e-fundresearch.com: Mr Nick Evans, you are the fund manager of the Polar Capital Global Technology Fund. When did you take over the responsibility of managing this fund?

Nick Evans: I joined Polar Capital in September 2007 and was appointed lead manager of the Global Technology Fund on 1 January 2008. Prior to joining Polar, I was Head of Technology and lead manager of the Global Technology Fund at AXA Framlington.

e-fundresearch.com: What is the current size of the fund?

Nick Evans: US$ 497.0m (31st July 2013).

e-fundresearch.com: Do you also manage other funds or mandates?

Nick Evans: I jointly run the team along with Ben Rogoff, who is lead manager on the Polar Capital Technology Trust plc.

e-fundresearch.com: What is the total amount of assets you manage currently?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Nick Evans: The total team assets across both Funds, as at the 31st July 2013, were US$ 1,373.6m. Technology is a core specialisation at Polar Capital, currently representing more than 14% of the Firm’s total assets under management.

e-fundresearch.com: How long have you been in the business as a fund manager?

Nick Evans: 15+ years

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Nick Evans: Our approach is benchmark agnostic and we have a broad flexible definition of what constitutes a technology stock – capturing any company that uses technology to provide significant competitive advantage (which can extend across other industries). This is very important because we are in the early stages of a new technology cycle and many of the big benchmark constituents are looking increasingly impaired due to lower cost, disruptive new technologies. Market capitalisation weighted indices are by their nature slow to adapt.

We aim to construct a relatively flat or un-weighted portfolio of secular growth stocks and allow the blended underlying earnings and cash flow to be the primary driver of performance. Typically we aim to deliver at least 20% underlying growth or 2x the index growth rate. We may also benefit from buying stocks cheaply and seeing multiple expansion. We would typically expect to benefit from M&A due to our structural bias towards small and mid cap stocks. That said, our approach is multi cap and we are very conscious of the liquidity profile. Polar’s investment philosophy is driven by performance rather than asset gathering which helps us maintain good exposure to smaller stocks.

Our competitive edge comes from a team of 6 experienced Fund managers and analysts dedicated to these two Funds. We are one of the largest technology teams in Europe and the largest in London which gives us very good access to management. Identifying technology themes is a core part of our process and an important driver of our long term outperformance – this helps us identify groups of stocks which will be winners (and losers) from new technologies and helps us focus our resources. The other core driver of alpha is bottom up stock picking. All team members travel frequently because we believe meeting with management and technology customers / experts is an important part of our process. When in the US we typically get better access to management than most local managers of a similar size because we have made the effort to visit companies at their HQ.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Nick Evans: The Dow Jones World Technology Index US$ is the benchmark used by the Fund. No benchmark is ideal but this is considered by the team to be representative of the global Technology equity universe. That said, we would not consider the index orientated Funds to be direct competitors – we focus on those Funds with a similar, more active growth centric approach. Over a rolling 5 year period we expect to be firmly first quartile in the broader peer group and to outperform our benchmark by at least 3-5% pa.

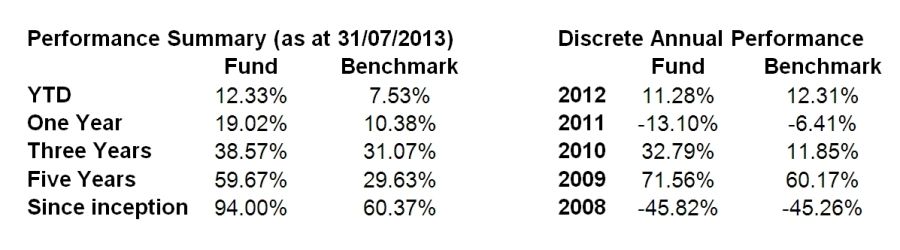

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Nick Evans:

e-fundresearch.com: What motivates you in your job?

Nick Evans: Understanding technologies across a variety of industries. Technology is constantly changing which makes it challenging. It is unlike any other sector because incumbency in Technology is usually a negative when new disruptive technology cycles emerge (typically every 8-10 years or so). Identifying companies and themes before growth inflects upwards and meeting with some amazing entrepreneurial CEO’s on a daily basis is the most enjoyable element.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Nick Evans: I would start up my own technology / internet company. There will be some incredible innovation in this space over coming years as the pace of innovation is accelerating. Or, perhaps teaching sailing!

e-fundreseatch.com: Many Thanks!

Link: Die besten Technologie Aktienfonds