Why have EM corporate bonds rallied so strongly?

The simple explanation: it is due to a lack of supply of available paper and an unprecedented structural, rather than cyclical, demand for EM corporates. In a world where interest rates and global bond yields look set to stay lower for longer, emerging markets corporates can deliver yield and diversification in a US dollar-based format. EM corporates as a whole yield 4.5%**, while EM investment grade corporate bonds yield 3.6%**. These yields look very attractive when compared to developed market investment grade bonds. We know that Asian investors have sought out US dollar-denominated investment grade bonds, and we believe that they have bought not only developed market but also emerging market debt. European asset allocators are also switching out of the euro into US dollar-based markets.

The turning of the tide?

After seven strong months of returns for EM credit, recent days have produced weaker price action. We believe this weakness stems almost entirely from the government bond market. Volatility and term premia have been crushed this year, which has led to high correlations across G7 bond markets. Thus a small change in sentiment in any G7 market can be amplified across them all.

A rise in European, Japanese and US government bond yields — due to concerns over the continued usefulness of quantitative easing (QE) in Japan, the less dovish rhetoric in Europe and strengthening US data — has recently led to a general risk-off sentiment. We believe this move is a buying opportunity, particularly in Latin American long-dated investment grade corporates.

Risks to watch in Q4

A rise in US interest rates is certainly one of the key threats facing EM corporates. It will create volatility in the US currency and a corresponding rise in market risk levels, which would negatively impact both commodity and oil prices, as well as the broader EM market. Furthermore, since more than 60% of EM corporates are investment grade, their returns are allied to duration (interest rate sensitivity); much more than the lower yielding, high yield markets in the developed world.

We believe a rate hike is possible in December, however just as likely is the realisation in 2017 that the last rate hike in December 2015 was a policy mistake. The US presidential election in November also poses a pivotal risk, particularly for Mexico. The election carries a great deal of uncertainty both in terms of who wins the presidency and what the post-election policies mean for EM. A Trump victory would surprise and disrupt markets, which would undoubtedly, negatively, impact EM. However, we believe this would represent a buying opportunity as there will be a realisation that much of the rhetoric will not lead to material policy change.

The fundamentals picture

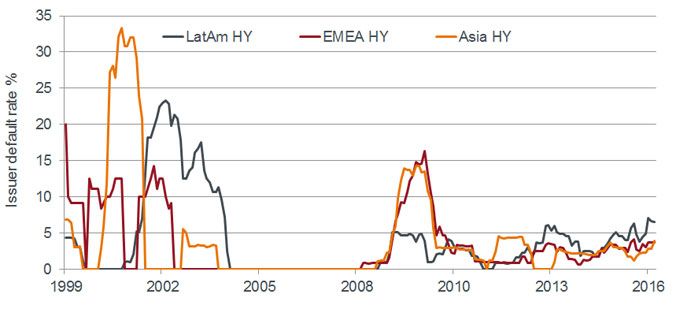

EM default rates have risen in 2016 but the increase has taken place almost exclusively in Latin America. Trailing 12-month defaults are currently running at 3.5% globally, but at 5.5% in Latin America. We expect this trend to continue, with Latin American, especially Brazilian, corporates dominated by the commodity and energy sectors. Asian defaults are also expected to stay low as Chinese companies focus on the domestic market for their financing needs.

Figure 1: a fairly benign default backdrop

That said, technical conditions in EM corporates continue to remain supportive and dominate market movements. Contrary to the rapid expansion of the asset class earlier this decade, foreign currency-denominated debt issuance currently remains subdued in EM. According to Bank of America Merrill Lynch, the trailing 12-month net supply in EM investment grade market is low, while net supply in high yield is negative. JP Morgan also estimate that more EM companies will pay off their foreign currency debt this year than they would borrow.

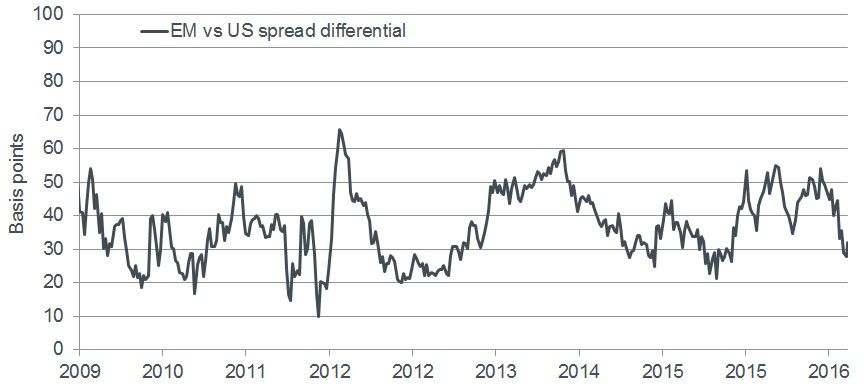

Figure 2: Diminishing supply of EM corporate bonds

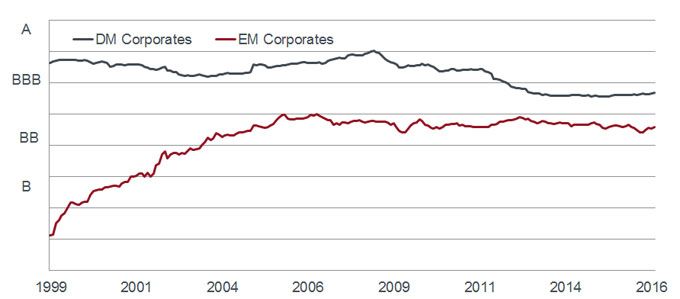

Global bond yields are low and emerging market corporate bonds are no exception to the rule. Compared to historical levels, the spread between developed and emerging market corporate bonds looks stretched (as shown in figure 3); however, the composition of EM corporate bonds has steadily improved over the last 10 years as figure 4 shows, which is in contrast to developed market corporate bonds.

Figure 3: the narrowing of divergence in spreads

The Henderson Horizon Emerging Market Corporate Bond strategy is currently defensively positioned with a neutral stance to the index. We are relatively cautious on the outlook of EM credit for the remainder of the year and believe it is likely that intermittent rises in volatility (albeit from historically low levels) will occur at various points, which could lead to some degree of repricing in EM credit. However, the cause of any instability and when it may appear is unpredictable.

Summary

It seems unlikely that the unprecedented strong returns year to date will continue into the year end and the weakness of the first half of September has served as a timely reminder. We view current weakness as a likely buying opportunity in selected names rather than a cue for further derisking, since we are conscious of the support of central banks for global bond yields.

We would expect to see coupon-type returns from here, although we remain cognisant of the risks that could lead to sudden increases in volatility. It is also possible that an unforeseen global or EM event arises, raising risk levels. However, in the near term the technical conditions remain favourable and continue to be the central factor driving movements in credit spreads.

Steve Drew, Head of Emerging Market (EM) Credit, Henderson Global Investors

*JP Morgan, Henderson Global Investors, as at 31 August 2016

**JP Morgan CEMBI Monitor, August 2016