Tempting yields

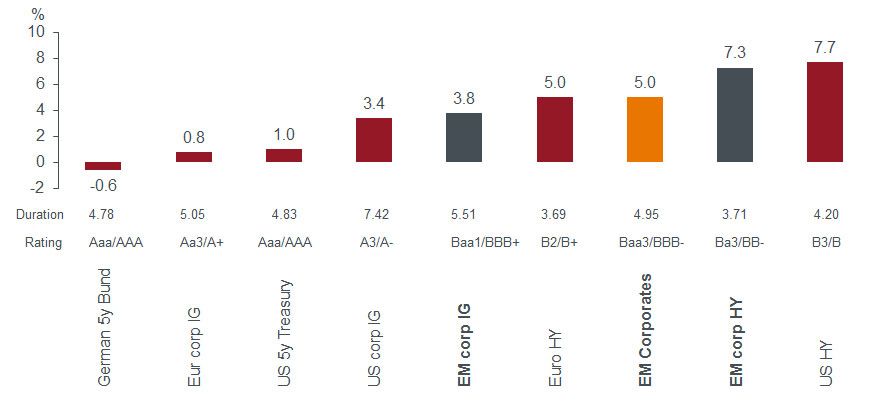

Emerging market corporate bonds provide investors with higher yields, and yet, from a better rated asset class than the high yield markets of the developed world with around 65% of EM corporates currently rated investment grade. As at the end of June 2016, emerging market corporate bonds (the orange bar on the chart below), with an average rating of low BBB, were offering a yield of 5%; the same as that offered by European high yield bonds with an average rating of B2/B+ (according to JP Morgan indices).

Fig 1: Yield to maturity on fixed income asset classes

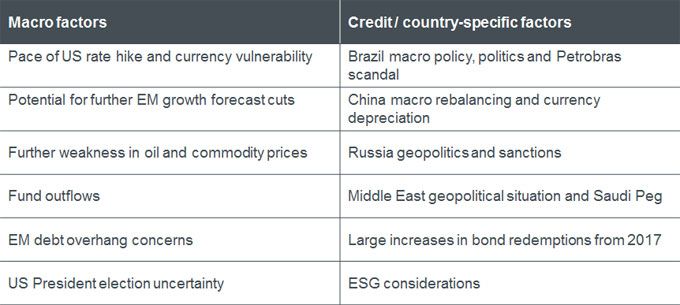

As ever there are always a number of key risks and considerations that must come into play when formulating a top-down view of emerging markets. Our style can be considered as a blend of top-down and bottom-up: our emerging market credit analysts review and analyse individual corporate issuers but the timing of the investment in any of these names is informed by our top-down view of the world. The chart below highlights our current key concerns and considerations.

Fig 2: 2016 key risk considerations

The most pertinent recent country-specific factor is of course Turkey and the failed coup on 15 July. Within our portfolios we were market weight Turkey on a duration times spread (DTS)* basis going into the weekend when events unfolded. We reviewed our positioning as a result of the political developments and the unexpected S&P downgrade on July 20**, and have since been adding to our Turkish positions. The rationale behind our thinking is that Turkey’s government debt to GDP ratio is low (about 35%), the banking system is healthy (3.3% non-performing loan ratio), growth rate is relatively strong (3.5%) and the budget deficit is low ( 2.4%), while Turkey has a strong track record of servicing its debt. Additionally, Turkey’s corporate bond issuers’ net leverage is small and we believe their refinancing risk is also low. The strong technicals of the wider EM market will likely support Turkish bond valuations, and as such we started to build up positions in the names that we think offer relatively better downside protection at current levels and can benefit from a rally in short term.

A working example: Koc Holding

Investment grade Koc Holding’s bonds are down in price by as much as nine percentage points in the aftermath, which we believe to be overdone. Koc Holding is Turkey’s largest industrial and services group in terms of revenues, exports, employees and taxes paid. Its revenue is about 8% of Turkish gross domestic product (GDP) and its export is 9% of total Turkish exports. The company is a well-diversified business operating in finance, automotive, consumer durables and energy sectors and has been trading in Turkey since 1926 under the Koc family ownership, with a net cash position at the holding company level. We think Koc’s credit profile will be relatively resilient to the heightened political risk and the bond is cheap at current levels for an investment grade company with no net debt.

The Fed element

A key macro concern of the last two years has been the pace and path of US Federal Reserve (Fed) interest rate rises. We believe that the Fed’s 25 basis points interest rate hike in December 2015 has now completed this rate hiking cycle. But even if our assumption is incorrect and the Fed does resume interest rate hikes, what will the effect be on the credit market? We believe that since terminal rates are unlikely to be more than 1%, any impact of Fed rate rises on the credit market will be minimal and that investors will continue to look for yield. And where is yield? In emerging markets credit.

We repeat: it’s not a homogenous market

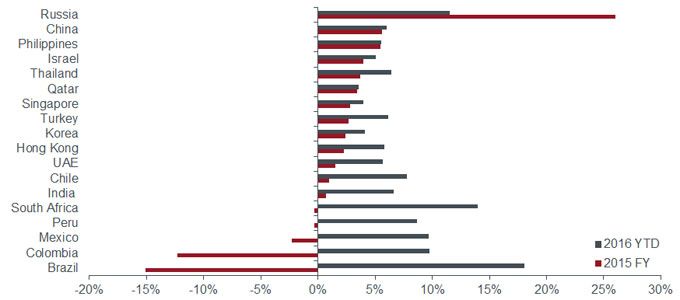

The last two years have proved that our investment philosophy — that emerging market countries no longer trade in a homogenous way — has never been more key. The dispersion of returns by country has never been larger. The chart below shows how over the course of 2015 Russian corporates, which had been one of the largest underperformers in 2014, produced the strongest returns, while Brazilian names were the worst performers. On the flip side, Brazilian credits have performed very strongly in 2016 year to date.

Fig 3: Broad major countries’ return

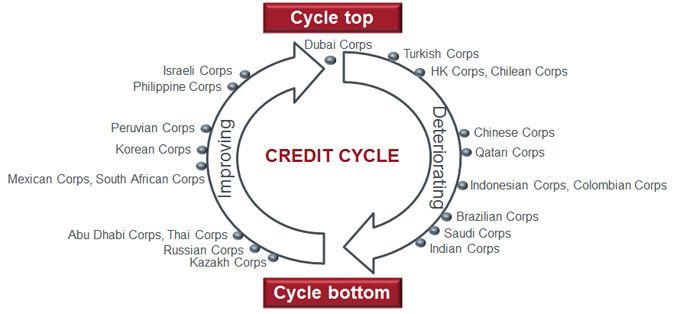

As always it is important to understand where different parts of the emerging market credit universe sit on the credit cycle. The chart below gives our current view.

Fig 4: EM Corporates credit cycle

It is worth highlighting that even within geographic regions, the credit cycles are at different points. For example in Asia, Thai credits are very early in the credit cycle, with Korea and the Philippines approaching the cycle top. Hong Kong, China, Indonesia and India have passed the peak and are progressing towards the bottom of the cycle.

In summary

Emerging market credit has benefited from both a risk-on mode of late and the continuing search for yield. With global interest rates expected to stay low or even move lower, the relatively high positive yield differential offered by EM corporate bonds will likely gain in appeal in the absence of alternatives elsewhere. With geopolitical events stirring in the background, a window of opportunity seems to have opened now, which we intend to fully utilise.

**S&P credit rating agency downgraded Turkey’s long-term sovereign foreign debt from BB+ to BB with a negative outlook