Department for Communities and Local Government’s (DCLG) on their proposal to reduce ground rents on new long leases to zero. Retirement homes remains a socially important and sensitive growth market for the government, so one would hope any ruling would, at the very least, not stifle this market. Even in the event of a negative ruling, the current valuation continues to offer an attractive margin of safety in combination with new management’s strategy.

Finally, interims from Morrisons (the Fund’s second largest holding) showed further strong trading in the form of accelerated wholesale activity and new store performances coming ahead of management expectations. Of particular note is the continued acceleration in cash returns to shareholders enabled by management’s cash-focused strategy; the interim dividend was increased 11.4% and accompanied by a maiden interim special dividend of 2.0p, implying a combined increase of 132% year-on-year. Despite this, the shares marginally underperformed over the month.

Alex Savvides, JOHCM UK Dynamic Fund