Emerging markets have had a particularly nasty run of late as shown in the chart below. The narrative around emerging markets has recently shifted from one of concern regarding the impact of US rate rises to now concerns over China. The Chinese economy is undoubtedly slowing; this has been commonly known for years and the government has been trying to restructure their economy from a high-growth, export-led model to a lower growth, but more sustainable, consumption-led economy.

What has changed now? Well, not a great deal in our view. It feels that market participants have begun to respond to news that should not actually come as a surprise. The move by the Chinese central bank to devalue the currency on 11 August seems to have been the primary catalyst behind the latest Chinese equity sell-off, with it being taken as a clear signal of a deterioration in the health of the economy.

Looking at China specifically, the inexorable rise of the ‘A’ share market in the first half of this year was widely commented on and broadly dismissed as not being particularly important given that it is nearly entirely a domestically owned market with retail investors who, it is fair to say, have a propensity to ‘speculate’ rather than ‘invest’. The market became incredibly frothy and valuations were completely detached from fundamentals.

The market was in clear bubble territory, and as always, when you get a bubble, it will eventually burst, which the ‘A’ share market surely has. During the sell-off, what has become rather worrying is the response by the Chinese authorities – introducing a raft of measures to underpin the market. As these measures have seemingly failed, the credibility of the Chinese authorities has been called into question.

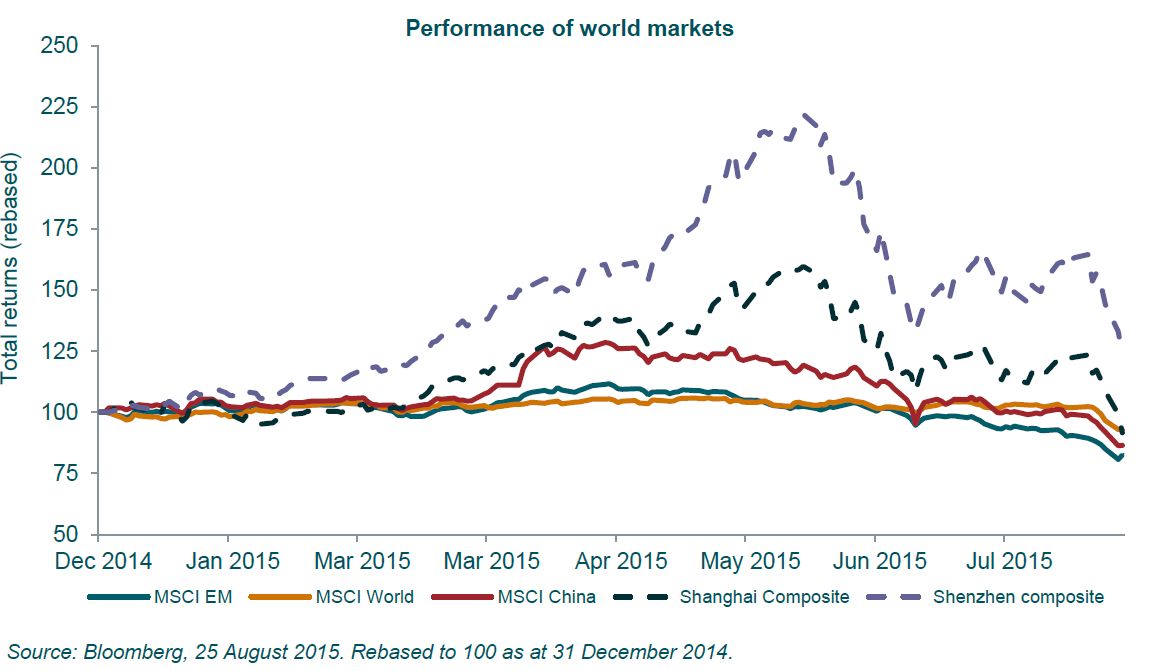

The chart below shows the year-to-date performance of three Chinese indices alongside the MSCI Emerging Markets and MSCI World. The Chinese indices included here are MSCI China (which are ‘H’ shares – Hong Kong-listed and therefore with an international and institutional shareholder base), the Shanghai Composite Index (‘A’ shares, domestic Chinese investors, predominately retail – this index includes the majority of the large Chinese state-owned enterprises) and Shenzhen Composite Index (‘A’ shares again, but a more technology-dominated index, similar to Nasdaq).

Away from China, we have also seen ASEAN markets suffer both falls in equity values and currency, so having ignored them for a long time we are tentatively starting to look again, mainly in Indonesia where areas of the market are beginning to show some value after years of being expensive. In contrast, Malaysia still looks too expensive relative to the fundamentals and quality of companies.

What you can also see is that, despite the very aggressive sell-off in the Chinese ‘A’ shares, the indices are still in positive territory year to date.

Value has begun to outperform growth as a style within emerging markets over the past couple of months, which is rare within the context of a weak market. This suggests that the weakness is causing a sell-off in some of the perceived safer growth or quality names, many of which are both over-owned and showing deteriorating fundamentals that have been ignored for too long. We remain focused on opportunities for companies that would be classed as quality cyclicals (technology, financials) or where we are seeing idiosyncratic improvements (insurance in Korea or Australia for example).

How have we responded to the recent sharp sell off?

Firstly, it is worth re-iterating we are not invested in the ‘A’ share market. In our view, the market looked expensive relative to the quality of company you could buy when we did a project looking at ‘A’ shares in advance of the launch of the mutual market access programme last October (which gave foreign investors access to the ‘A’ shares market for the first time). While the market has collapsed of late, we believe valuations still look expensive, particularly when you take into account the quality of the companies listed in these markets.

The very recent sell-off feels indiscriminate, everything China-related has been sold off from a company, sector and country perspective. We have been using the market falls to add to names where the magnitude of the sell-off in no way reflects any change in a company’s investment case. We have been using those names in the fund that have held up better as a source of cash. Of note, we have been topping up a handful of Taiwanese tech names (notwithstanding the recent China-related concerns, this area had been weak for a month already due to Apple’s results in July showing declining margins and the knock-on effect on their supply chain). In terms of notable names traded very recently, we have been reducing positions in some Korean names (E-Mart, Samsung, Hyundai) as well as Chedraui (Mexican consumer) and Prosegur (Spanish security business with significant LatAm operations) and we have been increasing positions in Taiwanese technology (Casetek, Hermes Microvision and TSMC). While we have reduced some Korean names, it remains one of our largest overweights and we continue to take the view that the rock-bottom valuations do not fairly reflect some decent operational performance and some signs of improving measures towards shareholders such as rising dividends.

We believe this volatility throws up a lot of opportunities. We have long stated that there are a huge range of valuations across our investment universe with the crowded trades (defensive sectors, India, ASEAN) being very crowded and the unloved areas (cyclical sectors, north Asia, Brazil) look relatively cheap. That is even more true today.