e-fundresearch.com: To what extent does a stronger USD as well as a potential FED rate hike actually impact your portfolio composition as well as your general outlook for US equities?

Alex Farman-Farmaian: The US dollar will fluctuate, just like the price of oil. Interest rates go up and down. These tend to be short-term phenomena. What counts is finding the next Bill Gates creating a Microsoft, the next Steve Jobs creating Apple, the next Francisco D’Souza building Cognizant, etc. We analyse and look to try to own organically GROWING businesses. Therefore short-term fluctuations brought on by dollar rates are often hardly noted on Wall Street, as one year’s USD fall might mean the next year’s rise. We expect our companies to continue to grow through such fluctuations and expand and take advantage of their superior management skills, better products and/or unique services. We believe that when other investors sell these businesses due to short term problems which are not structural….it gives the patient buyer and investor the opportunity to buy and own excellent businesses at cheaper than they should be. Over time, if we have done our work, these companies continue to grow steadily, and create wealth for their owners and shareholders, through up and down USD and interest rate cycles. We strongly believe that if we invest in quality then one will be repaid multiple times for the effort. Our track record shows that to be the case.

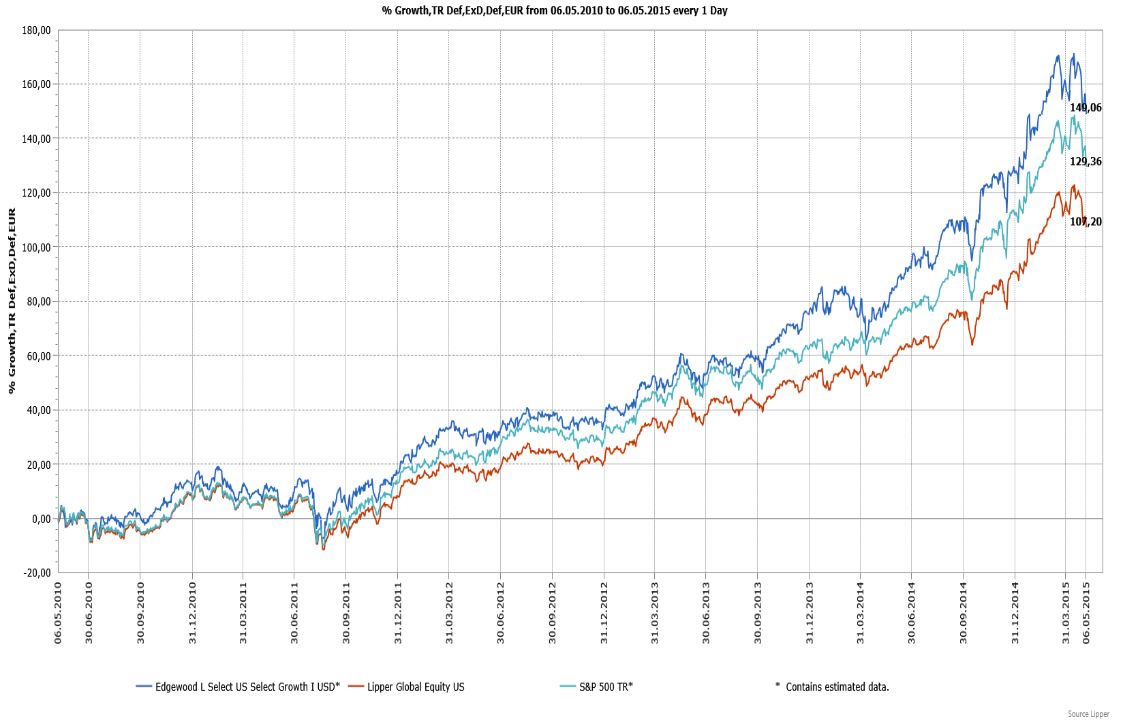

5Y-Chart: Edgewood L Select – US Select Growth vs. S&P500 vs. Peer-Group Average

Weitere beliebte Meldungen: