e-fundresearch.com: What can we learn from the SNB’s surprising decision to abandon its currency cap?

Laurent Crosnier: A typical Black Swan event, low probability and high market impact, which has hurt market participants betting on the currency peg or using the CHF as a funding currency. The decision, in itself, was unexpected and was a very negative “surprise” for the market if we consider the price impact on that day. The first lesson which can be learnt is to be always cautious on common beliefs especially when market positioning is overcrowded on a theme, second don't put too much emphasis on historical CB communication.

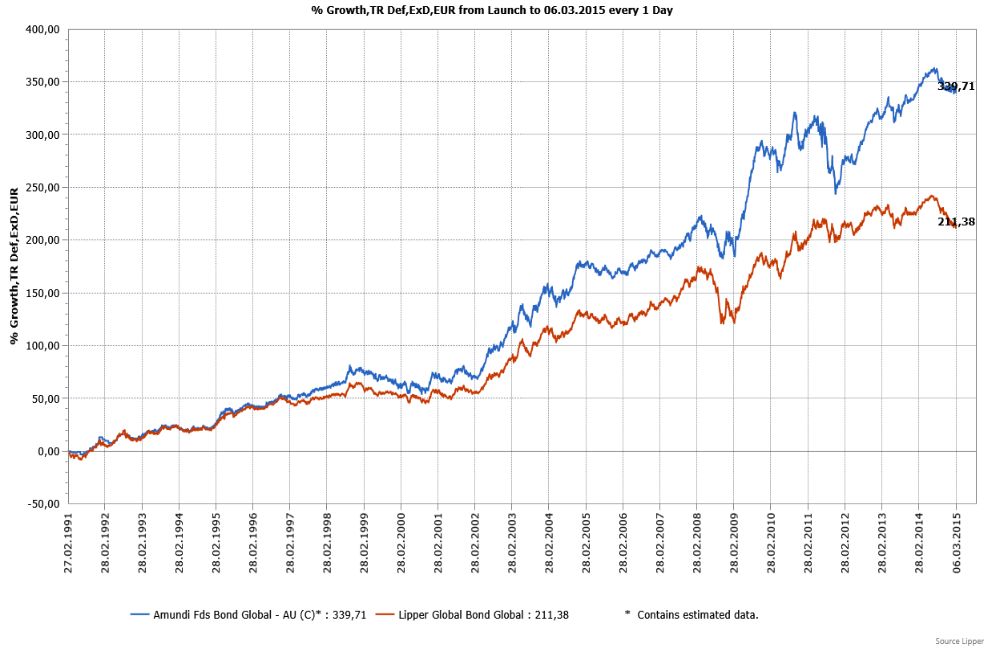

Chart: Amundi Funds Bond Global seit Auflage

e-fundresearch.com: How do you plan to make money in the fixed income universe in 2015 and to what extent has the ECB’s QE announcement influenced your portfolio positioning?

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...Laurent Crosnier: Following the announcement by the ECB to put in place a QE program, several investment strategies have delivered strong performances and should continue to do so in the coming months. Among the main winning strategies directly related to QE are the weakening of the Euro against USD, the out-performance of the peripherals countries against the core countries and the flattening of Euro yield curve. We believe these strategies should continue to deliver strong returns in 2015. We could anticipate positive side effects on the credit IG market which should react positively from the restoration of the credit channels and the search for yield from fixed income investors. Finally, the Inflation linked bond market currently exhibits attractive entry points (the 10 year inflation Breakevens are below 1% for Germany far below the 2% target for the ECB).

e-fundresearch.com: To what extent does fund size impact the efficiency and effectiveness of your investment strategy?

Laurent Crosnier: The current size of the portfolio, at 5.8bn$, allows us to actively manage our positions without any significant market impact. Moreover this fund invest primarily in liquid markets such as the currency, government bonds or futures markets amongst others, and does not invest in less liquid instruments such as private placements, distressed debt or structured products. Finally, this is a high quality fund with at least 80% invested in IG securities, and 2/3 in OECD markets, which is another way to enhance the liquidity of the portfolio.

e-fundresearch.com: Thank You!