Im folgenden Research-Kommentar nimmt Fidelity mögliche Szenarien der Index-Ausweitung und deren Auswirkungen und Möglichkeiten für Investoren unter die Lupe:

THE ROAD TO INCLUSION

The huge numbers behind China’s equity bull market have made headlines globally since the A-share market took off a year ago. It has returned over 100% in the past 10 months with an average daily trading volume over US$140 billion, more than twice the NYSE. By market cap, A-shares have become the second largest market globally, making up 19% of the global aggregate.

Perhaps some of the more interesting numbers are the smallest: 1% – the average daily trading volume contributed by foreign investors; and 5.9% – the portion of the market owned by foreign investors. Despite the size of China’s economy and capital markets, A-shares are not currently represented in the MSCI indices that international funds typically track or benchmark themselves against, and access to the market remains restricted.

A proposal to include A-shares into MSCI Emerging Markets and MSCI China was rejected in June 2014 due to too many constraints on investments under the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) systems, which until recently were the only ways foreigners could access the market. Since then, Chinese authorities have opened up the market further to foreign investors, expanding the quota systems to more countries and initiating the Hong Kong – Shanghai Stock Connect, a scheme that enables foreign investors to directly invest in Shanghai listed A-shares. A similar scheme linking the Shenzhen stock market is expected to be launched, possibly later this year.

With MSCI already announcing that 17 Chinese firms listed in the US (ADRs) will be included in the MSCI China index from November this year, there is increased speculation that A-shares could soon also be included.

A partial inclusion scenario

It is extremely unlikely that MSCI would announce the full inclusion of A-shares in the upcoming announcement. They have made clear that only the proposal of a partial inclusion is being considered, noting that a full and sudden inclusion could create market friction as funds that track the indexes would need to re-allocate large amounts of capital. The current quota restrictions could make that very difficult to do.

Full inclusion, according to MSCI, would necessitate the effective scrapping of the quota systems, the removal of restrictions on China’s capital account convertibility and for the market to align with international accessibility standards.

In a consultation released by MSCI in March 2014, a 5% initial partial inclusion was suggested (meaning that for each A-share that is included, its index market capitalisation would be capped at 5% of its market capitalisation). Any subsequent increase would be subject to “positive market liberalisation developments and public consultation with market participants.”

It is important to note that in the event of a positive announcement, investors would expect to be given time to adjust and build exposure before the measures became effective.

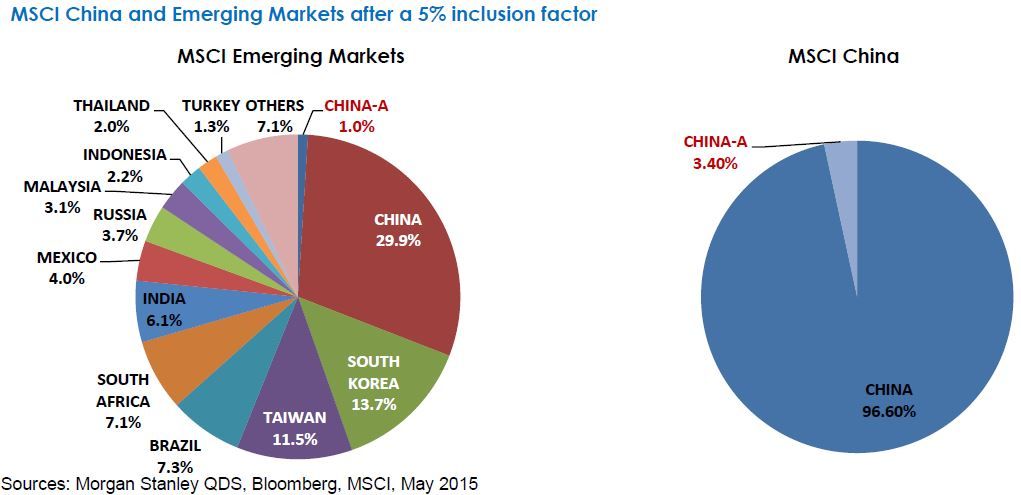

Implications of a 5% inclusion factor

Based on MSCI Emerging Markets requirements, there are around 217 China A-shares that could be eligible for inclusion. 5% of their aggregate market cap would be US$47.6 billion. If included, it could lead to US$2 billion of passive inflow(9). A-shares would make up about 3.4% of MSCI China and 1% of MSCI Emerging Markets.

The impact of a 5% inclusion would vary across funds. For those funds that may already have a weighting of A-shares of more than 3.4%, the impact could be minimal. In terms of flows, the initial US$2 billion is below the daily north-bound quota of the Hong Kong – Shanghai Stock Connect, with subsequent flows being far less.

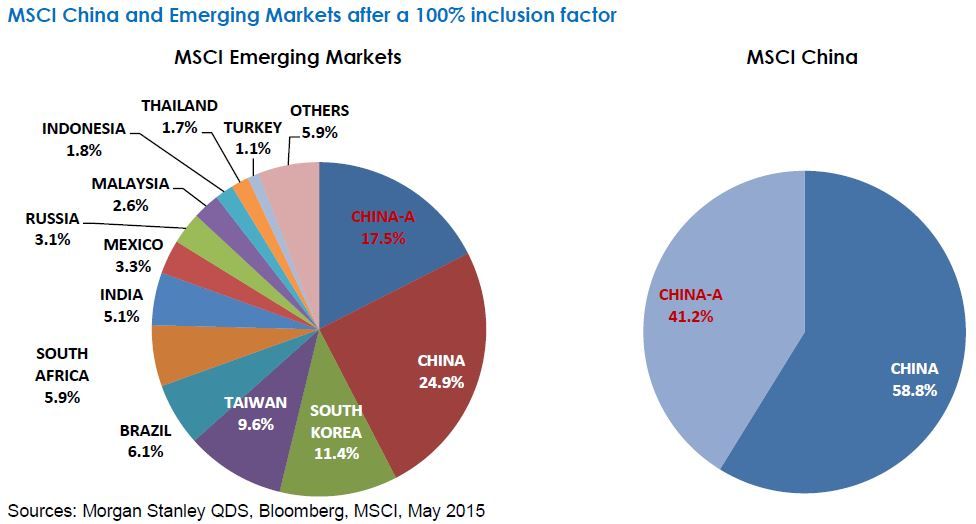

The end game: a 100% inclusion scenario

Whilst a full and sudden inclusion is unlikely, the long-term view is that A-shares will be fully included at some point. A full inclusion would suggest passive inflows of around US$33 billion, with A-Shares making up about 41.2% of MSCI China and 17.5% of MSCI Emerging Markets.

The biggest implication of this is on the passive fund management industry, who even with stock connect may not be able to easily access the market. The connect programme has a daily and an aggregate quota ceiling which if reached would theoretically prevent freely being able to rebalance. Some funds may have issues over beneficial ownership, or setting up appropriate custodian and broker relationships. So it is not a given that MSCI will go for inclusion.

Not much activity is expected on the part of the active management industry, because they will typically already have exposure if they like the market and will be unexposed if they do not; the relatively low likely level of inclusion in the benchmark is unlikely to change fundamental views and therefore drive much trading activity.

However, a gradual inclusion of China A-shares into MSCI benchmarks would represent another important step towards opening up China’s capital markets, and should thus be seen as a positive development and one that could help eventually lead to free A-share trading.

Weitere beliebte Meldungen: