Investment Universe, Process, Strategy and Benchmark – How does the Fund Manager invest? (ISIN: LU0167237543)

The BNP Paribas InstiCash funds are liquidity funds which focus on daily liquidity and capital preservation while producing the best achievable money market return to the investor. The fund is not suitable for private investors.

Our Money Market team has adopted a fundamental and risk controlled investment philosophy. We believe that the best way to add value in managing money market funds is through the construction of high quality and diversified portfolios composed of the most secure, liquid and flexible instruments while optimising yield (with a strict focus on risk) so as to provide the best possible money market return.

Our Money Market team has a prudent philosophy with regard to credit and in the case of the BNP Paribas InstiCash fund range, follows minimum credit rating rules imposed by the rating agencies. The team’s prudent approach to credit exposure is demonstrated by our internal diversification rules, which are stricter than those imposed by the rating agencies, so as to minimise the risk of default, downgrade and spread-widening associated with individual issuers.

The BNP Paribas InstiCash EUR fund invests in a diversified portfolio of high quality short-term money market instruments and fixed income securities (treasury bills and notes, commercial papers, certificates of deposit, etc). The fund may also invest in term deposits and repurchase agreements with high quality counterparties.

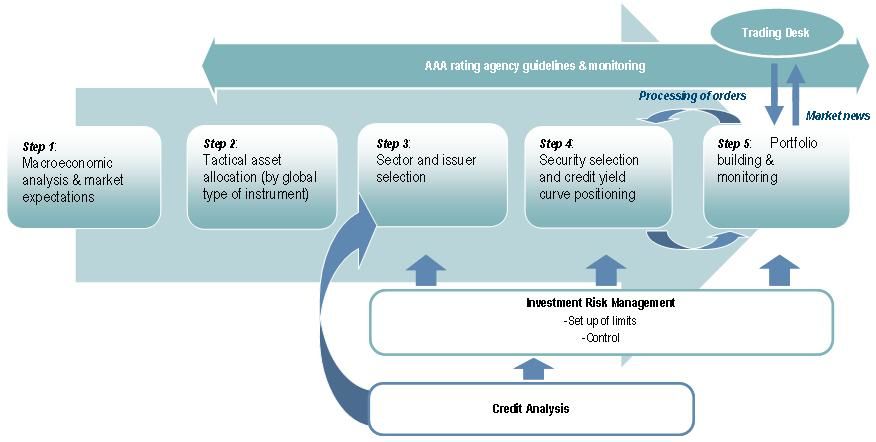

The investment process for the BNP Paribas InstiCash funds is a 5-step top-down process with a primarily qualitative approach and a focus on risk / return optimisation within four parameters: credit risk (principal & interest), liquidity, absolute & relative volatility and yield expectation. We do not choose an issuer for its yield but through a highly qualitative selection process.

• Step 1: Macroeconomic forecasts on the basis of fundamental analysis

Our Investment Strategy team determines the house view on macroeconomics, markets and different asset classes. These conclusions are then discussed by the monthly Asset Allocation Decision Committee which identifies macroeconomic trends and compares them to market consensus.

The Money Market team then adapts the committee’s strategy to the day to day management of the BNP Paribas InstiCash funds, through the monthly Money Market Committee, and when necessary in the course of month. This is done taking into account market considerations such as spreads and market flows, broker information and their own views regarding the macroeconomic environment and scenario.

The money market portfolio managers use multiple sources of information (internal and external research) in order to anticipate the evolution of short-term rates. In particular, they analyse central banks monetary policies and their influence on the overnight rate fluctuations (Eonia, Fed Funds, etc.), taking into account:

• the compulsory reserves of commercial banks

• the central banks bids

• government securities auctions and sales

• the borrowing requirements of firms

These short term macroeconomic indicators guide the money market portfolio managers in the positioning of their portfolios.

• Step 2: Tactical Asset Allocation

The Money Market team builds the global allocation by type of signature (sovereign, corporate, financials), rating quality, country and type of instrument (floating vs. fixed). This allocation is then used in conjunction with the manager’s preferred liquidity positioning (maturity), also based on information on inflow/outflow forecasts, to define an optimal portfolio.

• Step 3: Sector and Issuer selection

The credit analysts perform a qualitative analysis on the issuers’ universe. The conclusions of this analysis are discussed at a weekly meeting and during the monthly credit committee. Fund managers have a leeway in their sector outlooks so that they can be adapted to their own market view while respecting portfolio constraints.

A strict monitoring of issuer selection and the respect of issuer and counterparty limits which have been determined by the monthly Credit Committee (which comprises representatives of the company’s Management Committee, the Risk Management department, credit analysts and portfolio managers), based on fundamental and quantitative analysis, is carried out thanks to an automatic exposure limit system. The limits mainly rely on external and internal ratings as well as maturity variables. This process is fine-tuned on an ongoing basis according to news flows (rating downgrades, spread changes, specific events, etc.).

• Step 4: Security selection and yield curve positioning

Portfolio managers first review the overall risk exposure (limits per issuer, rating, maturity) before optimising risk / return ratio. Once an issuer is selected, the fund manager chooses the credit yield curve segment and the type of issue (floating vs. fixed).

• Step 5: Portfolio building & monitoring

The portfolio is constructed, taking into account the fund’s investment constraints (legal, regulatory, rating agency and internal) relating to authorised instruments, diversification, ratings, maturity and duration. The portfolio is built so as to actively manage the portfolio’s exposure to interest rate risk (duration, yield curve) and credit risk. A key element of the portfolio construction process is the optimisation of the portfolio’s structure, under the responsibility of portfolio managers who also need to ensure a sufficient level of liquidity.

Continuous portfolio optimisation is carried out through the management of in-and outflows, the monitoring of market news and proposals from brokers via the dealing desk.

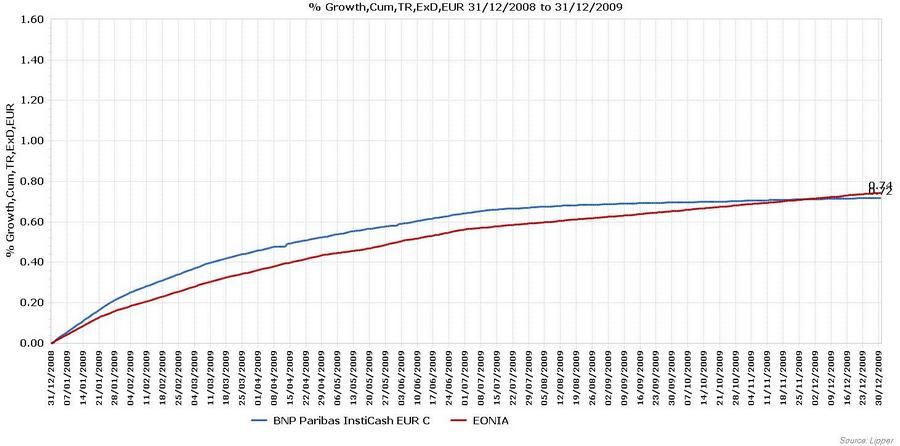

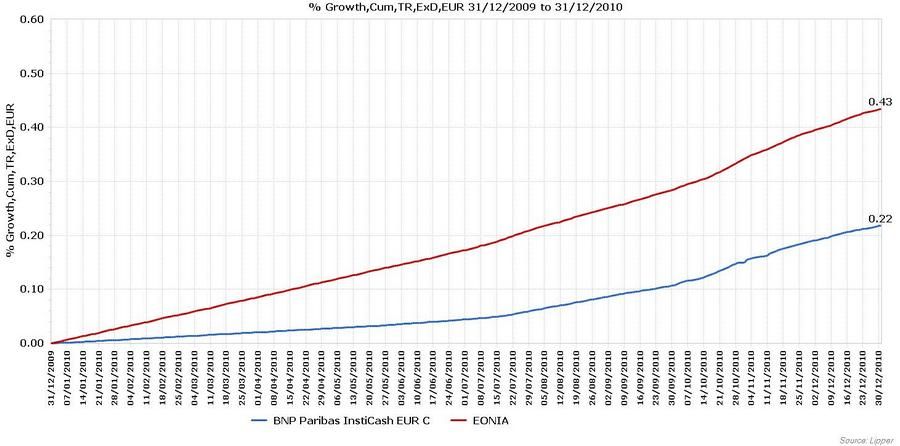

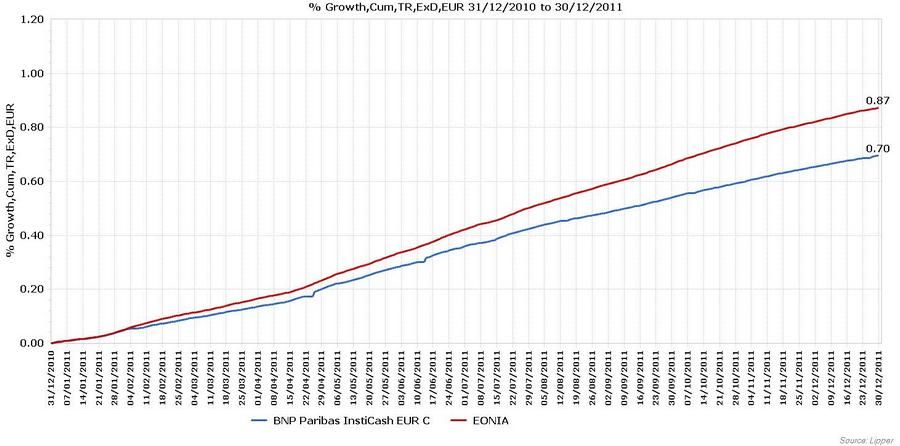

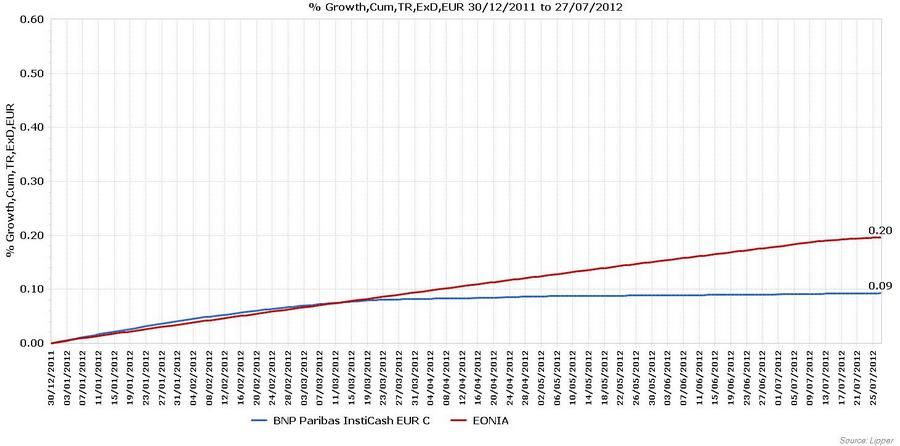

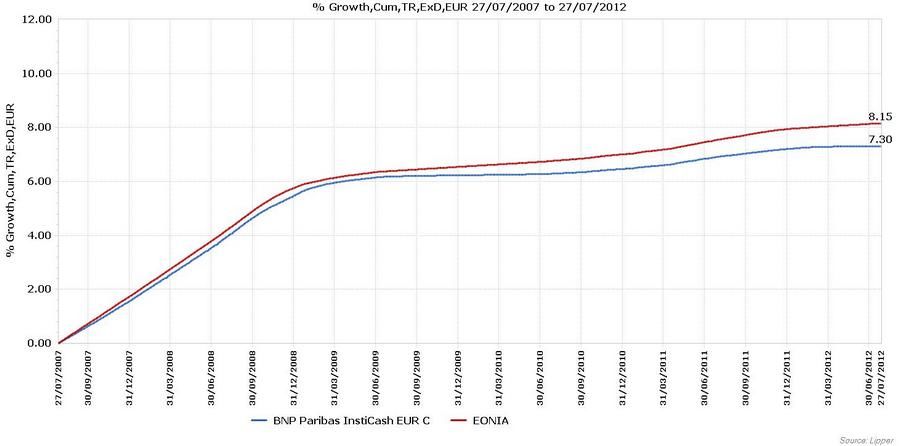

The benchmark is the Eonia (capitalised daily), which is the standard reference for money market funds, especially short-term ones that have a 1-day minimum investment horizon.

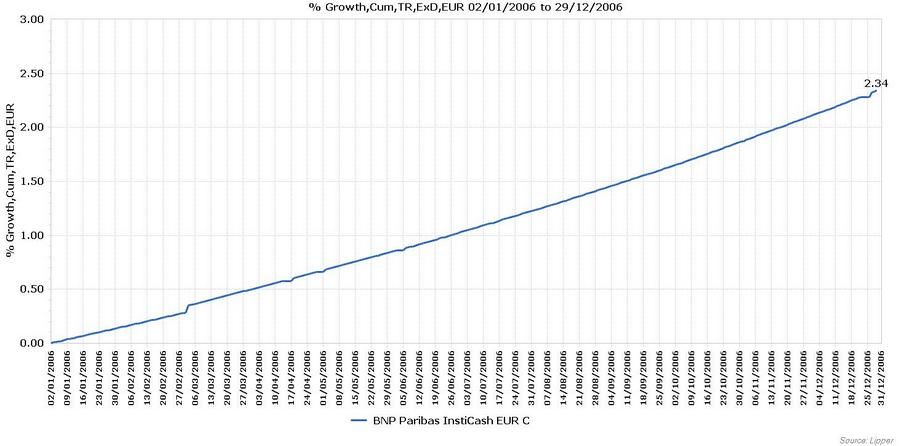

Performance Review 2006

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...

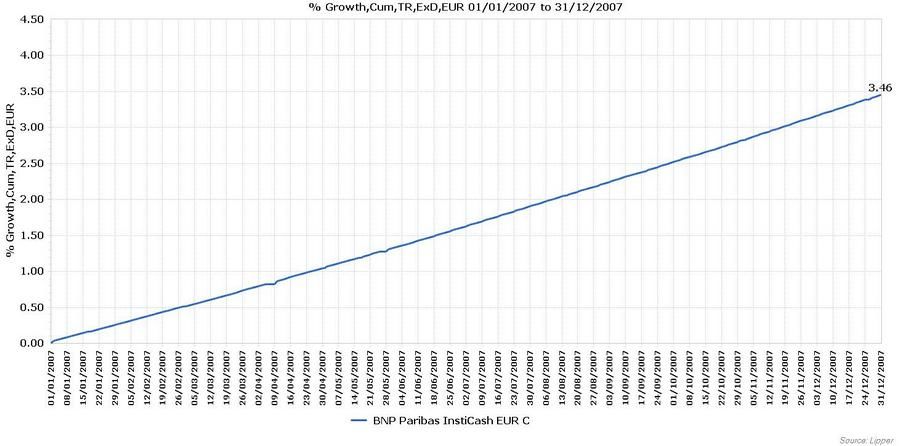

Dominique Leroy: "The fund outperformed its benchmark (gross of fees) over the period thanks to the active management of the investment team, which benefited from both rising and declining rate environments, and from the various periods of positive spreads that were described in previous paragraphs. The portfolio manager also succeeded to “avoid the losers” in his issuer selection process."