e-fundresearch.com: With the S&P 500 TR only delivering roughly 1.7% in the first four months of 2015, US equities seem to have lost quite some momentum versus their European peers. In your view, what arguments indicate that this development is only of a temporary nature and why should European investors consider an increase in allocation to US equities in the current market environment?

Alex Farman-Farmaian: We believe that every investor should have a solidly diversified portfolio. Given that the Europeans have exposure to their own markets and economies via their work, businesses and savings, we believe that a portfolio of great U.S. companies that are growing their profits on a global scale at a far faster rate than those in Europe or in emerging markets, and managed by very committed and honest management teams is a great diversification for all European investors, no matter what size.

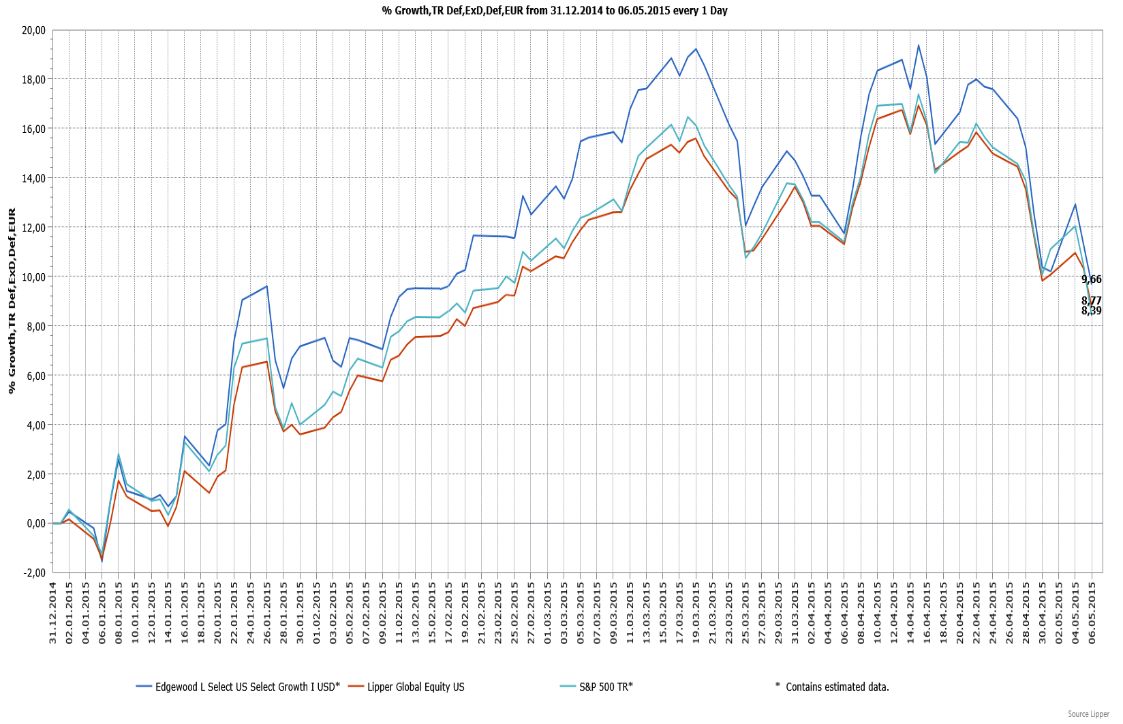

YTD-Chart: Edgewood L Select – US Select Growth vs. S&P500 vs. Peer-Group Average

However, an investor in stocks must look to the long-term, that is 5 years plus to make a significant amount of money in putting money in shares. Remember, shares are pieces of ownership of companies. It takes time for good managements to grow their businesses, and it that careful approach to growth protects investor/owners and can become very big money due to the power of compounding. Just look at Gilead, or Celgene, or even something as unknown as Cognizant Technology (ticker: CTSH) which despite the stock market collapse in 2008/9 has made investors very happy in the last 10 years by rising from a $10 per share price to $60 today. That is a huge return in a very safe company. That is investing. That is quality. That is finding an excellent U.S. growth company. That is what we would recommend all our investors to do. Do a lot of in-depth research to find a great group of companies, in special/great businesses, managed by great management, buy the stock and hold on very patiently while they make you your money over the long-term.

Currently, the U.S. market offers many excellent companies that fit that criteria, and since they are in the fastest growing large global economy, they will tend to do very well over the long-term.

Weitere beliebte Meldungen: