Brazil is struggling. During the last weekend between 1 and 2 millions of people were down in the street to protest against the president Dilma Rousseff. A weak economy and corruption were the main reasons for these demonstrations. The slower momentum of China, lower commodity prices, a tight fiscal policy and high interest rates are drags to economic growth.

Demonstrations during the weekend reflect the weak shape of the economy and were also focused against the president Dilma Rousseff whose popularity is at its lowest according to polls. (Brazil is probably the only country where the popularity of its chief of government is lower than the inflation rate).

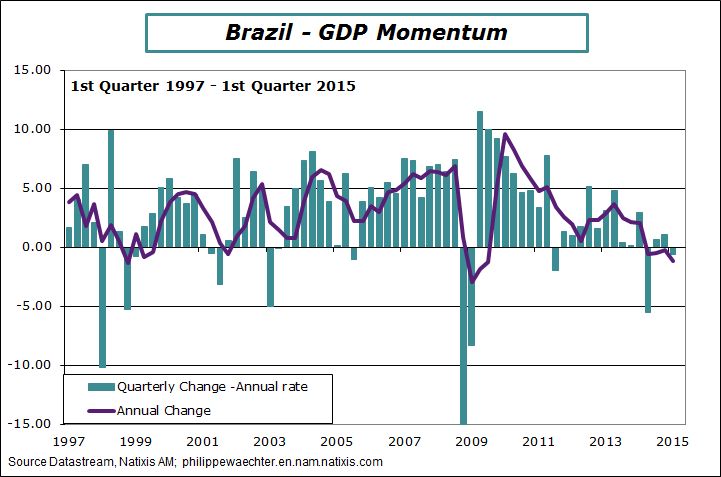

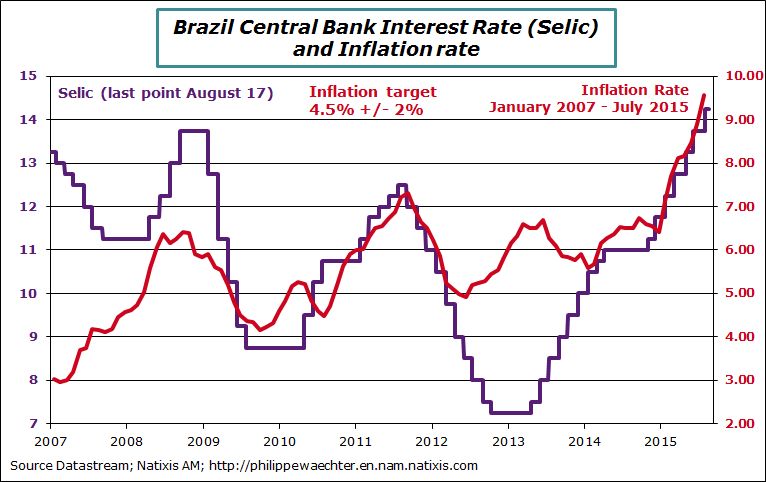

Brazil will be in a recession in 2015 after a very weak growth in 2014 (see graph below). This fragility is currently a characteristic of emerging countries. But contrary to other emerging countries the inflation rate is trending upward. It is at 9.5% in July. To limit this inflationary spiral, monetary policy is tight. The Brazilian central bank interest rate (Selic) is at 14.25%. It has double since April 2013 (see graph below).

The macroeconomic situation of Brazil is the most worrying amongst large economies. Weak economic growth, high inflation rate and low employment momentum would be sufficient to support the discontent of Brazilians. But now the fiscal policy is tighter and less generous for people. Moreover there is the corruption case of the government party which supports Dilma Rousseff with Petrobras (the large Brazilian oil company).

The strong growth and redistribution policy that characterized the era of President Lula (former Brazilian president, before Rousseff) are no longer the drivers of the Brazilian society, leading to uncertainty for every Brazilian. With Lula, the country’s economy had made a leap forward, with millions of people out of poverty. But the reasons that helped the Brazilian economy were specific: trade with China has increased dramatically during Lula’s mandate and commodity prices were trending upward. Therefore, the economy has taken advantage of a strong impulse in its exports with higher revenues from commodities. This led to a GDP growth close to 5% per year. It was then easier to have a social policy oriented to help poor people.

Since this period, the Chinese economy is no longer the world economic driver it used to be. This is a drag for Brazil but also for most emerging countries. At the same time commodity prices are trending downward, reducing dramatically Brazilian revenues. As investment has not been strong enough during euphoria, there is no substitute to trade with China or to commodities to support the Brazilian economic activity. The growth support from inside is not sufficient to avoid a weaker labor market. External conditions are no more supportive and because of insufficient investment in the past, internal demand has not the momentum that could compensate the weaker international environment. Households have perceived this uncertainty very clearly in their expectations but also in their purchasing power. As a consequence, retails sales are down by 3% in a year in June (volume).

The lack of growth drivers implies a real and persistent fragility. This could go beyond this point as rating agencies have said they could downgrade the Brazilian rating (Moody’s has cut Brazil’s credit rating to near-junk status). This will not create incentive for investors to come back.

President Rousseff and the president of the Senate have recently signed an “Agenda Brasil” which focuses on structural reforms. But if Brazil needs dramatically reforms to improve its outlook, these reforms will not change the current situation. There are mainly mid to long-term measures but what Brazil needs immediately is a stronger support on its internal demand.

The Olympics, next summer, will probably have a temporary impact as the World Cup did last year.

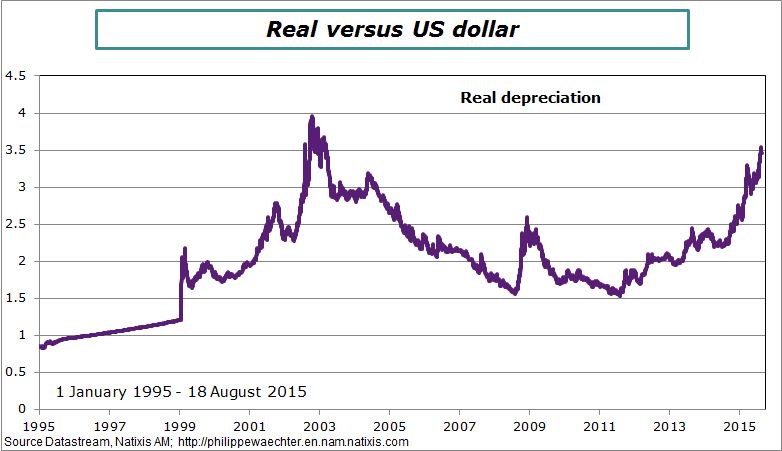

The Brazilian currency is depreciating rapidly. This reflects uncertainties on the economy, the impossibility for the Central bank to manage a too high inflation rate and a deteriorated external situation. In 4 years, the value of the real has been cut by half versus the dollar and by more than 40% with the euro. Its value is at is weakest since the beginning of the 2000’s (see graph below). Stronger prospects on the Brazilian economy are needed to stop this slide.

Brazil suffers from numerous imbalances and constraints but the most important is that there is an incapacity to manage inflation when the economy is in recession. This reflects low productivity gains and the impossibility to adapt rapidly to another context. That’s why there is a strong need for investment, specifically on infrastructure through public investment.

Brazil must create conditions to feed its own growth, to have more autonomy in its dynamics in order to be able to create jobs, revenues and a stronger social policy. Internal demand is key to improve economic prospects and that’s what Brazil lacks of. There is no need for a restrictive fiscal policy, as it is the case currently, because it weakens internal demand and is not a solution to Brazilian weakness. As world trade momentum is low, there is no reason to expect strong impulses from outside. Brazilians cannot wait the next wave of higher commodity prices to get better. The risk today could be political instability. Brazilian people have succeeded in the past to escape from this type of behavior, it is not time to take risks to bring it back.

Annex

I have had 3 graphs to the original article to highlight different issues.

The first is on GDP momentum, the second on inflation rate and monetary policy, the last on currency.

The change in regime can be seen. In the first decade of the 2000’s, growth was close 5%. This is no longer the case.

Weitere beliebte Meldungen: