e-fundresearch.com: How optimistic is your view into the future and what obstacles and challenges should investors be prepared to overcome in 2015?

Phil Milburn: We have learnt to live in a lower interest rate environment but we are not complacent about levels of Government bond markets. We recognise the lower yields on many fixed income products will encourage investors to look elsewhere. Investor’s expectations of fixed income returns may be too high if they are used to double digit fixed income returns. Europe still faces a number of obstacles if it can survive the pressures of the Euro crisis and the Greek issues it will create a more optimistic outlook.

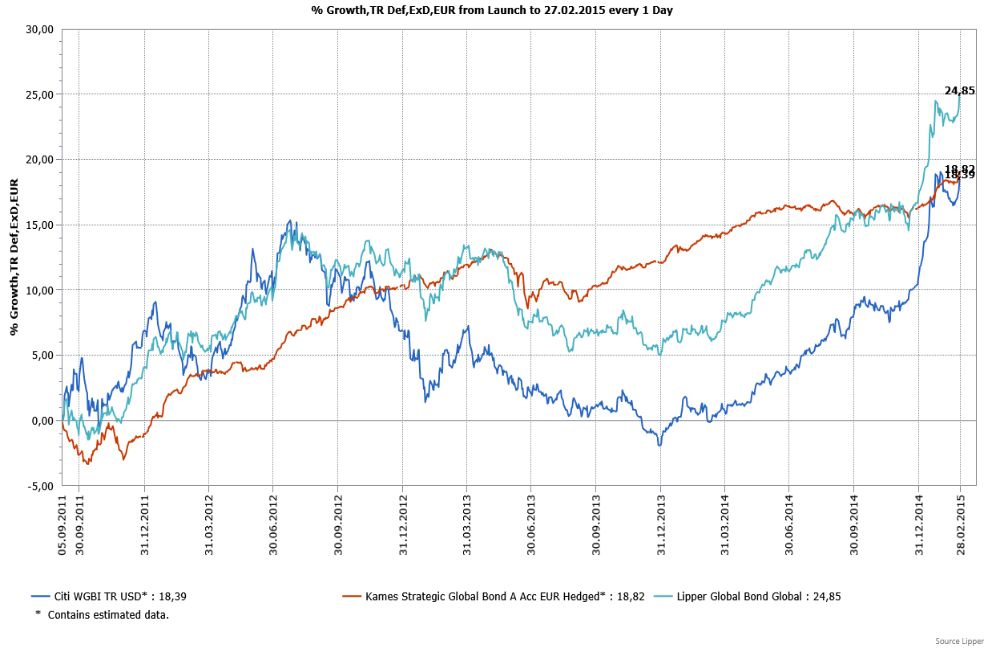

Chart: Kames Strategic Global Bond Fund

e-fundresearch.com: What can we learn from the SNB’s surprising decision to abandon its currency cap?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Phil Milburn: We can learn that Central Bankers aren't infallible and when events change they must learn to change with it. It was the reverse of the UK's experience from leaving the ERM in 1992. There will be further shocks from Central Bankers in the coming years as they and their balance sheets are far more intertwined with markets than they were before the financial crisis.