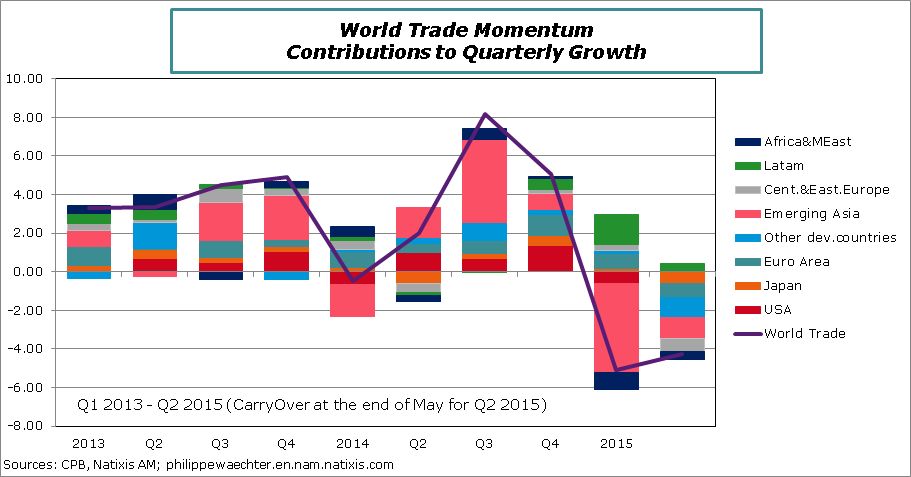

The current momentum of the world trade, in volume, is worrying me. Comparing May 2015 to May 2014 shows that world trade is growing at a mere O.4%.

For the whole first quarter, compared to the last three months of 2014, world trade has shrunken by -5.1%. For the second quarter the carry over growth at the end of May is negative at -4.25%. This is the second consecutive quarter of decline and that where the problem is.

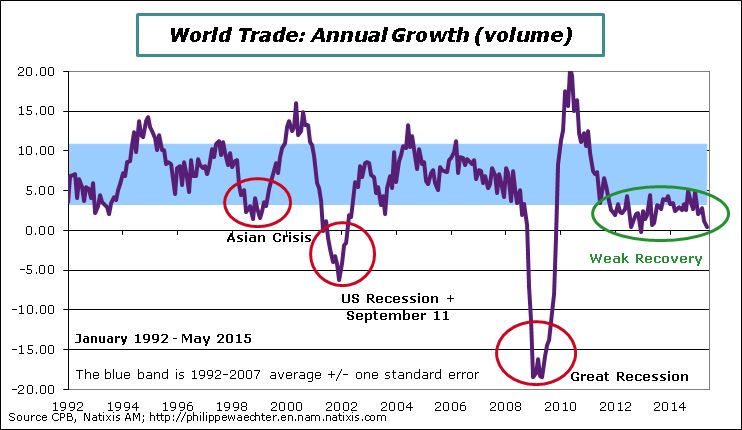

This weak dynamics in the world trade is not new. Since the end of summer 2011 its yearly growth rate is below the blue band on the graph. This blue band is the average growth from 1992 to 2007 +/- a standard deviation. Before after a shock that pulled it down (red circles on the graph), the world trade recovered rapidly with usually an overshoot before converging to the blue band.

This is no longer the case. After the rapid recovery seen in 2009/2010, the world trade momentum has slowed dramatically, staying below the blue band. It’s a very specific period. We cannot exclude that this could be a by-product of the austerity policies that have been put in place in Europe and that has led to a long recession from mid-2011 to the end of 2013.

1.) World trade is no longer a source of impulse for countries all over the world. In the past a strong dynamics in exports had a positive impact on production allowing a higher trajectory for growth. A country was then contributing positively to international trade. There was a kind of virtuous and endogenous business cycle.

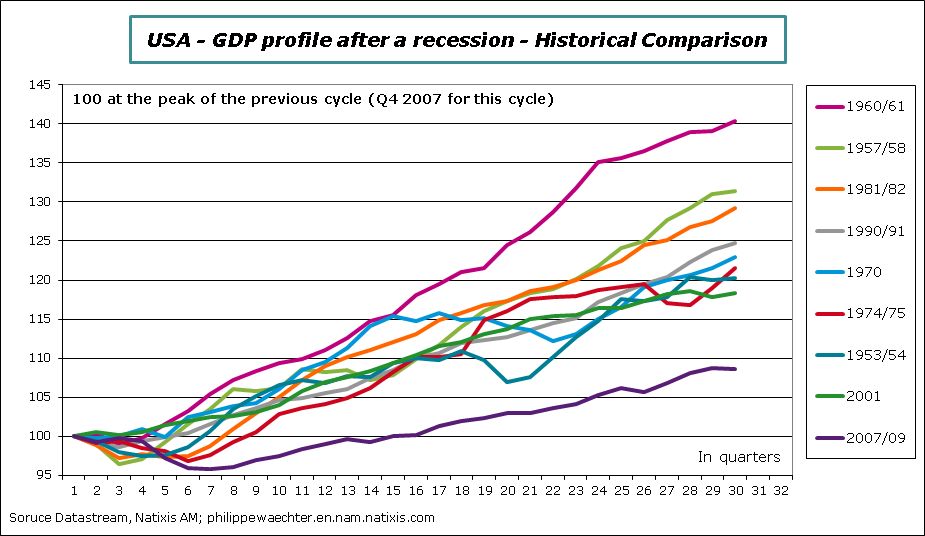

2.) This weak dynamics reflects the lack of a strong engine for the world economy. Looking at the three main engines, we see that none of them is able to be a catalyst for growth. The US economy doesn’t grow at a sufficiently rapid pace to create an impulse on global trade (see the graph in annex), China is not contributing as deeply as it used to do and Europe is barely recovering.

Looking at regional contributions to quarterly world trade growth we see that, at the exception of Latin America, all the other contributions are negative. The USA has a null contribution in the second quarter. It’s surprising as social unrest in US harbours in the first quarter has limited trades. Japan, the Euro Area, Emerging Asia (including China) and other regions have a negative contribution in the second quarter.

Interactions between large regions are currently low. There is no spillover from one region to another one. As a consequence, every large region has to create its own growth and the support for this latter is internal demand.

Growth forecasts are weak (the IMF has revised down its own forecasts for 2015). That’s why we can expect that economic policies will remain accommodative for an extended period. Internal demand momentum is and will be the sole source of growth. Tight economic policies would harm this support. Monetary policies will remain accommodative even in the USA. There are no more possibilities (except in Greece (??????)) to adopt tight fiscal policies because it would directly weigh on internal demand through lower government expenditures or lower households expenses. It would be a stupid economic policy orientation.

The world trade low momentum is the symptom of an economy that is not able to converge to a higher growth trajectory and that’s clearly a real worry.

The graph below presents the US GDP trajectory during and after each recession since WWII. The current profile is way below past trajectories and the current slope doesn’t let expect a rapid catch up. The USA economy doesn’t have the capacity to pull up the world economy. According to the current growth profile, the possibility of raising rates for the Fed is limited.

Philippe Waechter, Natixis Global Asset Management

Weitere beliebte Meldungen: