e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

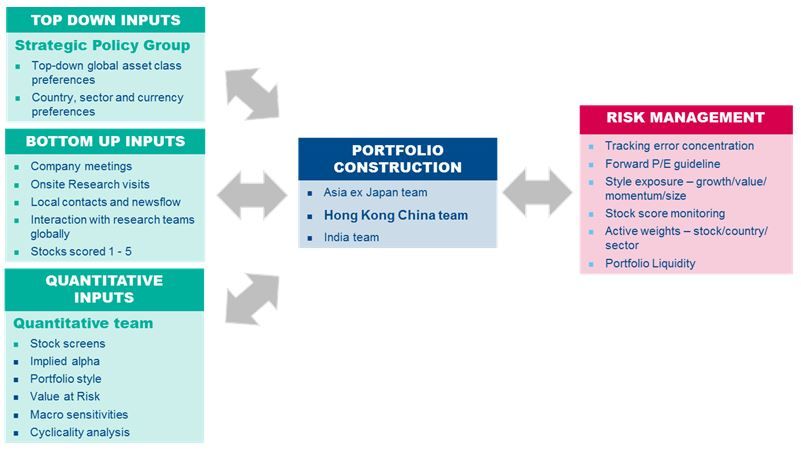

Laura Luo: The investment process of the Hong Kong China equity strategy is illustrated in the following chart:

Investment ideas can be broken down into two main sections:

I) Bottom up ideas: Identified by the sector/country specialist and portfolio managers: Our analysts and managers have a broad knowledge of companies across the investment universe as they have an average of 11 years’ experience of the Hong Kong China markets (as at 1st November 2014). The ideas can come from many sources, but normally fall within the following areas:

Through company visits: Industry knowledge and direct management meetings lead to further ideas. Our analysts are able to identify potential opportunities that warrant deeper research and company visits thereby creating a circle of constant ideas generationThrough industry contacts: Our length of experience and brand strength allows us to obtain major industry and market trends through the right contactsCross fertilisation of ideas among our specialists – e.g. strength of earnings in an Taiwanese company might have a direct impact on Chinese stocks

II) Thematic ideas: As well as identifying themes within their region from a bottom up perspective, the Hong Kong China Equity Team is able to use Barings’ research platform for macro and sector ideas from the Strategic Policy Group comprising senior asset allocation specialists, Research Teams and the Global Emerging Team. Stocks that may be influenced by such themes will be identified for in-depth research. These top down inputs help direct research focus and challenge our bottom up conviction of stocks. However, the ultimate inclusion of a stock in the portfolio is based on its bottom up merits.

Investment strategy is largely driven by the relative attractiveness of bottom up opportunities. Country and sector views help direct research focus and test our conviction on the recommended stocks. We conduct proprietary research on those stocks identified from the Ideas Generation stage. Proprietary research leads us to identify Growth, Liquidity, Currency, Management and Valuation (GLCMV) at the company level as key drivers of performance in Hong Kong China markets.

Stock Selection

The country/sector specialists within the regional teams are also responsible for conducting stock specific research. Using the GLCMV framework they evaluate the relative attractiveness of the companies in the countries they cover. The team’s main buy and sell disciplines include:

- A fundamental change in the earnings outlook versus consensus valuation anomalies, for example extreme valuations versus the norm

- Best and worst performing stocks trigger a review

The final stock recommendation is summarised as a 1 to 5 score that reflects the conviction of the specialist as to whether the stock will outperform. We define 1 as strong confidence of our performance and 5 as strong confidence of underperformance.

Each stock analysed also has an expected share price target. Additionally, a stock template is completed which explains, amongst other things the investment thesis for the stock. This framework provides the basis for our internal communication. Analysts continually monitor and update the stock rating to reflect their current view. Any changes to ratings are immediately communicated to the investment managers. Once stocks are ranked, the research is logged and published on an internal system (Synapse) that is accessible by all investment managers.

We focus our portfolio primarily on stocks that score 1 and 2. A detailed review of the companies takes place at a weekly regional team meeting.

Portfolio Construction

The investment manager is responsible for stock selection, using the recommendations of the analysts. This stage involves reviewing the proposed investment strategy relative to the benchmark, both in terms of active positions and expected tracking error. More importantly, it marries investment views (which includes the sector overview and global themes overlay) with risk management and client requirements.

We adopt a core approach in portfolio construction for the Baring Hong Kong China Fund:

- We aim to have 70-100 stocks in the portfolio so that each position can have material impact on the Fund

- The initial size of each stock is dependent on its liquidity and our conviction level. In general, we aim at maintaining a high level of liquidity for the portfolio so that we can liquidate the majority of our holdings within a reasonable period of time – under most circumstances, over 90% of the portfolio can be liquidated within 10 trading days

- We pay attention to the benchmark as it helps risk management and sizing of positions as well. The tracking error range for the Fund is 3-8% and we build up positions in stocks within this framework

We invest in both large cap and small / mid cap stocks. While the large cap may generate long-term alpha on company specific growth factors, they also provide a liquid proxy for the fund to capture tactical moves in country and sectors, which may be characterized as potential value added on “beta” considerations. We expect the small / mid cap stocks to generate long term alpha for the portfolio.

The team uses a variety of sources for research information primarily from proprietary analyses, forecasts and company / country visits and from secondary research obtained from brokers, periodicals and from companies themselves via web sites, annual reports etc.

Weitere beliebte Meldungen: