The annual results of Kraft Heinz and the commentary on what has happened to its business in the past couple of years has several lessons for those who invest in quality businesses.

With the imprimatur of Mr Buffet, the deal to combine Heinz and Kraft was a landmark transaction. An almost ruthless approach to cutting costs by the new owners was the new mantra for managing businesses with moats and steady revenues. In February 2017, Heinz made a bid to acquire Unilever; today Kraft’s market cap is less than Hindustan Lever, its Indian subsidiary.

So what went wrong? To start with the easy part: leverage. It is one of the defining moves employed by private equity firms – financial engineering (in the garb of attaining the ‘right’ debt: equity mix). This led a stable business to take on significantly more debt. In itself that might not be wrong, but when a business faces challenging conditions, management teams face mounting pressure to remain within debt covenants to the detriment of investments in the future. Second, was the zero-based budgeting approach to cost cutting. Popular at one time amongst business consultants, it drove management by the mantra of ‘why should you spend?’ Perhaps that question is justifiable for administrative costs, but if applied to all costs this might defeat the purpose of managing and rejuvenating a steady cash-generative business.

Finally, disruption in business conditions. The world over, retail chains were the first to feel the impact of the online disruption; food and staple brands are increasingly feeling the effects now. The changing tastes of millennials, niche new brands that can scale thanks to influencer endorsement marketing strategies and help from online platforms for nationwide delivery are challenging incumbents. It is critically important to reinvest continually into the business to maintain existing brands and create new ones. That ultimately is the crux of the ‘moat’ of quality branded businesses. In Kraft’s case, perhaps the high debt and focus on cost cutting left management with little room to focus on what should have been the core capital allocation decision.

Asian Paints in India – years of growth ahead

In Asia, there is one difference when compared to developed markets. Good long-term growth opportunities for several companies are still robust, albeit frequently interrupted by macroeconomic challenges. Take India as a case in point. After disruptions due to demonetisation and the introduction of GST, we now confront geopolitical tensions. I have no opinion of how this situation will resolve, but suffice to say that in the past, saner heads have prevailed. Results for the quarter ending December 2018 are almost through. Companies that managed the disruption of GST and demonetisation well were rewarded handsomely by the market; P/E multiples for the better-managed firms remain high.

Take Asian Paints (AP) for example. On the face of it, the stock has always appeared expensive on both an earnings as well as price-to-sales multiples. In my opinion, there is a logical reason for this: the structure of the paint industry. The world over, paints is an oligopolistic industry. Moreover, even in the US, the industry has not yet been disrupted by online commerce. In India, too, the industry is a cosy oligopoly, with AP the clear market leader. As of March 2018, total industry revenues were estimated at approximately Rs500bn (US$7bn), of which AP reported revenues of Rs166bn (US$2.3bn). The unorganised sector (small mom and pop chemical plants that have low-end paints with no brand resonance and poor distribution) still account for 30- 35% of total sales. That share is likely to fall over the next decade, in my view. This will partly be driven by trends of rising incomes and aspirations of customers who gravitate to branded offerings, but more so due to the introduction of the GST in 2017 and lowering the GST slab to 18% compared with 28% in prior years.

To illustrate the hold the four big companies AP (52,000 dealers), Berger (23,000), Kansai Nerolac (21,000) and Akzo (14,000) have on the market, it is instructive to look at the progress of a couple of firms that entered the industry early this century. Indigo Paints started in year 2000 and Kamdhenu Paints in 2008. It is difficult to get exact data of these unlisted firms but, from public data sources, Indigo has approximately 12,000 dealers while Kamdhenu has 4,000. After 18 years in the business, sales for Indigo are approximately Rs5-6bn p.a. To put that in perspective, the top four firms collectively spent Rs13bn in advertising and promotions in 2018.

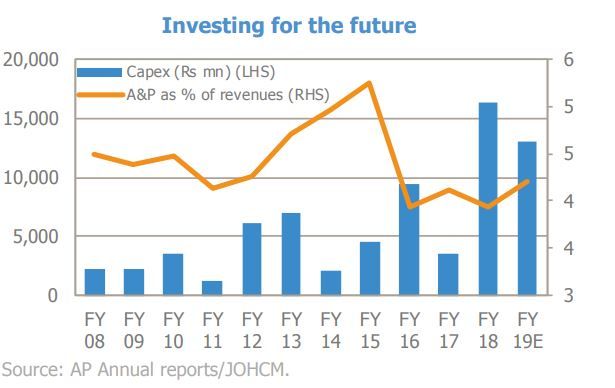

The cost of painting an apartment varies from 1-3% of the cost of purchasing the apartment. Paints are integral to decoration and aesthetics of the house. There is an umbilical link to the health of the real estate industry. In the past 7-8 years, home prices in India have, on average, remained flattish. A big bull market in property prices, which began in 2001/2, created an overhang of supply. Even in tough years, paint volumes have averaged growth of 6-8% p.a. Fortunately in the past couple of years, the Indian government has refocused its efforts on the housing sector. Providing subsidised rates of interest for affordable housing, changing GST rates for finished and unfinished homes and recognising that building and construction industries can provide ample employment opportunities. The industry is working with the National Skills Development Corporation to impart skills in its effort to train painters and increase engagement with architects. Current penetration levels of paints in India is low. Housing demand in India is likely to grow steadily as income levels grow and joint families splinter over time. As the industry leader, AP is using its cash flows to create capacity well in advance of anticipated demand. In the past five years, AP has invested Rs46bn in capex compared with just Rs20bn in the five years prior. Its A&P spend remains around 4% of sales, even on a much higher sales base.

Given this dynamic, my view on the persistence of industry growth and confidence in AP’s industry positioning and execution abilities overcome the concerns about valuation. Unlike Heinz, this company’s focus remains on the growth potential that lies ahead in the decades to come. It has invested in distribution, brand and capacity and is continually increasing its lead over competitors. The free cash flow for the firm in the next five years could possible double (or more) if demand for property starts to pick up in India. Even when the economy was slowing and inflation was high, AP demonstrated it had pricing power. It continues to toggle between retaining margins and reinvesting in the business. Overall, I do not foresee a fate similar to Heinz. On the contrary, AP’s approach to business might be one that Heinz is forced to veer back towards.