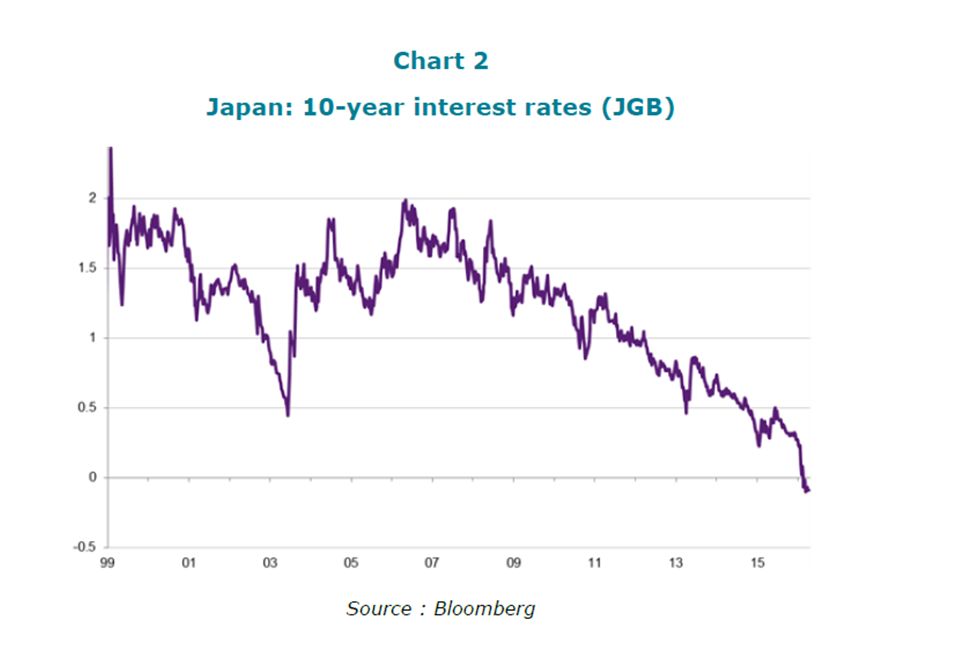

"The governor of the Bank of Japan (BoJ), Haruhiko Kuroda, was given a clear mandate by the Prime Minister in 2013, to end the deflationary pressure which had been weighing on the country since 1998. In order to do so, the governor implemented an ultra-aggressive monetary strategy, based on massively increasing securities purchases by the central bank and by including more risky securities in the asset purchase program, particularly listed real-estate investment companies and equity ETFs. Three years after the launch of this quantitative and qualitative easing program (QQE), it is clear that the results have fallen short of initial expectations. Although underlying inflation has managed to move into positive territory, it has struggled to break through the 0.8% threshold, compared to the official target level of 2% (chart 1). Even worse, anticipated inflation reflected in a variety of sources (fixed-income markets, corporate and household surveys), have fallen back perilously close to zero. This failure has dented the credibility of the BoJ.

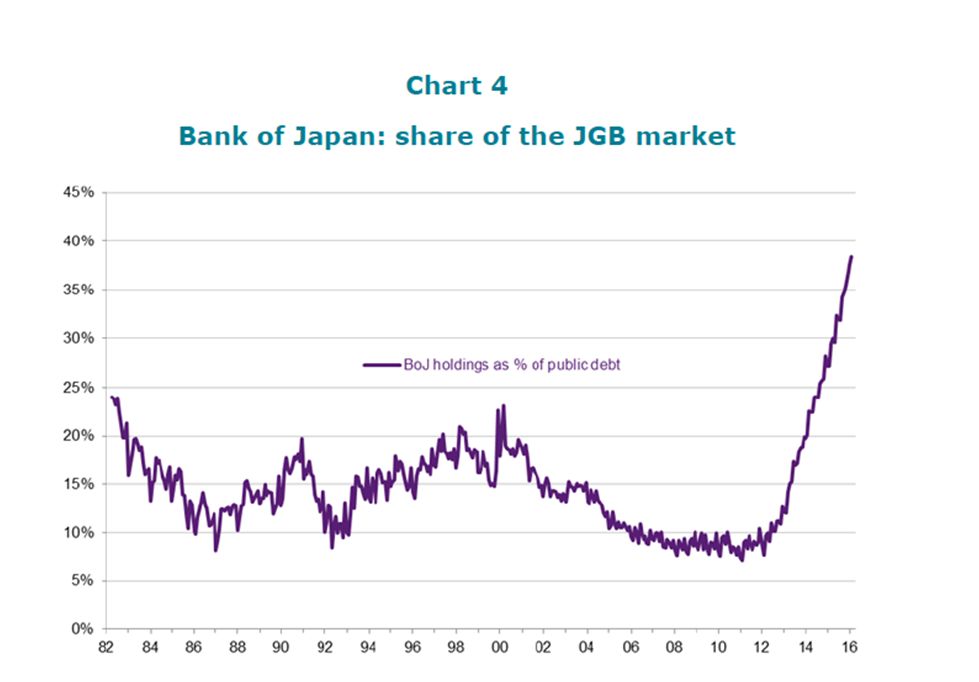

However, the introduction of a negative interest rate policy had dangerous side-effects. Firstly, the hostile reaction from banks (wishing to streamline their balance sheets) had not been anticipated and furthermore, the measure made it increasingly difficult for the BoJ to find sellers of JGB for her QQE2 program. The Bank of Japan was already facing the risk of a shortage in purchasable JGBs by mid-2017. Meanwhile, as the market anticipated JGB supply drying-up, with a risk of bank deposits tipping into negative territory, non-financial investors refused to sell their sovereign securities, whatever the price offered by the BoJ. Anxious to match their income flows with their long-term liabilities, while preserving capital and limiting counterparty risks (which are not zero in the case of banking deposits), institutional investors are now “liquidity adverse”, which causes a type of “bond trap” making it even more difficult for the BoJ to achieve its QQE targets. Although Haruhiko Kuroda introduced negative rates in order to ward off the risk of a liquidity trap, he ultimately destroyed the bond-market pricing mechanism. The benchmark previously provided by interest rates has disappeared.

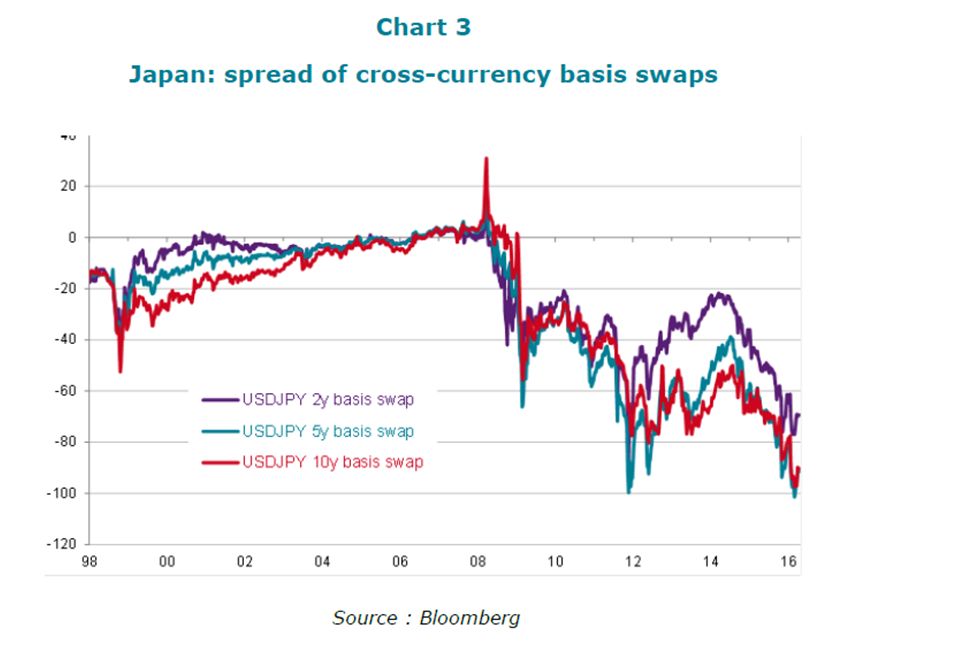

Furthermore, the cross-currency basis swaps market has become saturated in Japanese counterparty-risk, which limits the ability of domestic institutional investors to diversify their portfolios into foreign bonds. Heavy portfolio rotation towards foreign assets (initiated by the giant public pension fund GPIF) has effectively created strong demand for currency-risk hedging among Japanese investors. These hedges, set up through the cross-currency basis swaps market, triggered a “Japan premium” on the yen leg of swap contracts (chart 3). This premium has wiped out part of the additional anticipated remuneration from foreign bonds. Investing in foreign bonds has therefore become less attractive for domestic investors, which increases their dependence on the JGB market.

The BoJ is therefore facing a new challenge of finding fresh sources of purchasable assets in the context of its quantitative easing program. Governor Kuroda will be under heavy pressure to implement new stimulus measures at the meeting scheduled on 28 April. The BoJ could always broaden its QQE margins by stepping-up its risky asset purchases (local government bonds, equity ETFs, J-REITS), although the amounts involved would remain modest, given the limited size and liquidity of these markets. Even an extension of maturities among purchased JGBs would fail to sustain the QQE program long enough to credibly achieve target inflation of 2%.

An alternative option would be to abandon the quantitative objective of increasing money supply and instead target long-term interest rates directly. The BoJ would undertake to maintain long-term rates below a given ceiling limit as long as anticipated inflation remains low. The most credible strategy would nonetheless be for the BoJ to acknowledge that QQE implicitly monetizes public debt (chart 4) and therefore only makes sense if it is coordinated with an ambitious budgetary stimulus program and structural reforms. This amounts to reminding the government of the meaning behind the legend of the three samurai arrows: each one breaks easily on its own, but they are more resilient when held together.

As Japan boasts a position of net creditor compared to the rest of the world, public debt is a political matter rather than an economic issue. Japanese democracy has opted for demographic decline, to the benefit of national socio-cultural unity, which should help find a political solution to the challenge of an ageing population. The government nonetheless needs to accept that it has to clearly define the terms of the debate, instead of working behind the scenes by assigning quasi-fiscal targets to the central bank, which blurs boundaries between fiscal and monetary authority, and weakens Japanese democratic and capitalistic institutions.

Unfortunately, Prime Minister Abe no longer appears to enjoy the political capital to implement such a Big Bang. His reelection hinges on his promise to drastically adjust the budget, by increasing value added tax (VAT). If the next VAT hike expected in April 2017 is delayed, the government could have to re-establish its legitimacy by dissolving parliament again.

Japanese equities and long-term rates are likely to remain highly volatile given the imbalance in the JGB market and fears of QQE ending as early as mid-2017.

We remain underweight on Japanese equities in our global multi-asset portfolio."

Raphael Gallardo

Strategist – Investment and client solutions

Natixis Global Asset Management

Weitere beliebte Meldungen: