e-fundresearch.com: Mr Frank Thormann, you are the fund manager of UniFavorit Aktien (ISIN: DE0008477076). Since when are your responsible for the fund management?

Thormann: I have been involved in the management of “UniFavorit Aktien” since Nov 2008. From 1 Nov 2008 until 31 Mar 2010 I was responsible for the North American portion (55% of assets) of the fund. Since 1 Apr 2010 I am responsible for the entire fund.

e-fundresearch.com: Which benchmark do you adhere to?

Thormann: MSCI World (Developed Markets).

e-fundresearch.com: Are you also responsible for other funds at the moment?

Thormann: No.

e-fundresearch.com: What is the total volume that you manage in all your funds?

Thormann: AUM = 400 Million Euros.

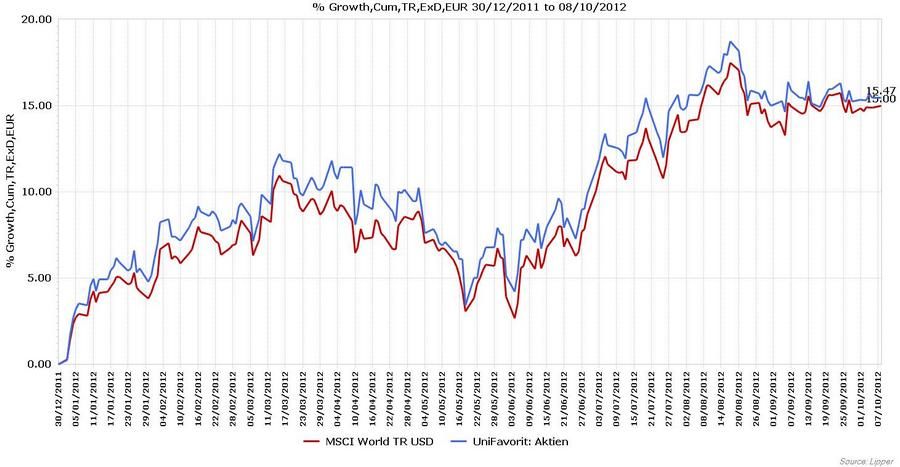

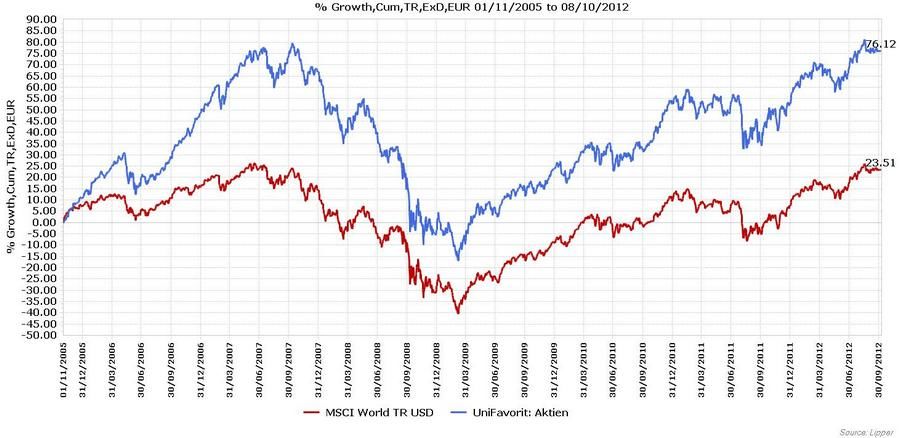

e-fundresearch.com: Regarding the performance: which performance did you achieve since the beginning of the year and in the years 2007-2011? Absolutely and relatively to the relevant benchmark?

Thormann: As of 31 Aug, the performance YTD of the fund was +3.40% relative and 16.7% absolute (gross of fees).

| Performance Relative | Performance Absolute | |

| YTD 2012 | +3.4% | +16.7% |

| 2011 | +5.9% | +2.8% |

| 2010 | +6.4% | +26.2% |

| 2009 | +1.3% | +30.8% |

| 2008 | -2.5% | -41.3% |

| 2007 | +19.0% | +17.7 |

Note: all performance is gross of fees

e-fundresearch.com: How content are you with your own performance in the last years and this year?

Thormann: I am very pleased to have been able to add value for our clients.

e-fundresearch.com: How are you able to deliver added value for your investors with your performance?

Thormann: It is our goal to deliver outperformance for our clients, meaning performance that exceeds the benchmark, which measure broad global equity markets. We strive hard to continue to select attractive investments with attractive risk / reward characteristics. We credit our successful investment strategy of how we select securities as well as our rigorous fundamental analysis for these successful results.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...

e-fundresearch.com: How long have you been a fund manager already?

Thormann: I have been working as a portfolio manager since Jan 2008 for Union Investment. Previously I worked for seven years as an investment analyst for American Century.

e-fundresearch.com: What were your biggest successes and your biggest disappointments in your career as fund manager?

Thormann: My biggest success has been the positive track record of the UniFavorit Aktien fund I have been able to establish since taking over the fund.

My biggest disappointment has been the lax risk management and moral standards of many financial market participants leading to the recent financial crisis.

e-fundresearch.com: What kind of capital market situation do we have at the moment? How do you act in this environment?

Thormann: We currently operate in an environment of slowing economic growth translating into reduced earnings growth for most companies around the world. Against this backdrop the economy is working through the consequences of a loose credit cycle and the consequent financial crisis.

We have a preference of businesses with durable, profitable and proven business models. These are companies that possess significant competitive advantages over their competition and are conservatively financed. As such they have their future in their own hands and have little exposure to government regulations.

e-fundresearch.com: What are the special challenges in this environment?

Thormann: Companies that are heavily dependent on government regulation or subsidies face increasing risk profiles.

e-fundresearch.com: What objectives do you have till the end of the year and in the mid term for the upcoming 3 to 5 years?

Thormann: It is our objective to select investment opportunities on behalf of our clients that significantly outperform the global equity benchmarks on a multi-year holding horizon.

e-fundresearch.com: Do you model yourself on someone? Any ideals?

Thormann: While I study and admire many of famous investors and their teachings, I believe it is critical of each investor to develop their own investment style.

e-fundresearch.com: What motivates you in your job?

Thormann: The ability to add value to our clients as well as the intellectual challenge that comes along with it.

e-fundresearch.com: What else do you want to achieve or do you have any further aims as a fund manager?

Thormann: I aim to achieve very good investment results in the long term. As such, I hope to lengthen the positive track record of the fund.

e-fundresearch.com: What other profession would you have taken interest in, apart from becoming a fund manager?

Thormann: I am a very curious person and have wide range interests spanning travel, sciences, philosophy, history and among others…

e-fundresearch.com: Many Thanks!