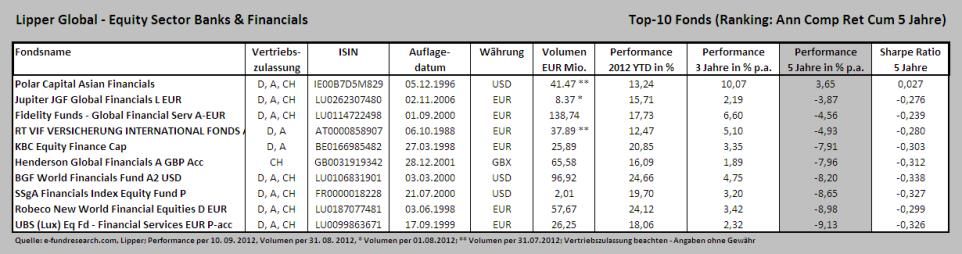

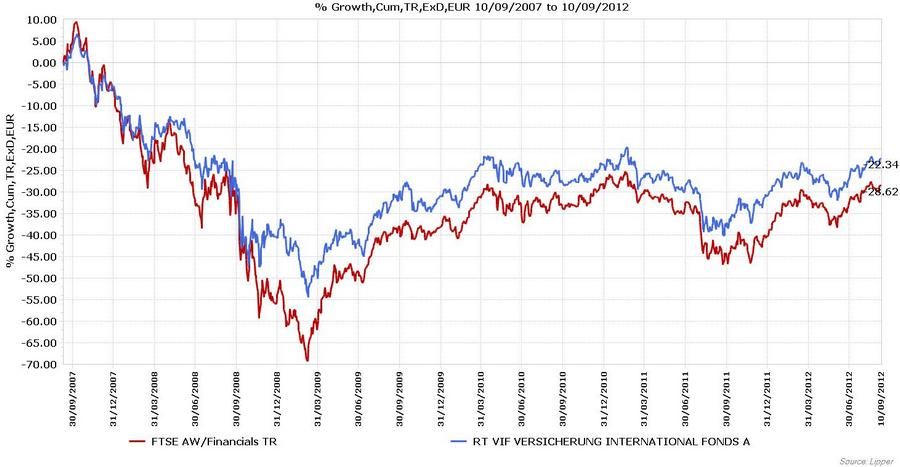

Die obige Tabelle ist eine Darstellung der besten zehn Sektor Banken & Finanzwesen Aktienfonds - gereiht nach Performance 5 Jahre in % p.a. (insgesamt 30 Fonds in der gesamten Assetklasse - Lipper Global Equity Sector Banks & Financials). Die Fondsmanager von Jupiter, Fidelity, KBC, State Street und UBS haben die Fragen von e-fundresearch.com beantwortet. Keine Antworten wurden von den restlichen Top-10 Gereihten zugesandt. Die durchschnittliche Performance der Top-10 Fonds seit Beginn des Jahres liegt bei +18,26 Prozent.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne... e-fundresearch: "What is your current global outlook for the banks & financials equity sector?"

There are a number of areas where I do see a positive outlook within the sector. There are opportunities in selected emerging economies, where debt penetration is very low and there are favourable demographic and policy drivers. The property sector in particular will benefit from low interest rates and also offers asset backing at a time when the value of money is coming under question. And in developed markets positions in niche areas such as mortgage servicing which have gone through significant consolidation are also attractive. So stock picking is very important in this environment.”

Frédéric Jamet, Head of Investments SSgA – France, "SSgA Financials Index Equity Fund P" (ISIN: FR0000018228) (13.09.2012): "Our most probable scenario is a reasonably positive one where the European banks will be sustained by the construction of the European union with no major disruption of the market. As such the financial equity sector seems cheap."

e-fundresearch: "Which are the most important factors currently when you assess banks & financial stocks?"

Sotiris Boutsis, Fund Manager, "Fidelity Funds - Global Financial Serv A-EUR" (ISIN: LU0114722498) (20.09.2012): “I look at key variables such as capital strength and other liquidity metrics. With so many mixed signals in the global macro environment, I also find that scenario analysis is important. This involves looking at potential upside outcomes as well as what will happen to a particular stock or theme should negative scenarios play out. Overall, I have a preference for companies with high levels of profitability and also higher growth characteristics.”

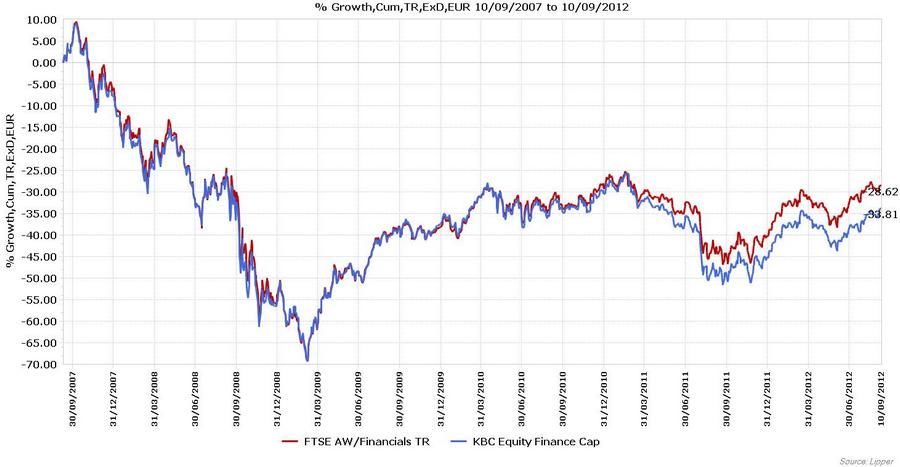

Dirk Sebrechts, CFA, Fund Manager, "KBC Equity Fund Finance Cap" (ISIN: BE0166985482) (17.09.2012): "In terms nough anymore, but has to be coupled with pricing power and earnings potential."

Frédéric Jamet, Head of Investments SSgA – France, "SSgA Financials Index Equity Fund P" (ISIN: FR0000018228) (13.09.2012): "The major factors are the global growth, which is low, the global risk which should be under control, and the current price which is cheap."

Phil Pearce & Zenon Voyiatzis, Fund Managers, "UBS (Lux) Eq Fd - Financial Services EUR P-acc" (ISIN: LU0099863671) (18.09.2012): "Financial services businesses, particularly banks, are highly leveraged plays on macro-economic fundamentals. This means forecast error can be high and ensuring that investments fall the right side of attractive themes is important. We prefer financial institutions with a strong balance sheet and funding position, an element of sustainable competitive advantage and a good management team. Investments should be cash generative and be able to run themselves for the benefit of the equity stakeholder. This leads to a quality bias, justifiable in an environment where the strong get stronger and where classical value often becomes a value trap."

e-fundresearch: "Which regions and/or sectors are currently overweight or underweight in financial stocks? What are the reasons for it?"

Robert Mumby, Fund Manager, "Jupiter JGF Global Financials L EUR" (ISIN: LU0262307480) in his latest commentary: Global financial stocks finished August largely unchanged in euro terms as the rally first initiated in May was countered by disappointing economic news from Europe and China. Nevertheless, the global monetary easing cycle looks to be gaining momentum with the outright monetary transactions (OMT) initiative in Europe and probable QE3 in the US providing support to sector share prices despite a largely deteriorating earnings outlook. The FTSE All World Financials index rose by 0.5% in euro terms whereas the fund declined by 0.25%.

The portfolio continues to favour situations which provide sustainable high returns and in geographical areas of the world and sub-sectors which provide exposure to growth, together with exposure to companies with significant valuation discounts. Emerging market exposure has been scaled back on slowing global growth concerns but we have increased positions in Europe where the risk of a break-up of the eurozone has ameliorated as a consequence of the ECB’s initiative. The fund is also positioned to take advantage of the boom in refinancing as lower funding costs become available as a result of easing measures.

