e-fundresearch.com: Why Asia?

Samir Mehta: The long-term argument for investing in Asian equities is a familiar one: the region is home to dynamic economies where increasing income levels and rising domestic consumption have created a powerful secular trend.

As for why Asia now, it's important to note that with the exception of Malaysia (where we have no investments) and Indonesia, the other Asian economies are net commodity importers. The recent dramatic fall in commodity prices is a powerful positive change in fundamentals for Asia compared to almost all other emerging markets countries.

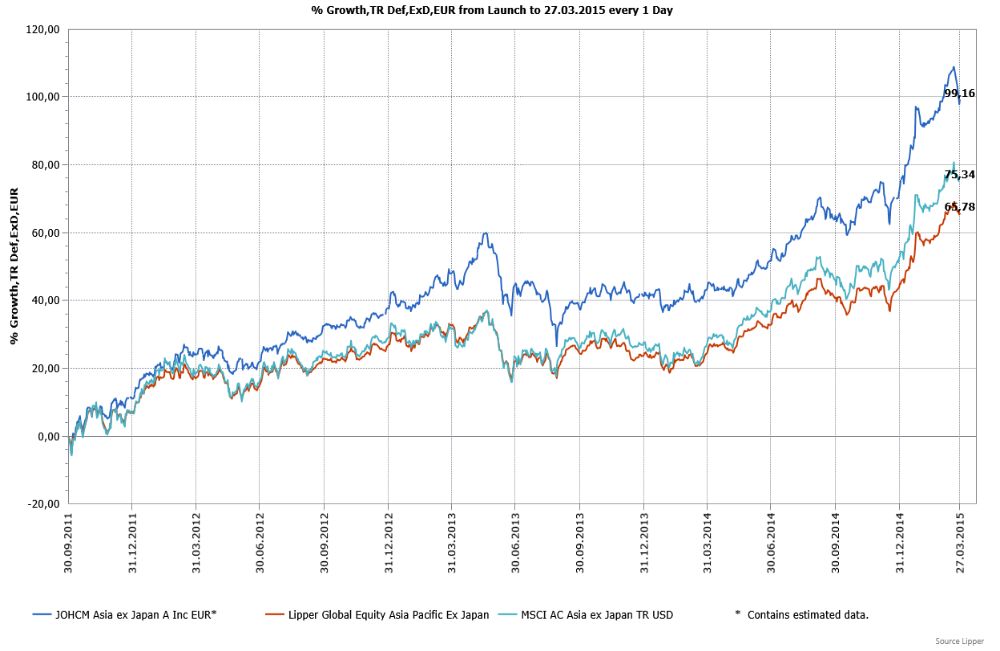

Chart: JOHCM Asia Ex-Japan Equity Fund seit Auflage

e-fundresearch.com: How do you plan to make money in the Asian equity universe in 2015 and how will the ECB’s QE program and a potential rate hike of the US FED influence your investment universe?

Samir Mehta: In the broadest sense, by sticking with our robust investment process that focuses on long-term, sustainable quality growth.

In terms of the immediate outlook, a rising US dollar is not conducive to strong performance by emerging market equities. However, as I mentioned earlier, the sharp fall in commodity prices is a very powerful structural change for Asia. We are bottom-up focused investors and look for businesses that can survive and thrive during tough economic conditions. Companies in India, Taiwan and Philippines meet many of the characteristics we look for. We might look to trim our exposure to China this year if the Chinese market rises further and look to add some stocks in Indonesia if we see a sell-off in that market.

Weitere beliebte Meldungen: