e-fundresearch.com: To what extent can TOBAM’s strategies be classified as “smart beta”? How do you differentiate yourself from your competitors?

Christophe Roehri: TOBAM is one of the founders of what has been called later by the industry the “Smart Beta” movement. We do not like the expression “Smart Beta” since it is lacking a clear definition.

In order to properly answer this question it is important first to define what is beta. Originally, beta is a measure of how much you access the systematic risk premium available in a given market. Secondly, what is the systematic risk premium? It is the return of the un-diversifiable portfolio.

Most of the smart beta approaches emerged from the observation that the current representation of beta by the industry, which is the market capitalization-weighted benchmark, is failing to achieve two objectives. The first objective is to be close to the efficient frontier ex-post and the second is to be truly diversified. The market cap-weighted benchmark has failed to meet those two criteria and as a result there is a growing demand for a smarter way to access the equity risk premium.

The common thread of mainstream smart beta approaches and their providers is the recognition that market cap-weighted indices are not the optimal solution for investors. In that sense, “Smart beta” approaches are smart, or at least “smarter” than the traditional benchmarks.

What defines truly a smart beta approach, I believe, is its capacity to deliver an equilibrium portfolio. Risk Factor investing for example is contradictory with the notion of equilibrium since betting on a factor for pricing or strategic reasons remains an arbitrage. This is as far as the similarities go in the smart beta world.

The core investment philosophy of TOBAM is to harness diversification to optimally capture risk premium of an asset class. At TOBAM we don’t know if we are “smart” but we believe that we provide the Beta.

e-fundresearch.com: For which regions/asset classes do TOBAM’s Anti-Benchmark® strategies work best?

Christophe Roehri: TOBAM’s only strategy is the Anti-Benchmark® which is systematically applied to different investment universes defined by their reference benchmarks.

From a theoretical standpoint, there should not be meaningful differences in long-term relative performance characteristics across different investment universes by applying the same systematic strategy. Empirical evidence over long-term periods confirm that statement.

Over short-term periods, we might see temporary differences between regions which are primarily driven by the differences in the concentrations to be found in the market cap-weighted indices (for example, energy in Canadian equities or Financials in Euro equities) and the way these concentrations are rewarded over the short term.

e-fundresearch.com: In which market phases do TOBAM’s Anti-Benchmark strategies deliver the best/worst performance relative to the corresponding market weighted benchmarks?

Christophe Roehri: TOBAM’s research indicates that market cap weighted indices under-allocate important diversifying sources of equity risk premium. The Anti-Benchmark® strategy generates returns from all diversifying investment opportunities. This diversification aims at offering additional upside in range bound markets, and also offers some protection from market declines, since concentrations within the indices often lead the downside.

There is, however, one market condition which can lead to short-term under-performance for the Anti-Benchmark®. It occurs when the Benchmark outperforms the Anti-Benchmark®! What we mean by that is: the benchmark is a portfolio with concentrations, so when these concentrations are rewarded, the benchmark may temporarily perform better than a diversified portfolio. Following such an event, either the rest of the market catches up with the initial leaders, or the momentum of the narrow list of names reverses. In both cases the Anti-Benchmark® has the potential to return to providing excess performance.

e-fundresearch.com: To what extent does fund size impact the efficiency and effectiveness of TOBAM’s Anti-Benchmark® strategies?

Christophe Roehri: In a nutshell, we believe that the Anti-Benchmark® strategy is very scalable. For example, our research indicates that the Anti-Benchmark® does not suffer from significant alpha decay, and is not sensitive to constraints on stock concentration nor on the frequency of rebalancing.

e-fundresearch.com: Major central banks have largely distorted asset class correlations due to excessive QE measures– how has TOBAM managed to overcome the challenges of distorted correlations?

Christophe Roehri: A properly diversified portfolio is indeed very stable. While the historical levels of pairwise correlations between assets can be unstable, the diversification characteristics of a portfolio, expressed by the hierarchy of the pairwise correlations, are remarkably stable over time.

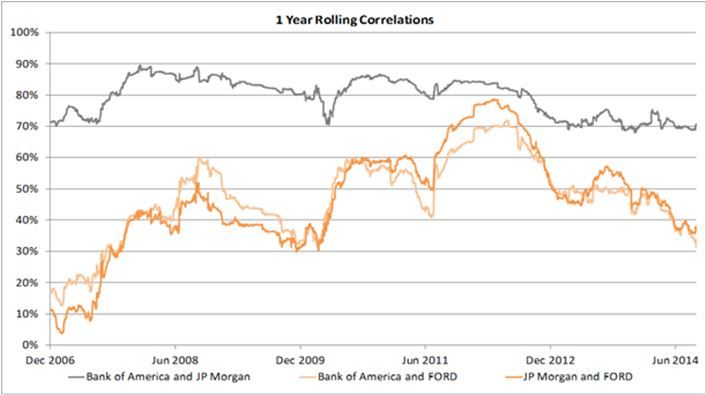

A simple example can be used to illustrate this phenomena: while the historical levels of correlation between Bank of America (BoA), JP Morgan (JPM) and Ford do vary; their hierarchy– the fact that BofA and JPM are more correlated than BofA and Ford – is remarkably stable.

This is the only information that is needed in order to assess that a portfolio combining BofA and Ford is more diversified than a portfolio combining BofA and JPM.

e-fundresearch.com: Thank You!

Weitere beliebte Meldungen: