In determining where the current economic slowdown is likely to end up, it helps to consider the potential paths to recovery. Will the recovery be V-, W-, U-, or L-shaped? We will talk about why we are modeling the recovery the way we are, where the potential pitfalls are, and what the different bull/bear scenarios look like.

V, W, U, L: Historical Experiences

Economic expansions do not die of old age. Recessions are precipitated by either policy (four of the past six times) or malinvestment (two of the past six times).

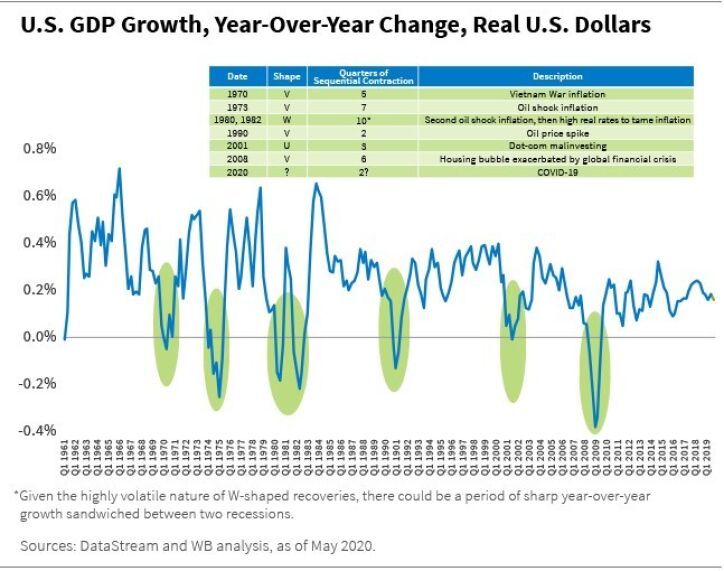

But what about recoveries? Economic growth during recoveries tends to resemble one of several unique shapes: Vs, Ws, Us, or Ls. There are no L-shaped recoveries in practice, but we have seen Vs (four of the past six recoveries), Ws (one of the of the past six recoveries), and Us (also one of the past six recoveries). The chart below illustrates.

While Vs appear sharp in a historical context, upon closer inspection they are long and uneven, with three of the past four lasting more than a year each.

It is too early to determine which type of recovery we will see, but the possibility of a second wave of infections—most likely in late autumn 2020—suggests that the recovery out of the current economic recession is likely to be long and uneven.

What Drives Recovery?

The current recession could prove to be the deepest and the shortest in at least five decades. But the path to recovery is highly dependent on consumers' ability and willingness to spend. So, wages, employment, and bankruptcies will likely determine the shape of this economic recovery.

Loss of income (beyond what the fiscal bridge covers) is in line with historical experience; we can monitor the extent to which fiscal support compensates for loss of income from other sources. But fear levels are unique to our current recovery. Only September 11 provides a useful comparison (at least in regard to travel-related expenditures), and leads to a cautiously optimistic conclusion. Despite existential risks and fear after the September 11 attacks, U.S. air passengers returned to the skies within two to three years, in line with the recovery from the recession of the early 2000s.

Recovery Scenarios?

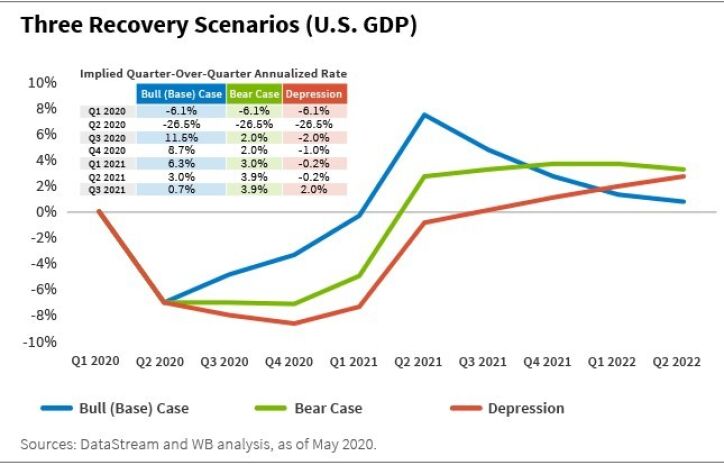

Our base case is cautiously bullish, as this is not an economic recession, so no serious imbalances have built up.

Under this scenario, driven by extensive testing, we would expect to see a gradual resumption of activity from May, with a 10% improvement in activity month-over-month. Extraordinary liquidity would fuel the post-shutdown recovery. Massive unemployment (15% to 20%) should last less than six months, and a speedy return to the labor force bodes well for consumption. A return to pre-COVID-19 shutdown output levels could be expected within two to three years.

Then there is the bearish case. Under this scenario, new cases of COVID-19 would peak but remain at elevated levels. Lockdowns would lift more gradually, so we would see less than a 10% improvement in activity month-over-month. U.S. corporates were already highly levered before the crisis. Increased levels of debt together with a significant loss of output looking out over one to two years would view force investment and hiring cuts. Unprecedented levels of unemployment and bankruptcies would slow the economic recovery considerably. The bottom three quintiles of income distribution would be disproportionately affected, so aggregate demand growth would be materially slower after an initial pent-up demand surge.

Lastly, there is the possibility of a depression. Under this scenario, the virus would defy expectations of flu-like behavior and dissipation with warm weather. New cases would peak but remain at high levels for weeks, and lockdowns would remain in place for months, not weeks, until treatments become available. Adequate fiscal support would be either unavailable or ineffective. The resulting mass bankruptcies and unemployment would destroy production (supply) and massively reduce domestic demand after lockdowns—such that the eventual recovery would take years.

This is not our base case, as indicated. But even with the strongest possible recovery and no setbacks (which are quite likely, especially in the United States), 2020 gross domestic product (GDP) is likely to be about 5% lower than it was in 2019. That would be the deepest contraction we have seen in at least decades, and will feel bad for many months.

Olga Bitel, partner, is a global strategist on William Blair's Global Equity team.

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: