e-fundresearch.com: How optimistic is your view into the future and what obstacles and challenges should investors be prepared to overcome in 2015?

Hans van Zwol: For fixed income investments in general, we can only be moderately optimistic. However, looking more into detail there are still fixed income asset categories where we expect relatively attractive returns. Moreover, comparing these asset categories with other investments like savings accounts or short-dated government bonds the added value is clear. Clearly, the challenge for the next few years is how to overcome the low yield environment. We believe that this is an environment in which active return should play a more prominent role.

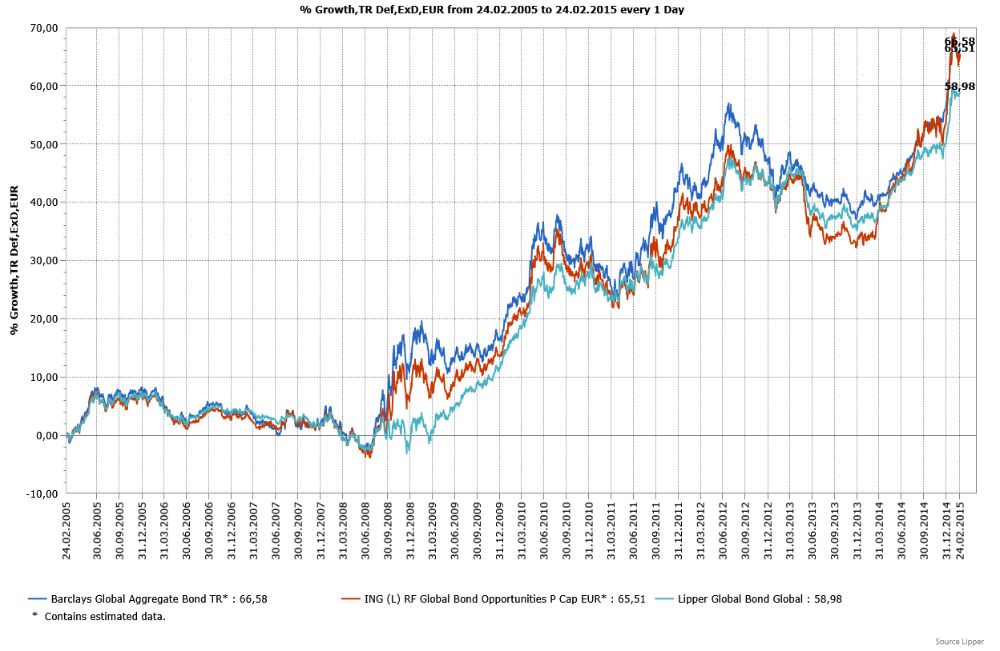

Chart: ING (L) RF Global Bond Opportunities

e-fundresearch.com: What can we learn from the SNB’s surprising decision to abandon its currency cap?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Hans van Zwol: The lesson for active investors is that one should be very cautious with leaving stop-loss orders below a ‘floor’-level. As with EURCHF, you run the risk of your orders being executed at much worse levels than where you left orders. It is a reminder again that one should always focus on diversification and avoid risk concentrations.