e-fundresearch.com: Mr. Robert Smith you are the fund manager of the Baring German Growth Trust (ISIN: GB0008192063). When did you take over the responsibility of managing this fund?

Robert Smith: 1st November, 2008

e-fundresearch.com: What is the current size of the fund?

Robert Smith: EUR 372.062.491 (as per 28.02.2013)

e-fundresearch.com: Do you also manage other funds or mandates?

Robert Smith: No

e-fundresearch.com: How long have you been in the business as a fund manager?

Robert Smith: Just over 10 years as a fund manager. Prior to that, I worked as stock analyst in the Europe Small Cap Equity Team of Nick Williams.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Robert Smith: A quant screen for buy ideas and when to sell; meet the management to talk through the business model and industry dynamics; technical analysis to aid the timing of purchases and sales. The quant screen is the competitive edge.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Robert Smith: We use the HDAX as a benchmark index because of the all-cap nature of the fund. Our peer group is all the other Germany single country funds, however we would note that very few of our peer group would go as far down the market cap scale as we do, as we buy companies with market caps down as low as EUR100m.

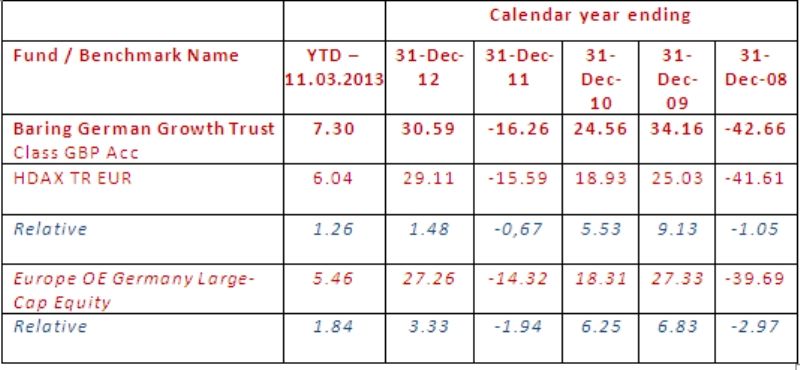

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Robert Smith:

3-year-performance

e-fundresearch.com: Many Thanks!

Weitere beliebte Meldungen: