The nature of emerging markets has been changing, and Information Technology (IT) has become the most dominant sector in the MSCI Emerging Markets Index. In this respect, the recent announcement by MSCI and S&P of a review of the Global Industry Classification Standard (GICS) will shake things up.

A key outcome of the review will be a significant reduction of the IT weighting in the index. Despite the lower IT weighting, however, I believe technologically innovative companies will continue to have a dominant role in emerging markets.

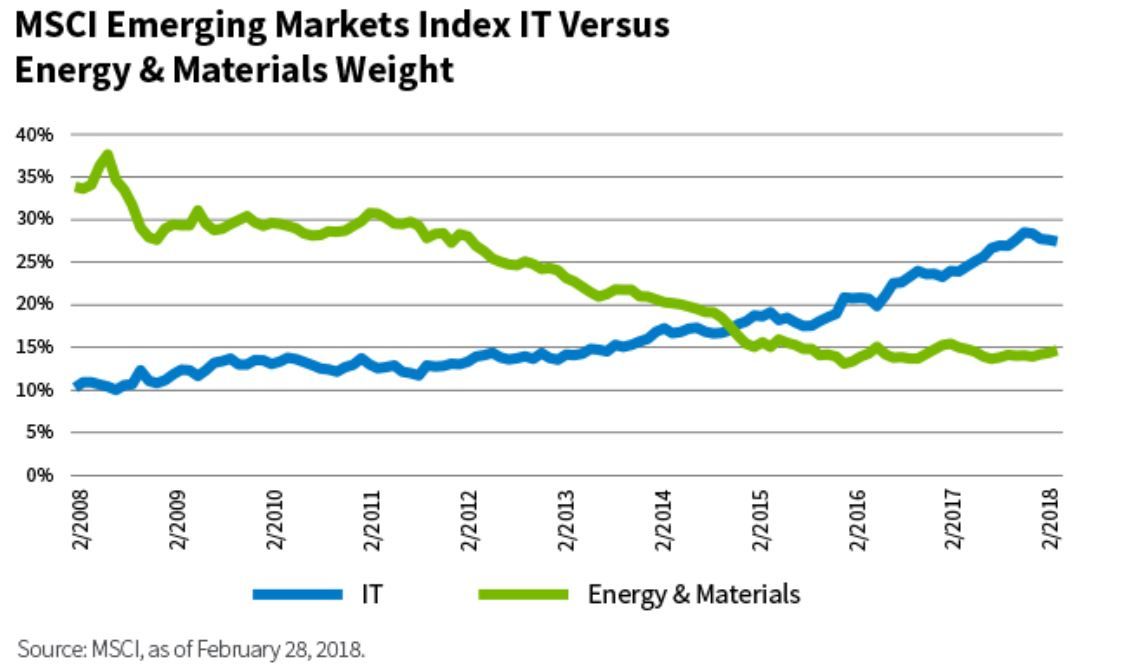

The nature of emerging markets has been changing. As the chart below shows, over the past 10 years the MSCI Emerging Markets Index has experienced a structural shift toward IT at the expense of heavyweight commodity sectors. The change is even more pronounced compared with 20 years ago, when IT only represented 5% of the index.

The Internet Services & Software industry, which is led by the so-called “BAT” companies (Baidu, Alibaba, and Tencent) and now accounts for more than 10% of the index, has been a key driver of the increase in the index's IT sector weighting.

But the increase is not exclusively due to these companies; many emerging market companies are at the forefront of the technology revolution.

Moreover, technology-enabled business models are prospering beyond the technology sector, across different industries, from financial services to consumer sectors.

It is not surprising, given these changes, that MSCI and S&P recently announced a review of the GICS, which were developed in 1999 to organize companies into industrial groupings based on similar production processes, products, or behavior.

The GICS structure currently consists of 11 sectors, 24 industry groups, 68 industries, and 157 sub-industries into which all major public companies are organized.

A key outcome of the GICS review on the MSCI Emerging Markets Index will be that the index’s IT weighting will decline by nearly half, mostly in favor of Telecommunication Services, which will be renamed Communication Services.

The bulk of the IT weighting reduction will come from the discontinuation of the Internet Software & Services industry. The rationale, according to S&P and MSCI, is that the industry “has become too large and diverse to be useful for analysis or index construction. It has evolved to include new business models using internet technology to cater to a variety of end users and industries.

A majority of respondents [to a survey MSCI and S&P conducted prior to announcing the changes] now regard the internet as simply a medium for delivery of a company's products and services.”

One result of this change will be the reclassification of Tencent and Baidu from the IT sector into the Communication Services sector, while Alibaba will join the Internet & Direct Marketing Retail industry in the Consumer Discretionary sector. In other words, the BAT will no longer be in the IT sector. That's quite a change.

An approximation of the MSCI Emerging Markets Index weighting changes based on the most recent information disclosed by MSCI is shown below.

The index's increased weighting in the new Communication Services is largely driven by two factors. The first is the reclassification of a large part of Internet Services & Software industry as described above.

The second is the movement of the Media industry group from the Consumer Discretionary sector into the Communication Services sector. MSCI's rationale for the latter is the acknowledgment of the convergence between content creation and delivery—that is, between media and telecommunications companies.

This loss to the Consumer Discretionary sector, however, is more than offset by the new inclusion of Alibaba and other such companies in the Internet & Direct Marketing Retail industry in the Consumer Discretionary sector.

Company fundamentals are agnostic to index classification, and in our view fundamental active management should be as well. Nevertheless, investors will likely be affected by GICS changes as sector profiles will become more blurry.

In particular, the IT and Communication Services sectors will be meaningfully altered, thus making historical comparisons difficult.

Stripped of some of its most secular growth components, the new IT sector's growth profile will diminish, as will its valuation. Based on our estimates, the IT sector's one-year historical earnings-per-share (EPS) growth rate will decline from 30.6% to 16.5% and its price-to-earnings (P/E) ratio will decline from roughly 15 to 10, as the table below shows.

Conversely, the historically low-growth Telecommunication Services sector will morph into a fast-growing, innovative Communication Services sector (with expected long-term growth soaring to 31.5% versus 14.0% for the old Telecommunications Services sector).

These changes will make historical comparisons hazardous and will certainly pose challenges to investors who attempt to gain exposure to fast-growing, innovative companies in emerging markets blindly through passive sector strategies.

Moreover, despite the lower IT weighting, I believe technologically innovative companies will continue to have a dominant role in emerging markets over the next decades.

For example, according to TechCrunch, 40% of the world's so-called “unicorns” (which are start-up companies worth more than $1 billion) are in emerging markets, and South Korea tops the league of most innovative economies in 2018, based on the Bloomberg Innovation Index.

In addition, the Chinese government's continued support to its technology champions and backing of start-ups in the “internet of things” (the network of physical devices, vehicles, home appliances, and other items embedded with electronics that allows them to connect and exchange data), smart appliances, and high-end consumer electronics will continue to drive technological innovation.

Whether these companies are now categorized in Communications Services, Consumer Discretionary, or even Financials or Industrials sector, the lower IT weighting does not mean that there will be any less technology or innovation.

Romina Graiver

Portfolio Specialist

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: