A vetoed appointment

The latest news from Italy is that President Sergio Mattarella has vetoed the appointment of eurosceptic Paolo Savona as finance minister in the government that the anti-establishment Five Star Movement (M5S) was trying to form with the anti-euro, anti-immigration Lega (League) party. In response, the two parties have abandoned their attempt to form an alliance. Italy has now been without a government for 85 days, a new post-war record. The most generous diagnosis of the situation here is that the country has slumped into a, now familiar, state of political paralysis. Italy has, after all, had 90 governments in 116 years. A less constructive interpretation is that the country is in the midst of a serious constitutional crisis, with potential for spilling over to the broader eurozone. The President has appointed Carlo Cottarelli, a former International Monetary Fund (IMF) official, as caretaker prime minister, with the aim of forming a non-political, technocratic government to steer the country through its budget later this year and to elections after that. However, it seems unlikely that Parliament will give Mr Cottarelli the support he needs when the vote of confidence takes place in the next few days. In that case, his administration will probably just form a bridge to a new election, which looks set to come as early as September.

Impeachment could be sought

Before that, as reported in recent days, it is possible that M5S will attempt to seek impeachment of President Mattarella, on the grounds that he has overstepped his mandate in blocking the appointment of Mr Savona. The level of political energy on this topic is undoubtedly very intense, but it is worth noting that the Italian constitution sets the bar high for success on this front. Instead, the prospect of elections and the inevitable party-political manoeuvring in the run-up are likely to be the main focus for financial markets in the months ahead. Of course, at this stage, the outcome is very hard to call. The populist parties will aim to effectively turn the election into a referendum on Italy's euro membership. Any evidence of a further swing towards these parties would undoubtedly rattle financial markets. Back in March, M5S had almost 33% of the vote and the League had 17%. Their collective vote share will tend to be seen as a barometer of the anti-establishment and eurosceptic movement, but the picture is complicated by the role of Silvio Berlusconi’s Forza Italia. That’s because it is not obvious whether Lega will campaign in a right-wing coalition with Forza Italia, as it did in March, or run in an anti-establishment alliance with M5S. To the extent that Berlusconi would be seen as a moderating influence, the former would be much preferred by investors over the more worrying prospect of a strengthened Lega-M5S pact.

Collision course?

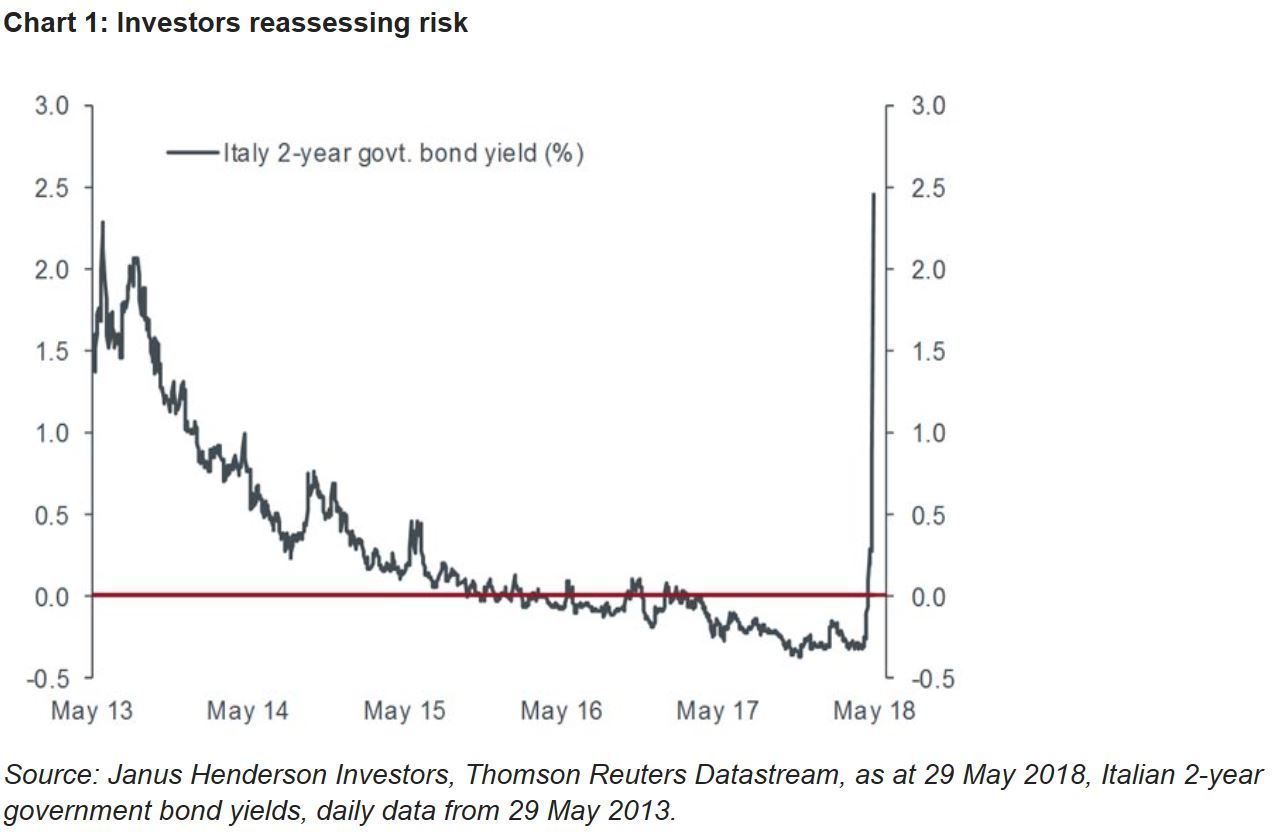

These political developments have done little to alleviate fears that Italy is now on a collision course with both the European Union and financial markets. A highly visible power struggle between the establishment and the populists looks set to run all the way until the autumn election. Developments here will remain a potentially significant source of market uncertainty throughout then, with investors watching not only the polls but the inter-party horse-trading as well. At this stage, markets are viewing the Italian situation as just another catalyst for a rational repricing of risk in financial markets – a global theme for 2018. It does, however, have the potential to turn into something more sinister as Italian government bond yields surge (see chart). We intend to watch this one closely.

Weitere beliebte Meldungen: