e-fundresearch.com: How many positions does the portfolio usually contain and what is the average holding period of an investment?

Céline Piquemal-Prade: A Global portfolio typically comprises 30-40 stocks which we believe achieves the diversification criteria for the Global portfolio.

Subject to significant changes in the business environment, changes in management or wholesale changes in the business strategy of the company, once a company enters the investment universe it tends to stay there for quite some time and (subject to valuations) stays in the portfolio for typically 3-5 years.

e-fundresearch.com: To which extent does fund size impact the efficiency and effectiveness of your investment strategy?

Céline Piquemal-Prade: Comgest’s Global strategy is currently open to investors. The current size of Comgest Monde has no impact on the efficiency and effectiveness of our investment strategy.

e-fundresearch.com: In which market environment does your investment strategy deliver the best (relative) results?

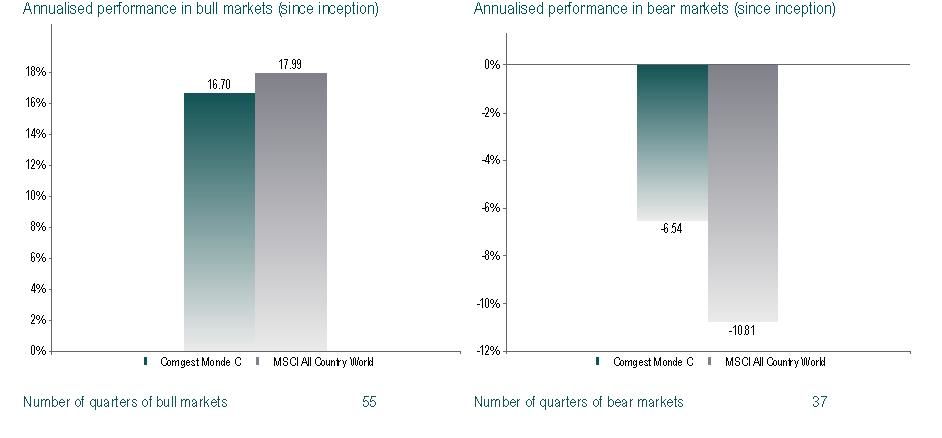

Céline Piquemal-Prade: Our portfolios have historically performed best over the long term as well as during difficult market periods, especially when markets are fairly rational and are predominantly driven by earnings growth.

Historically our portfolio has behaved well in bull markets and extremely well in bear markets.

Below is a chart outlining the annnualised performance of Comgest Monde C (since inception) as at 30/03/2014 in bull & bear markets:

Past performance is no guarantee of future results. Indices are used for comparison of past performance only. Performance calculation based on NAV to NAV variation expressed in euros. Fund volatility is calculated using weekly performance data. The index used for comparative purposes changed from MSCI AC World price to MSCI AC World dividends reinvested from 30/06/2005. Source: FactSet/Comgest.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Céline Piquemal-Prade: An index is used purely for comparative purposes.

Our choice of stocks is independent of benchmarks and focuses on absolute performance, typically resulting in lower volatility than that of the reference index, the MSCI AC World net index. We do not follow any country or sector allocations.

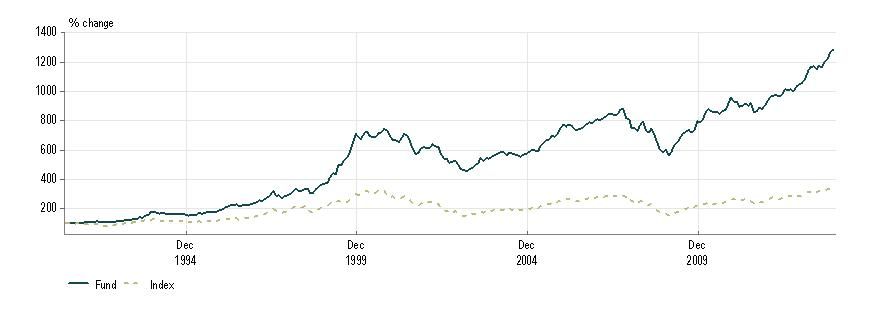

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Céline Piquemal-Prade: Please find below the returns of Comgest Monde C (as at 31/03/2014, net in euro):

Past performance is no guarantee of future results. Indices are used for comparison of past performance only. Performance calculation based on NAV to NAV variation expressed in euros. Fund volatility is calculated using weekly performance data. The index used for comparative purposes changed from MSCI AC World price to MSCI AC World dividends reinvested from 30/06/2005.

Source: FactSet / Comgest.

e-fundresearch.com: What motivates you in your job?

Céline Piquemal-Prade: What motivates me and what I love doing is identifying the best business models, the best companies that will be able to make a difference over the long term thanks to a unique product, service, approach, management and buying them early or when the market has doubts about these companies. This is how I bought Softbank (the telecom gainer in Japan) three years ago at a single digit valuation and how I got into Google during the Lehman crash.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Céline Piquemal-Prade: I first thought about being a lawyer but acting rather than reacting made me pick finance!

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: