e-fundresearch.com: Why should investors consider an allocation to a CoCo portfolio and which distinctive risks & chances should investors be aware of?

Daniel Björk: The banking industry continues to deleverage and CoCos still pays attractive risk premia. As a result the CoCo market is a unique opportunity to participate in this fundamentally improving trend. As the Espirito Santo case has shown, active issuer / security selection and constant monitoring is of outmost importance. Therefore we currently avoid all Austrian and most peripheral banks.

e-fundresearch.com: What impact will the ECB´s QE programme have on the structure as well as the risk/reward profile of the CoCo market?

Daniel Björk: We see the effects positve for the further development of the CoCo market. Moreover we believe that the development of this asset class during the last years and the wider enlarged liquidity by QE of ECB in the Euro-zone will lead tot he fact that the banks will be strenghtened and the stress-tests will show the real risks within the banking sector. At last in this market situation of low interest rates investors need to look for alternatives – CoCos can be such alternatives.

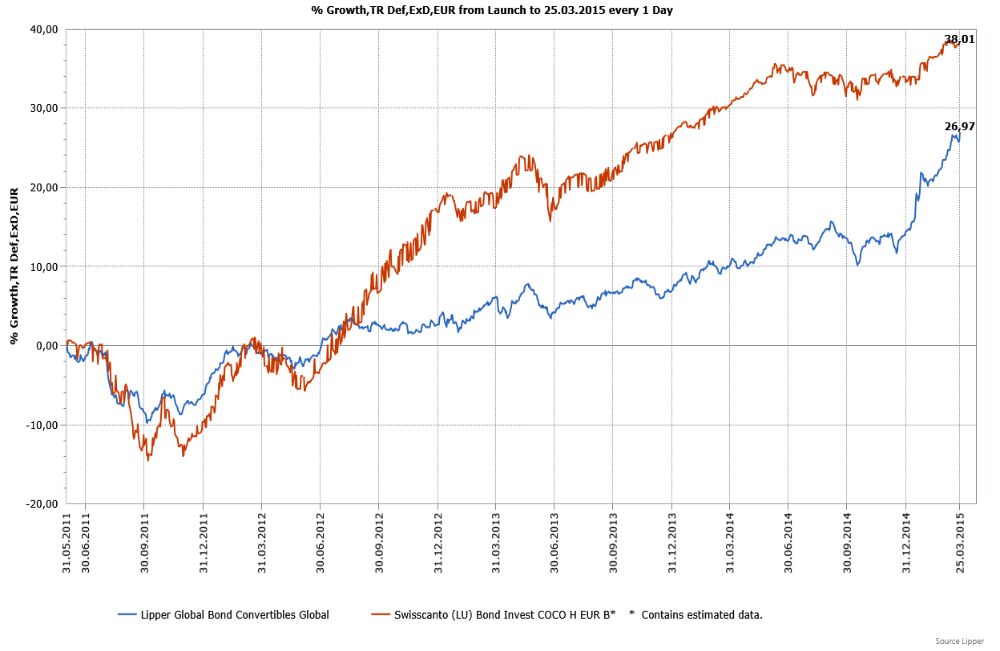

Chart: Swisscanto (LU) Bond Invest CoCo seit Auflage

e-fundresearch.com: What are the key differentiating features of the investment strategy of the Swisscanto (LU) Bond Invest CoCo in comparison to peers?

Daniel Björk: Our fund invests into CoCos globally, which can be changed into equity or written down – in relation to given equity rules. Until the CoCo market has reached a size, which enables us to a useful diversification the fund will also invest into subordinated bonds of financial institutions.

Our portfolio holds 45% in CoCo bonds at the moment, mainly by issuers which are strong national leaders in their business. We are very optimistic for the ongoing development of these kind of banks due to the fact that they have already started actions to ensure that the strictly equity rules of Basel III are implemented. Moreover we are convinced that the national champions in relation to their reputation, political consequences etc. have a lot to loose when they trigger a CoCo bond easygoing. The market offers a lot of solutions to avoid such a scenario. We expect that our investments will use all of this opportunities before they change a CoCo into equity or write down it.

With our strategy we have achieved very good results in comparison with our competitors. At the moment the fund has a volume of EUR 530 Mio. and I expect that is the optimal size to manage such a portfolio. On the one hand we can efficient diversify and transpose our alpha ideas – on the other hand the fund can add more money without having influence on its investment process. Furthermore we have the knowledge of nearly four years working with our fund in this asset class. We were one of the first movers to offer a CoCo fund (31.05.2011) and our ongoing performance is very convincing.

e-fundresearch.com: Thank You!

Weiterführende Archiv-Artikel:

Im Fokus: Entwicklungen am CoCo-Markt

Weitere beliebte Meldungen: