Economic and market backround: a bumpy ride down

The UK stock market reached a peak in May 2018. Since the darling buds of May, though, it has taken a bumpy ride downwards, with the FTSE All-Share Total Return index now firmly in negative territory for the year at -5.95%.

Whilst the market remains an irrational beast, we would highlight four influences that have been building during the period:

New politics: it is becoming clear that the shift in the global political environment is not a temporary phenomenon, but that we are experiencing a structural move away from the free market liberal ideology that has dominated Western politics and economics for the last 40 years. In particular, the previous received wisdom of the benefits of tariff-free trade is being challenged. This has led to weakness in capital goods and resources stocks, sectors which have previously benefited from the growth in global trade.

The end of QE: central banks have signalled an end to the quantitative easing experiment that has fuelled and distorted asset prices over the last decade. Cash-consumptive “unicorn” businesses that have surfed this liquidity wave have seen their share prices crash.

The return of inflation: tight labour markets globally and an inflationary UK budget (a 4.9% increase in the National Living Wage from April 2019) have heightened the prospect of further interest rate rises from record low levels. This has predictably hit valuations of cyclical and highly indebted companies.

Risky behaviours: market participants and company managements have travelled further up the risk curve. There has been a surge in M&A (past the previous cyclical peak) while measures of investor optimism indicate a worrying level of complacency. As a result, equity valuations have reached previous cyclical highs and corporate balance sheet gearing has surpassed previous records.

Performance: doing what it says on the tin

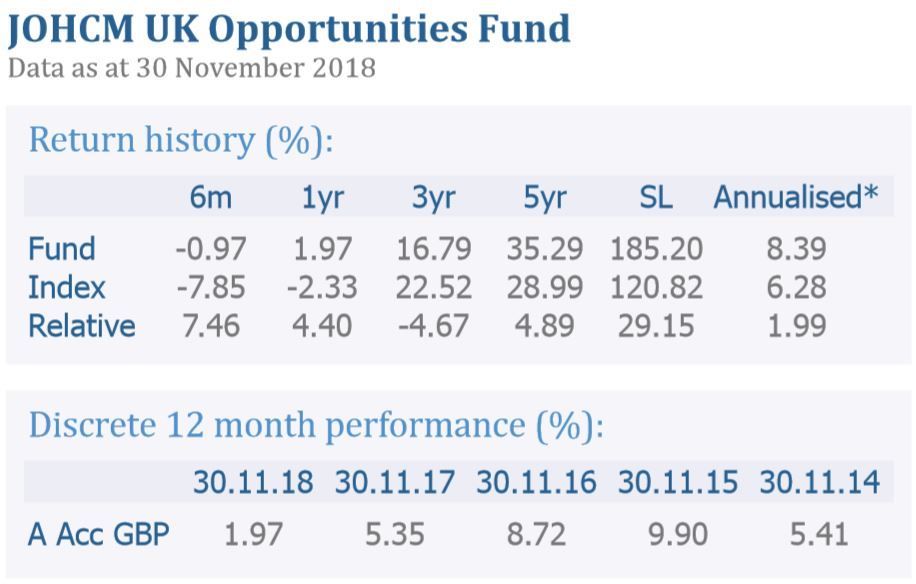

Our overriding objective remains to protect and then grow client capital. Over the last six months, the Fund has returned -0.97%, net of fees for the A Accumulation share class. This is in the context of a -7.85% return for its benchmark, the FTSE All-Share Total Return index (12pm adjusted).

Our exposure to high quality businesses has been key to the Fund’s resilience over this period. Diversified businesses with predictable and recurring cash flows, such as Unilever, Diageo, Reckitt Benckiser, WM Morrison and GlaxoSmithKline, all added value during the period. The portfolio also benefited from the takeover of insurance broker Jardine Lloyd Thomson.

In the debit column, shares in distribution business DCC were weak during the period despite a strong operational performance. We still like the diverse conglomerate structure of the business and DCC’s strong balance sheet.

Vodafone was also a laggard. The business has failed to address its oversized dividend, which, together with recent M&A, has led to an increase in debt. However, the business benefits from long-term structural tailwinds, as consumers across the world spend even more time on their mobile phones. Vodafone remains highly cash generative and the ability to reduce leverage remains within management control.

The exhaustiveness of our research process has arguably helped us to avoid the worst stock-specific blow-ups. Nevertheless, experience has taught us that we will not avoid them all. We are prepared for an unpredictable road ahead.

Portfolio activity: increasing resilience, reducing cyclicality

We made a number of changes to the portfolio during the period:

- We started a position in Reckitt Benckiser, taking advantage of weakness in the share price whilst being encouraged by progress made on strengthening the balance sheet. The business retains strong consumer brands with defensive characteristics as well as growth opportunities.

- We have also initiated a position in accounting software provider Sage. Again, the weakness in the share price provided a valuation opportunity to buy into a cashgenerative company with a loyal customer base and recurring revenues. We welcomed the change in CEO and recent announcement of a renewed focus on and investment in the core business.

- Other new investments included: Direct Line, where the compulsory nature of motor insurance should provide some defensive characteristics as well as an attractive dividend; and Imperial Tobacco, where an attractive valuation, management’s commitment to debt reduction and improved operational performance warranted the stock’s inclusion in the portfolio.

- We have sold our positions in the mining sector (Rio Tinto and BHP Billiton), given a less favourable outlook for Chinese growth and excessive build up of leverage there since 2008.

- We further reduced cyclicality in the portfolio with the sale of Ferguson and Mondi (following on from the sale of DS Smith earlier in the year).

Outlook: the great unwind has barely begun

Whilst there has been a small correction in stock markets this autumn, valuations of most high quality business with strong balance sheets remain unattractive. Cash remains king, giving us the flexibility to sell, be patient and have firepower when opportunities present themselves.

Whilst tighter monetary policy is beginning to be felt by the US economy, we are a long way from the corporate deleveraging that will eventually need to take place. Credit markets are only just starting to wake up to the likely consequences of a decadelong build up in corporate debt. The non-financial BBB debt market has nearly trebled in size from US$655bn in 2009 to US$1,843bn in 2018 (source: Morgan Stanley), credit quality is diminishing and, with BBB being 2.5x the size of the subinvestment grade market, it could mean a severe shortage of buyers.

The signs that flows into passive and ETF funds are slowing are important and also merit concern. These flows have been the dominant source of new money, whose buying, regardless of price or risk, has accelerated market gains. This is especially true in the illiquid area of corporate debt, where passive funds and ETFs have ballooned in size since the last global downturn. The consequences of negative flows as greed turns to fear will be felt across asset classes.

It won’t surprise followers of the Fund to read that we remain defensively positioned. We continue to avoid balance sheet leverage, particularly banks and life insurance companies, which are exposed to rising impairments and dislocation in bond markets respectively. Earlier we flagged political risk as a mounting consideration. Investors have yet to adjust to the structural shift in the political environment. Owning large, diversified international companies will help us navigate these increased potential risks.

Patience and discipline are essential to our process. Through our research efforts we have drawn up a shopping list of high quality businesses. We will deploy our cash when changes in valuations, balance sheets or management behaviour turn these individual risk/reward pay-offs in our favour, but only then.

Finally, a reminder of the portfolio’s attractive yield characteristics. Even with our elevated cash position, the Fund is currently yielding c. 3.1% (based on our unofficial internal yield forecasts).

Michael Ulrich, CFA, Senior Fund Manager

Rachel Reutter, CFA, Senior Fund Manager

Roshni Rajan, CFA, Analyst

J O Hambro Capital Management