Sotiris Boutsis, Fund Manager, "Fidelity Funds - Global Financial Serv A-EUR" (ISIN: LU0114722498) (20.09.2012): “The portfolio is overweight stocks with above average growth prospects and stronger fundamentals. The stock views drive the sector and geographic positions. This bottom-up process leads me to underweight areas most exposed to the sovereign debt crisis and de-leveraging.

For a long time I have liked emerging markets, but now I am finding that the investment case there is more complicated than in the past and one needs to be incrementally more selective. Specifically, political considerations and policymaker involvement has been a major factor affecting several emerging markets. In terms of portfolio positioning I like Thailand, where consumption and investment are supported by recent pro growth tax and wage initiatives in the aftermath of the floods. I also like credit stories where credit costs will fall over the next couple of years, and asset gatherer franchises with the right footprint that allows them to grow earnings.”

Dirk Sebrechts, CFA, Fund Manager, "KBC Equity Fund Finance Cap" (ISIN: BE0166985482) (17.09.2012): "I still believe that financials Eurozone are attractively priced in the longer run. The second most attractive region is still North America in my opinion, where I prefer the large cap names. In Asia Pacific I have taken a positive stance on Japanese financials, where I see the highst risk/return potential in the region. I'm still cautious on of emerging markets, where I expect valuations to come down furhter in the nearer term."

Frédéric Jamet, Head of Investments SSgA – France, "SSgA Financials Index Equity Fund P" (ISIN: FR0000018228) (13.09.2012): "From an index point of view, no region/sectors are under or overweighted. However when compared with the MSCI world all sectors, it appears that the world financial sector is underweighted in America, neutral in Europe and overweighted in Pacific."

Phil Pearce & Zenon Voyiatzis, Fund Managers, "UBS (Lux) Eq Fd - Financial Services EUR P-acc" (ISIN: LU0099863671) (18.09.2012): "We are underweight banks with a bias towards large, globally diversified and select emerging markets institutions. We avoid many banks facing significant political pressures and cashflow constraints from the need to repair balance sheets and build capital for the new regulatory environment. We are overweight diversified financials, with a bias towards global asset managers. Asset managers are highly cash generative businesses and those in the industry's structural sweet spot stand to do well. Geographically, we like select emerging markets and North America and are underweight Europe, where the banking system suffers from more significant structural and cyclical issues."

e-fundresearch: "Please comment on the performance and risk parameters of your fund in the current year as well as over the past 3 and 5 years."

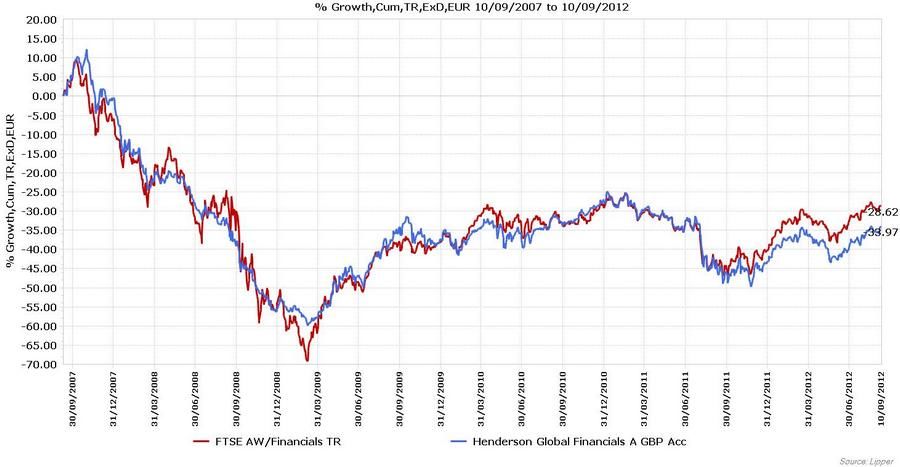

Robert Mumby, Fund Manager, "Jupiter JGF Global Financials L EUR" (ISIN: LU0262307480) in his latest commentary: In the last year, the Jupiter Global Financials fund has returned 12.5% in euro terms compared to 19.8% for its benchmark, the FTSE AW Financials Index, although over the same period the Bloomberg Europe 500 Banks and Financial Services index declined by 1.7%. In the last three years, the fund has returned 3.9% compared to 16.0% for the benchmark.

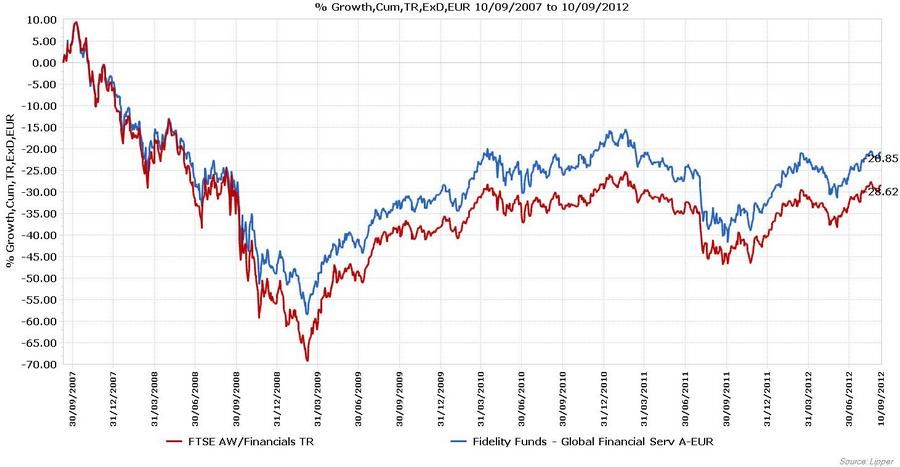

Sotiris Boutsis, Fund Manager, "Fidelity Funds - Global Financial Serv A-EUR" (ISIN: LU0114722498) (20.09.2012): “Since the beginning of the year to 31 August 2012, Fidelity Funds Global Financial Services has returned 16.0%. Over 3 years the fund has returned 19.7% and over 5 years -26.2%, reflecting the impact of the credit crunch years. A key contributor has been the strong performance from property securities, as well as more recently a rally from bank stocks in anticipation of further quantitative easing.

Our risk management comes from a combination of the types of companies we invest into, which are typically higher quality, and also our portfolio construction. We aim for a diversified portfolio and control the amount we allocate to specific stocks and sectors.”

Dirk Sebrechts, CFA, Fund Manager, "KBC Equity Fund Finance Cap" (ISIN: BE0166985482) (17.09.2012): "The performance year to date is very satisfying thanks to our adequate stock selection and allocation. Performance has also been good in the longer run. We invested defensively when the banking crise broke out and invested more in emerging markets. When things improved in 2009, we reversed this defensive stance, and invested more agressively in banks and life insurance companies, the higher beta stocks. In 2001 however, we were caught a bit by surprise by the European sovereign crises and the related salami crash, which didn't help the (relative) performance of the funds. The fund complies with the strict risk parameters that apply to all funds of KBC Asset Management."

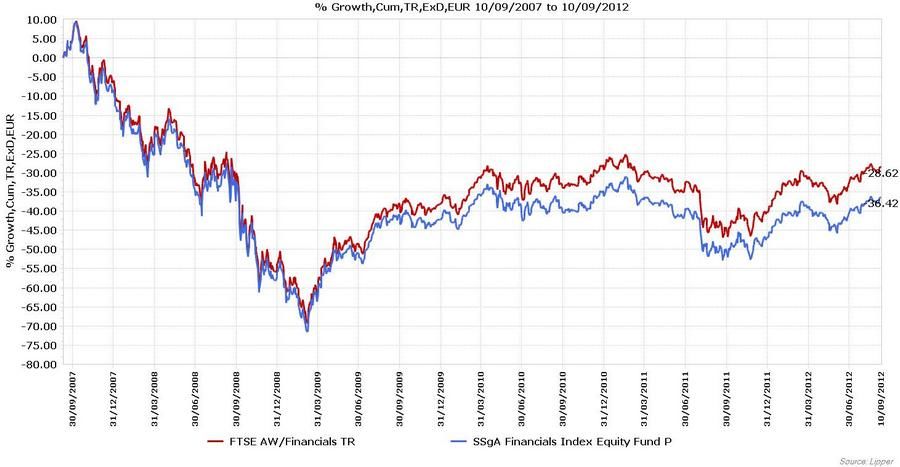

Frédéric Jamet, Head of Investments SSgA – France, "SSgA Financials Index Equity Fund P" (ISIN: FR0000018228) (13.09.2012): "The risk parameters of the fund constraint to a full replication methodology with a target of a minimum tracking error and a performance as closed as possible to the performance of the benchmark. The performance of the fund has been slightly above the performance of the benchmark with an annualized overperfomance of 1.08%, 1.18%, 1.67% over respectively 1, 3, 5 years."

Phil Pearce & Zenon Voyiatzis, Fund Managers, "UBS (Lux) Eq Fd - Financial Services EUR P-acc" (ISIN: LU0099863671) (18.09.2012): "The current portfolio management team has been in place since October 1, 2011. The Fund has returned 16.7% YTD (31 December 2011 to 31 August 2012, net of fees), 1.8% p.a. over three years and (10.2)% p.a. over five years. The Fund is a concentrated portfolio of c.30-35 holdings. Our cautious view is manifest in a portfolio beta relative to the MSCI World Financials Index of 0.9."

e-fundresearch: "Which regulatory changes do you expect in the financial sector within the next 12 months?"

Sotiris Boutsis, Fund Manager, "Fidelity Funds - Global Financial Serv A-EUR" (ISIN: LU0114722498) (20.09.2012): “The trend is clearly towards more regulation, but the specifics are difficult to anticipate as they are often driven by unpredictable political processes. Pressure on capital is a persistent theme, although some aspects of Basel III appear to still be under consideration or open to further interpretation. There is discussion in Europe around banking structures with some advocating a re-introduction of an equivalent of the US Glass Steagall Act in the 1930ies, a law that imposed banking reforms. I believe this is unlikely to happen as it lacks political support in France and Germany, but less dramatic changes may be proposed as a compromise. The implementation of European banking union is also open and will result in a degree of regulatory uncertainty as some rules at least will inevitably have to be harmonised. The US elections are also going to be a factor.”

Dirk Sebrechts, CFA, Fund Manager, "KBC Equity Fund Finance Cap" (ISIN: BE0166985482) (17.09.2012): "The new Basel and Solveny directives will imply stricter regulation for banks and insurance companies. Many banks have been forced to shrink the balance sheet, increase capital and improve their funding profile. Insurance companies have to comply with stricter investment rules. This means that is not very likely that the returns of the heighdays will come back. I expect however that the new directives will not be as severe as the market expects at thjs stage. I also that the sector will ultimately adapt to the new situation."

Frédéric Jamet, Head of Investments SSgA – France, "SSgA Financials Index Equity Fund P" (ISIN: FR0000018228) (13.09.2012): "Two major regulatory changes will probably be the implementation of Basles III which will lead to a more restrictive capital allocation of the banks, and the global control that will be set up by the ECB on Eurozone banks."

Phil Pearce & Zenon Voyiatzis, Fund Managers, "UBS (Lux) Eq Fd - Financial Services EUR P-acc" (ISIN: LU0099863671) (18.09.2012): "For banks, Basel 3 rules governing risk weightings and quality of equity capital should be finalised. We expect one or two addendums to Basel 3 that have the impact of requiring higher levels of capital to back certain business. In Europe, the release of the Liikanen report in the fourth quarter will direct the debate for the coming year and may require European banks to ring-fence certain assets as per UK regulation. Our hope for the coming twelve months is that a more final and globally consistent framework is closer."

All Performance Data in the Top-10 list per 10.09.2012: