Emerging market equities have underperformed developed markets by a further 5.5% so far in 2015, according to MSCI indices. The price to book ratio of the MSCI Emerging Markets index stood at 1.55 at end-June versus 2.24 for the MSCI World index of developed markets – a 31% discount, the largest since 2003. Is it time to increase EM exposure?

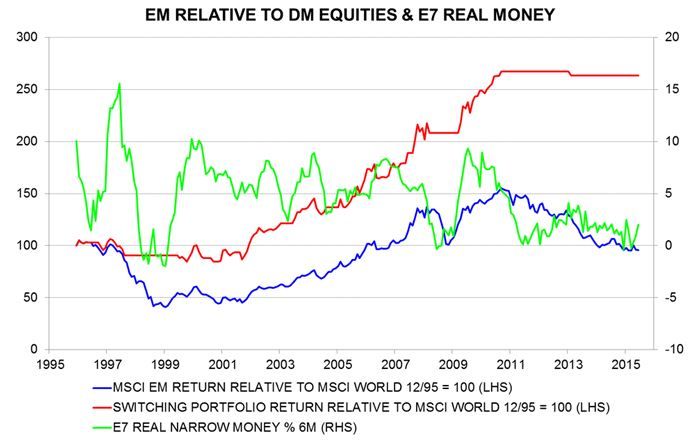

Emerging equities have lagged since 2010, when six-month real narrow money growth in the “E7” large economies fell sharply to below its 1996-2009 average of 5.5% (not annualised) – see first chart. This slowdown signalled that economic prospects were deteriorating at a time of exuberant sentiment towards EM – the MSCI EM index reached a peak price to book premium to MSCI World of 18% in 2010 while 98% of global fund managers polled by Merrill Lynch claimed to be overweight.

E7 real money growth recovered modestly in 2012 but remained below the historical norm and fell away again in 2013-14. Fund managers, meanwhile, have filed for divorce – a net 20% are now underweight, representing a 1.9 standard deviation shortfall from the long-run average, according to ML.

Previous bouts of underperformance in the late 1990s and late 2000s were also associated with a sharp decline in real money growth to below average – first chart.

A simplistic strategy that would have worked well would have been to invest in emerging markets when E7 six-month real money growth was above 4% and had not fallen by more than 2 percentage points over the last six months but revert to developed markets if either of these conditions was no longer met. Such a strategy would have outperformed a passive investment in EM by a cumulative 176% between end-1995 and end-2014, or 5.5% per annum – first chart.

E7 six-month real money growth has recovered recently but remains weak, at an estimated 2% in June. It may be advisable to await further improvement before increasing EM exposure.

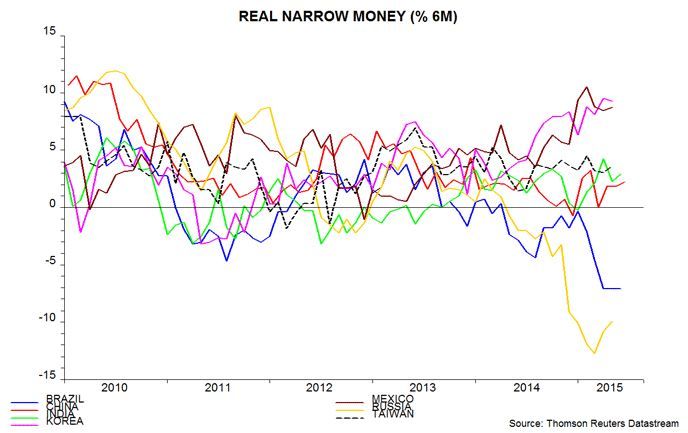

How likely is a further pick-up? The second chart shows real money trends in the individual economies. The E7 aggregate has been suppressed by significant real money contraction in Russia and Brazil; a recovery in these two economies, where interest rates have respectively fallen and stabilised, could be sufficient to lift the E7 measure to the 4% “buy” level.