"Top-down, bottom-up, value, growth, momentum, quality, size… the choice of factors for investors seeking alpha is seemingly endless, and recently has been complicated further by the number of new offerings from ‘smart beta’ or the ‘factor zoo’. Each investment approach has its merits, although all are dependent on either the skill, or luck, of the fund manager(s) and/or whether the underlying market conditions favour their approach. But what if there was a different way to invest? One that aims to produce long-term alpha, but is not based on forecasting stock returns, or making asset allocation decisions based on fundamentals and/or factor models?

Intech – an independent subsidiary of Janus Henderson Investors – believes that the answer lies in advanced, but well-established, mathematics. It embraces an investment philosophy grounded in observations, not expectations, and therefore does not rely on subjective forecasts of markets, factors or company performance. Intech uses mathematics and systematic portfolio rebalancing in an attempt to harness a historically reliable source of alpha – volatility. Intech’s founder, Dr E. Robert Fernholz, first demonstrated in a 1982 academic paper that maintaining a portfolio’s diversification by regular rebalancing generates a return premium. Buy-and-hold portfolios, such as index trackers or other infrequently reconstituted portfolios do not capture this rebalancing effect efficiently.

Using this academic foundation, Intech’s approach is to estimate relative share price volatility and correlations, optimise a portfolio based on these estimates to determine target weights, and then rebalance regularly in order to capture alpha and control risk. This rebalancing has a ‘buy low, sell high’ character, selling recent winners and reinvesting the proceeds in recent losers.

For investors seeking a broad range of return drivers, Intech’s approach could appeal on two levels:

- The process has been shown to provide alpha over the long-term, in a wide range of market conditions

- The pattern of excess returns has historically been lowly correlated to its peers

To demonstrate the diversifying benefit of adding an Intech fund to a portfolio of European funds, the Janus Henderson Intech European Core Fund has been included in a simulation with its Morningstar peers.

We performed the following experiment. From a universe of 55 comparable European equity funds in the Morningstar database, we used a Monte Carlo simulation to create portfolios of three randomly selected funds (not including the Intech fund). We measured the performance and risk statistics of each three-fund portfolio, and repeated until we had generated 10,000 three-fund portfolio combinations. For each of these three-fund portfolios, we then randomly replaced one of the funds with the Intech fund, and compared the performance and risk of the new portfolios against the originals.

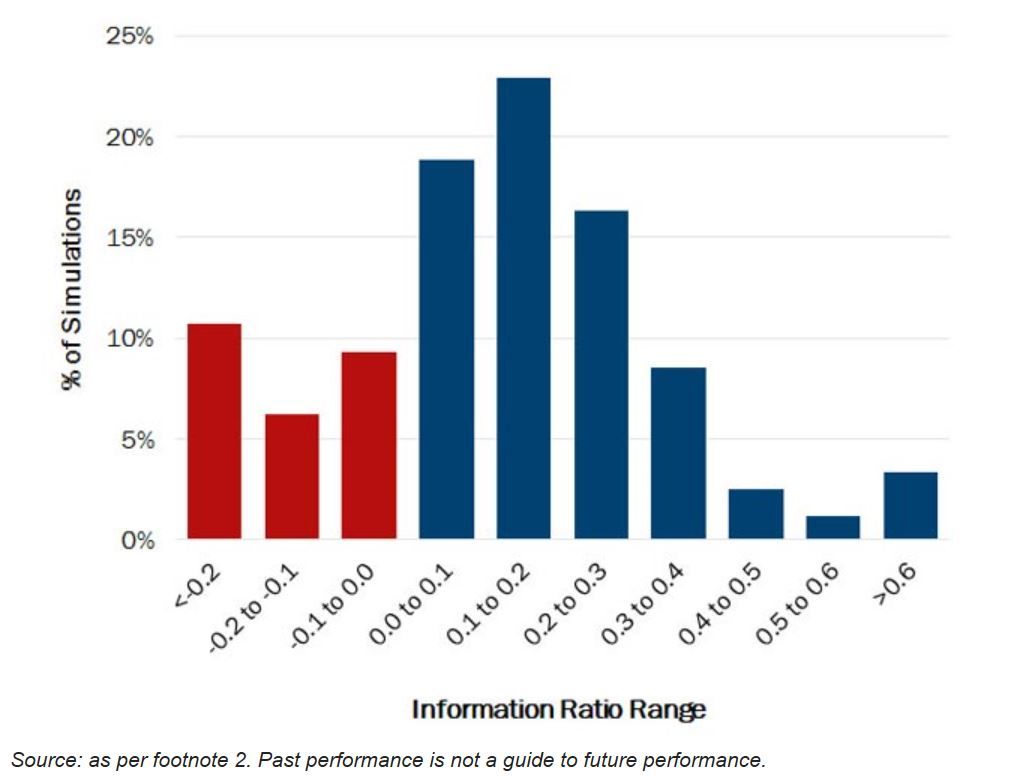

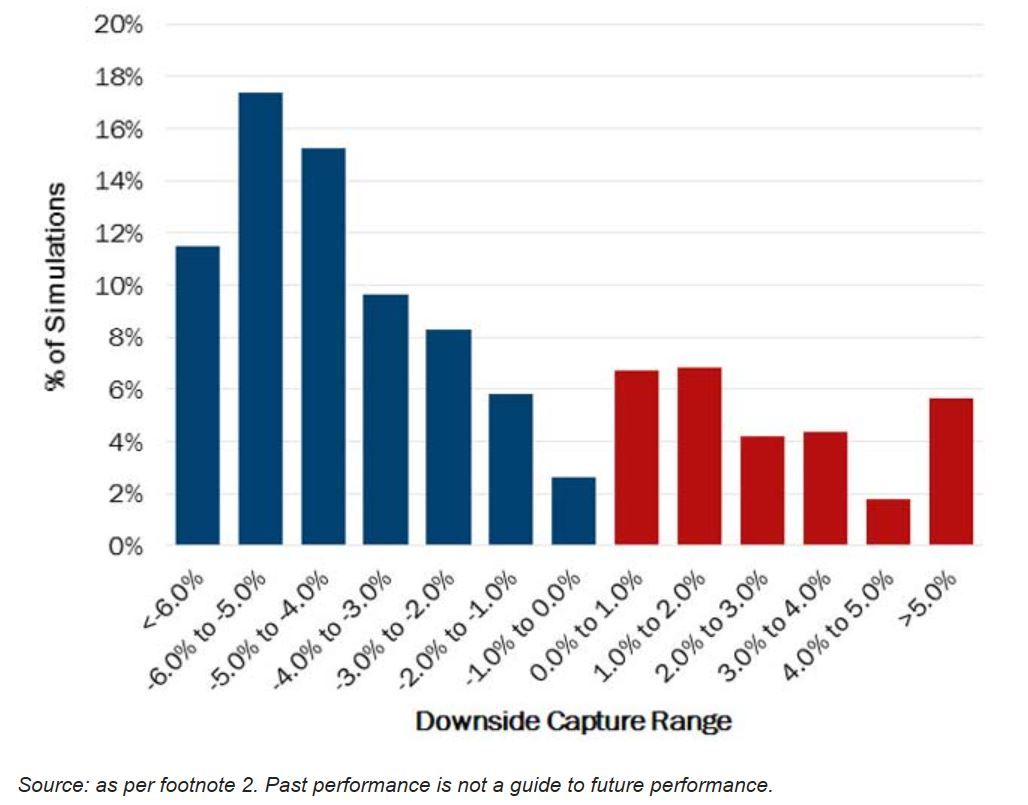

The results of the experiment can be seen in the following charts:

Excess return: in 69% of cases (that is, c.6,900 of the 10,000 portfolios) the excess return of the three-fund portfolio was increased by including the Intech fund.

Tracking error: More importantly, due to the low correlation of Intech’s alpha source to more traditional approaches, the tracking error of the three-fund portfolio was decreased by including the Intech fund in 95% of cases.

Information Ratio: This increase in excess return and decrease in tracking error resulted in an increase in Information Ratio in 74% of the 10,000 simulated combinations.

Downside Capture: And finally, demonstrating that the Intech approach seeks to outperform in a wide range of market conditions (including down markets), the downside capture of the three-fund portfolio was reduced in 71% of cases through inclusion of the Intech fund.

This experiment shows the risk-adjusted return enhancement and diversification benefits that the Janus Henderson Intech European Core Fund would have delivered to investors since launch (to 31 October 2017). In our view, the results demonstrate the potential value of the fund as part of a European strategy blending manager styles, but also the attraction of the fund as a standalone ‘core’ European equity holding."

Adrian Banner, CEO und CIO, INTECH