Supportive measures

There are now tangible signs that confidence is slowly returning. The unemployment rate for Europe as a whole peaked in mid-2013, and, while still at elevated levels compared to historical averages, has begun to move downwards. From a low point in 2013, growth in new car sales is now firmly back in positive territory - job security makes a new car purchase a far easier decision. This return to confidence should have positive knock-on effects across the economy.

Growth is still fragile, however, and in early June, the ECB announced a package of monetary policy measures. These included cuts to interest rates and a new funding scheme for corporate lending - the Targeted Longer Term Refinancing Operations (TLTRO) - that should help to move growth up a gear. Key to its success may be the strength of the euro: the ECB will be hoping that the euro weakens and thus aids exporters.

One of Europe's strengths remains the capacity for companies in the region to be global leaders. Such companies include Roche, the Switzerland-based leader in oncology and haematology, and Continental, the German tyre and automobile components manufacturer, that is at the forefront of hydraulic brake systems. The global reach of European companies and the breadth of their sources of revenue allow European equity portfolios to be adjusted towards companies with exposure to those regions with the most compelling opportunities. In the past, this has meant exposure to emerging markets but more recently developed markets, including Europe, have become more important.

Rewarding stockpicking

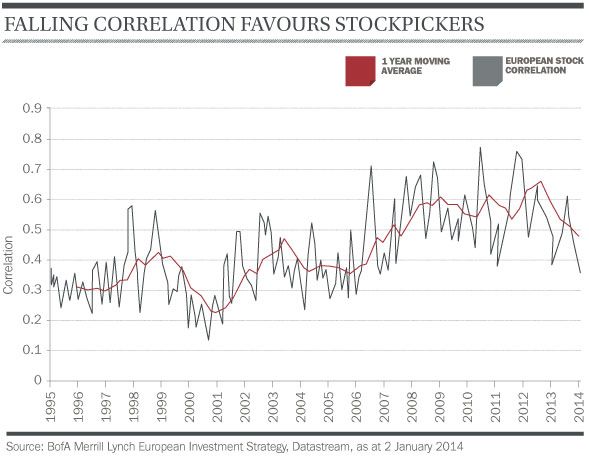

Since the financial crisis, Europe has seen a rise in the correlation between the winners and losers of the equity markets, with good stocks and bad stocks moving more in unison. This reduces the value that fund managers can add through strong stock selection. However, this trend has reversed since late 2012, with correlations falling, creating better conditions for active managers to outperform through good stock selection.

The lower correlation is understandable. As the crisis recedes, less attention is paid to the macro picture and more focus is given to corporate fundamentals, not the least of which is earnings. The re-rating in European equities has so far been driven by 'price' in the price to earnings (P/E) ratio, but we have yet to see the highly anticipated growth in earnings that would justify further gains. Earnings growth disappointed expectations in 2013, and the market will be heavily driven by whether the optimistic estimates for 2014 and 2015 (Citi consensus estimates at 8 per cent and 13 per cent respectively) can be met.

John Bennett is Director of European Equities and Manager of the Henderson European Focus Fund and Henderson European Selected Opportunities Fund.