Investment universe

The Invesco Euro Corporate Bond Fund (ISIN: LU0243957825) will invest at least two thirds of its total assets (without taking into account ancillary liquid assets) in debt securities or instruments denominated in euro issued by corporate issuers.

The fund will invest primarily in investment grade (Moody’s Baa or higher) fixed and floating rate bonds and other debt securities which, in the opinion of the Investment Adviser, have a comparable credit quality issued by corporations in any part of the world or issued or guaranteed by any government, government agency, supranational or public international organisation in any part of the world.

The fund may invest in non-investment grade securities which generally will not exceed 30% of the net assets of the fund. Up to one third of the total assets of the fund (without taking into account ancillary liquid assets) may be invested in Non-euro debt instruments or debt instruments issued by public international debtors. Investments not denominated in the euro are intended to be hedged back into euro at the discretion of the Investment Adviser.

Fixed interest securities comprise any or all of the following types of security:

- bonds, debentures, notes and treasury bills issued by governments, local authorities and public authorities

- corporate bonds, notes and debentures whether secured or unsecured (including securities convertible into or exchangeable for equity shares)

- securities issued by public international bodies such as the European Investment Bank, International Bank for Reconstruction and Development or such other body which is, in the opinion of the Investment Adviser of similar standing

- certificates of deposit, commercial paper and bankers acceptances

Derivatives and forwards relating to debt instruments may be used for the efficient portfolio management. The aim of any derivative or forward used for such reasons is not to materially alter the risk profile of the fund, rather their use is to assist the Investment Adviser in meeting the investment objectives of the fund by:

- reducing risk and/or

- reducing cost, and/or

- generating additional income or capital for the Fund at an acceptable level of cost and risk.

The fund may, from time to time, sell interest rate futures in order to reduce participation in the bond markets or to produce gains for the Fund in falling bond markets

The fund may also enter into credit default swaps (as both a protection buyer and seller).

The fund can invest up to 30% of its net assets in liquid assets.

Investment philosophy & process

Investment philosophy

At the core of our investment philosophy is a belief in active investment management. Fundamental principles drive a genuinely unconstrained investment approach, which aims to deliver attractive total returns over the long term.

The team’s investment philosophy is built on a belief that fixed interest markets are mostly efficient but continually present opportunities. For example:

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...- Markets have a tendency to overshoot, moving prices away from fundamental value.

- Investors have different objectives – for instance, investors that are required to match liabilities of a certain duration, or central bank intervention.

- Some institutional investors can have rigid investment constraints – changes in the credit rating of an issuer can force some investors to sell.

By exploiting market inefficiencies such as these through fundamental analysis and a strong emphasis on valuation, we aim to deliver consistent, long-term outperformance under most market conditions.

Investment process

The team’s approach to investment management can be summarised as follows:

Active: The Henley Fixed Interest team do not track indices and their focus is on absolute risk and return

Flexible and pragmatic: Their approach is informal, iterative, flexible and changes according to market conditions

Market driven: The team exploit opportunities on a short-term as well as a longer-term basis

‘All-weather’ funds: The products are designed to be managed through the market cycle

Valuation driven: They place strong emphasis on assessing value, based on fundamental analysis of potential risk versus potential return

This philosophy and approach have shaped an investment process which adheres to the core disciplines of logical thought processes, comprehensive analysis and constant re-questioning of underlying assumptions. The investment process comprises three key elements which drive portfolio construction – macroeconomic analysis, credit analysis and value assessment.

Macroeconomic analysis

Our macroeconomic views play an integral role in all the main portfolio decisions. The focus of the team’s macro work is on the development of a view about the general direction and structure of interest rates, and the trend in the pricing of credit risk. To a large extent these broad views set some important individual bond parameters, such as preferred maturities, yields, sectors and overall credit risk tolerances. The macro view and analysis also provides the foundation on which duration, yield curve and credit strategies are built.

The main elements of top down analysis that are important for the fund are the:

- General direction of monetary policy and developments in official interest rates

- Shape of the yield curve and its likely development

- General trend in the pricing of credit risk and ‘credit spreads’

The first two factors are influential in determining the overall interest rate (or duration) risk which we take in the portfolio. The third factor will be a guiding force behind the level of credit risk we take in the portfolio.

However, the judgement on duration and credit risk is more refined than, say, simply lengthening duration in anticipation of falling interest rates or raising credit exposure in anticipation of credit spread narrowing. For example, there have been important and significant changes in the shape of yield curves around the world in recent years which have necessitated careful examination of the entire yield curve and the choice of strategies to capitalise from these developments.

Credit analysis

The assessment of individual corporate credits is central to the investment process. The external sources of research to which we have access are the starting point for that analysis. These external sources include the three main credit rating agencies – Standard and Poor’s, Moodys and Fitch/IBCA. This external research often provides, however, a fairly “static” view of an individual credit and, as has been clearly demonstrated in recent years, credit assessment can change very quickly.

Partly for such reasons, our own analysis is of crucial importance. Our emphasis, however, will be on the dynamics and the evolution of these measures, rather than on the numerical value of the ratios at a particular point in time. For example, a company that is actively taking steps to reduce excessively high leverage will be more attractive than one with the same degree of leverage but taking few steps to address the situation.

The quality of management is an important factor in our qualitative assessment of high yield issuers. In that light, company visits are becoming more important for us. In this way, our research on companies is quite similar to that done by equity analysts. The financial measures we look at in assessing an individual company will tend to have a different focus to those used by equity analysts, emphasising the ability of a company to adequately service its debt. The measures we look at include: the extent of gearing; the relationship between a company’s net debt and its EBITDA (Earnings before Interest, Tax, Depreciation and Amortisation); and the relationship between EBITDA and the company’s overall financing costs. EBITDA is used primarily as a proxy for a company’s free cashflow and we will often make adjustments to EBITDA to take into account, for example, required capital expenditure. Different financial ratios will be appropriate for different companies operating in different sectors and at different stages of development. Our emphasis, however, will be on the dynamics and the evolution of these measures, rather than on the numerical value of the ratios at a particular point in time. Other technical considerations such as issue size, dealer sponsorship, supply and numerous other technical factors will also be considered.

The credit risk process is not designed to minimise risk in isolation from return considerations. The fund managers are looking to maximise returns from acceptable and well understood credit risk exposures.

Value assessment

Once a deep and informed credit risk opinion has been established about a particular corporate borrower, absolute and relative risk and value judgements can be made. We seek to understand why an opportunity may exist, including:

- Market overreaction to one aspect of a company’s situation

- The effects of ratings moving below investment grade

- Issuance patterns

- Mis-pricing of covenant protection

In keeping with our absolute risk and return mentality, a judgement is made about whether the potential returns (both from income and capital) sufficiently justify the risks. We also consider the risk / return profile of a bond in relation to cash and government bonds, as well as corporate bonds. An appreciation of relative value enables us to select the best value corporate bonds given pre-determined variables such as maturity, sector and credit rating. This also helps us to identify credit trends and pricing anomalies.

Investment strategy & benchmark

Fund manager

The fund has been managed by Paul Causer and Paul Read, Co-Heads of the Invesco Perpetual Fixed Interest team, since launch.

Fund objective

The fund is invested to achieve, in the medium to long-term, a competitive overall investment return in euros with relative security of capital in comparison to equities.

Due to the unconstrained nature of the investment process the fund does not have a benchmark, instead it utilises its peer group, the Morningstar GIF OS EUR Corporate Bond, for performance comparison purposes.

Investment Strategy

The fund is invested in a diversified portfolio of investment-grade bonds, including banks and other financials, where we feel there are good opportunities for yield enhancement. We remain convinced that bank capital is currently the biggest area of value in the investment grade bond market and it is a key theme in the fund. We believe that structural reform, the implementation of Basel III and rising capital levels will strengthen bank balance sheets and reduce the risk of their debt instruments. We think that yields available in this part of the market are attractive, even allowing for the volatility we have seen. Our holdings are diversified across banks and across the capital structure, with a strong focus on the better-capitalised, 'national champion' banks. The fund maintains a high level of liquidity - cash currently stands at 12.5%. This can be put to use when attractive opportunities arise. Modified duration remains low at 2.4.

Fund outlook

The sovereign debt crisis is a key factor in our markets. Recent months have seen an improvement in investor sentiment but we believe that periods of volatility are likely to continue to occur as the crisis in peripheral Europe develops and the effects of this volatility can extend beyond the government bond universe. We are retaining the shape of the fund, keeping overweight financials and underweight duration. Our aim is to add yield from assets that are attractive on a risk/reward basis while not chasing returns in areas of the market we believe to be fully valued.

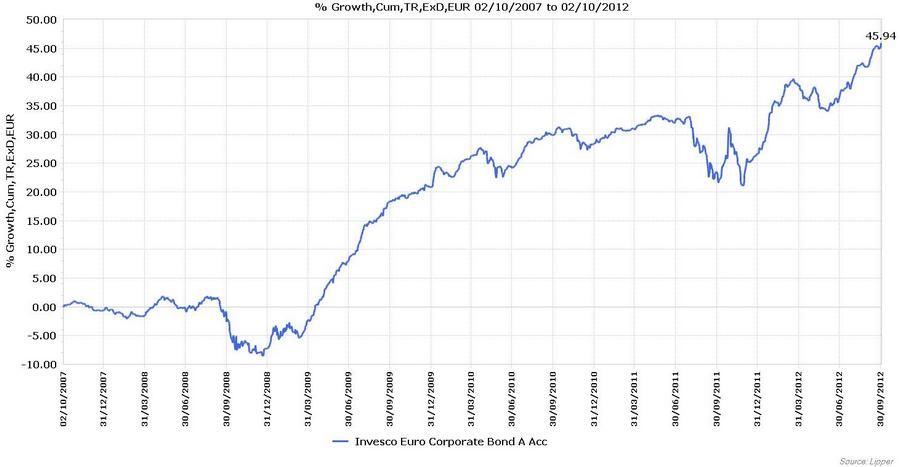

Performance Review 2007

We remain convinced that bank capital is the biggest area of value in the investment grade bond market and it is a key theme in the fund. We believe that structural reform, the implementation of Basel III and rising capital levels will strengthen bank balance sheets and reduce the risk of their debt instruments. Our holdings are diversified across banks and across the capital structure, with a strong focus on the better-capitalised, 'national champion' banks. The fund maintains a high level of liquidity.

Our strategy has evolved over time but bank capital has been a key theme within the fund since the outbreak of the financial crisis, and a major driver of performance. We accept the additional volatility that comes with some of the positions we hold, and continue to selectively take advantage of bouts of weakness and strength in the market. We continue to assess our strategy on a risk-and-reward basis.