Much has been written about WeWork, usually centred on the company’s valuation and business model. We would like to consider what impact WeWork is having from a real estate perspective and ask does WeWork, well, work?

What is WeWork?

First and foremost WeWork is a shared office space provider. The company set up its first shared space in 2010, and has since expanded rapidly to lease space in over 250 locations in more than 20 countries, managing over 10 million square feet (sqft) of office space.

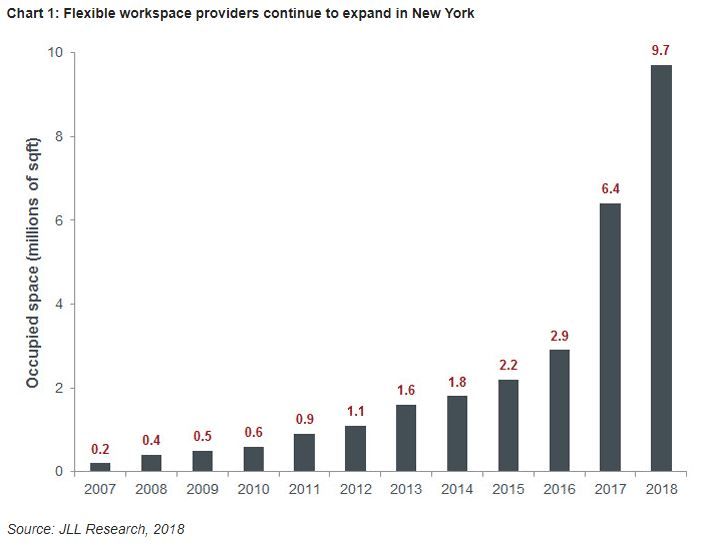

Shared office space is not a new concept. The idea of buying wholesale (from a landlord), subdividing the space and then selling it retail – to individual or corporates who requires extra space – has been around for some time. The idea of flexible workspace, however, has increased significantly since 2007 – see chart 1:

What is new?

If you were to ask certain people in the industry what is different about ‘flexible’ workspace providers, they would probably say “not much”. Sceptics such as Sam Zell, Chairman of Equity Group Investments, maintains there is little new in this business model that has not been done before.

What is the real estate view?

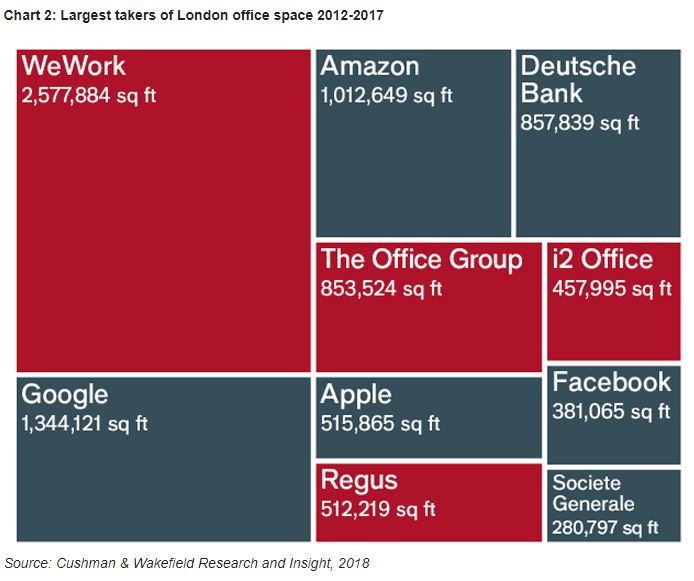

According to global commercial real estate services company Cushman & Wakefield, WeWork is currently the largest private office occupier in central London (see chart 2), and the second-largest private office occupier in New York. More recently, it has bought buildings in both cities. So from a real estate perspective, WeWork’s impact is mostly as a tenant rather than owner.

So does having WeWork as a tenant impact the valuation of that building?

Given the asset/liability mismatch between the short-term subleases WeWork offers its clients and the long-term lease obligations it enters into with landlords, investors in buildings occupied by WeWork have typically required a higher return to compensate them for this additional risk, resulting in lower valuations for these buildings.

However, the high spec and service level offered to WeWork tenants is already putting pressure on traditional office landlords to up their game. This is likely to increase capital expenditure spend for office building owners that want to offer a competitive product; after all, free breakfast clubs entitled “Thank God It's Monday” and yoga classes on “Wellness Wednesday” do not come cheap.

What are the risks?

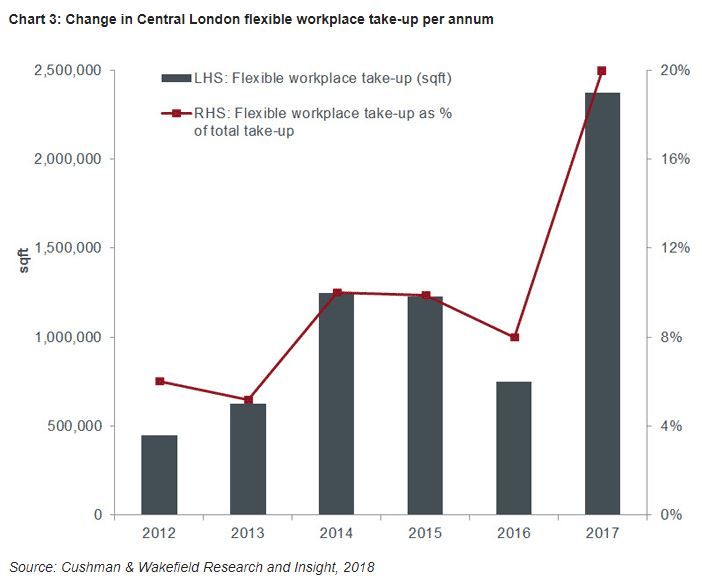

WeWork does not own most of its space. It takes long-term leases with landlords. This means it is liable for rental payment regardless of the health of the underlying tenants. This liability mismatch is key. One reason WeWork’s tenants are prepared to pay more rent than they would in a traditional lease is for this very reason – they value flexibility, as illustrated in chart 3. This is not necessarily a negative. Some business will no doubt grow and require more space, but the failure rate for start-ups is notoriously high and with leases starting from one month, it is easier to ‘hand the keys back’.

So what is WeWork worth?

Why is a company that is currently loss-making valued at $20bn? Clearly investors believe the business is worth more than the sum of its parts. A recent article in the Financial Times looked at trying to ‘fill the valuation gap’, with interesting results. Valued on the same metrics as IWG, a flexible work space competitor, it would be worth less than $3bn.

Indeed, IWG is an interesting case study. In 2003, following the bursting of the dotcom bubble, they filed for bankruptcy. The liability mismatch between long leases at higher fixed rents versus shorter-term lower market rents was ultimately their undoing when market rents and demand for space rapidly fell.

So does WeWork work?

WeWork has had a positive impact on small companies, helping them to reduce costs and grow faster by offering highly flexible accommodation and facilitating connections to other businesses and entrepreneurs. As a prolific taker of space in office markets globally, WeWork’s short-term impact on real estate owners has been positive. Only time will tell if WeWork is a tech company, an ‘asset light’ real estate business, or somewhere in between. One thing that is not in doubt is the impact of companies like WeWork on the real estate sector is only likely to increase, for better or for worse.

Tim Gibson and Guy Barnard, Co-Heads of Global Property Equities, Janus Henderson Investors

Weitere beliebte Meldungen: